Swing Trading BLOG – Swing Trading BOOT CAMP

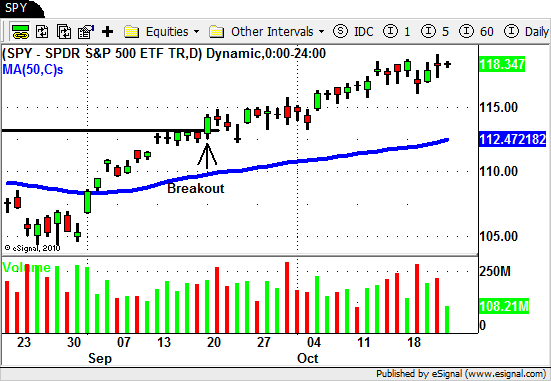

Swing Traders continue to enjoy the recent uptrend as the markets moved to new multi-month highs this week.

The week started off a bit negative and Tuesday's GAP DOWN was the first real sign of weakness we have seen in sometime.

The market quickly recovered though as the major indices pushed higher to close out the week.

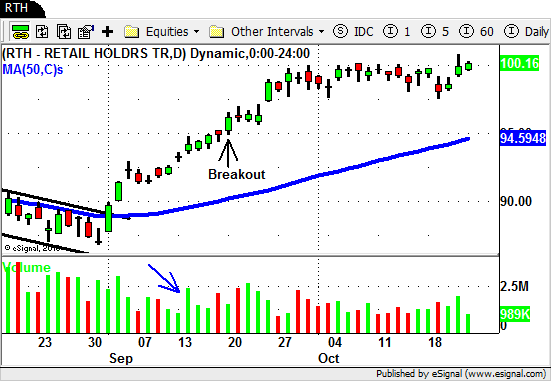

As far as sectors go we saw a bit of rotation this week as some of the weaker sector ETF's moved higher while a few of the stronger ones took a bit of a break.

Retail ($RTH) and Real Estate ($IYR) traded to new multi-months highs while the recently strong Energy ($XLE) and Oil Services ($OIH) sectors traded up but still below their recent highs.

The Financials ($XLF) and Homebuilders ($XHB) remain weak but the Broker/Dealers ($IAI) are showing a bit of strength.

As far as individual stocks are concerned it was also a bit of a mixed bag.

APC, SOHU, DAL, and GS had nice moves to the upside and AMZN continued to rip.

SLB, ADSK, CHKP also moved higher while SMG and SKS just keep on rollin'.

On the flip side we saw decent sell offs in TSL, SNDK, X, JCG and MED.

As we move into next week there are still a lot of stocks setting up for potential LONG trades.

The only caution sign we see is the lack of volume that we saw as the market pushed higher at the end of the week.

We are still in a very BULLISH phase so we will simply wait for the opportunities to present themselves and act accordingly.

Until next week…Good Trading to YOU!