Here is your Swing Trading update for the trading week ending 05.31.19.

After the holiday we saw a nice continuation to the DOWNSIDE in the market this week.

With lots of people expecting some sort of bounce from an OVERSOLD position the charts always tell the true story…if you know how to read them.

S&P 500 ($SPY)

The S&P got rocked again this week (along with just about everything else.

Take a look at the chart. After pushing lower mid-week last week we saw 2 STALLbars near the LOW END of the trading range. When the market opened up on TUESDAY we saw the continued push LOWER on VOLUME, breaking down from the 2 STALL bars.

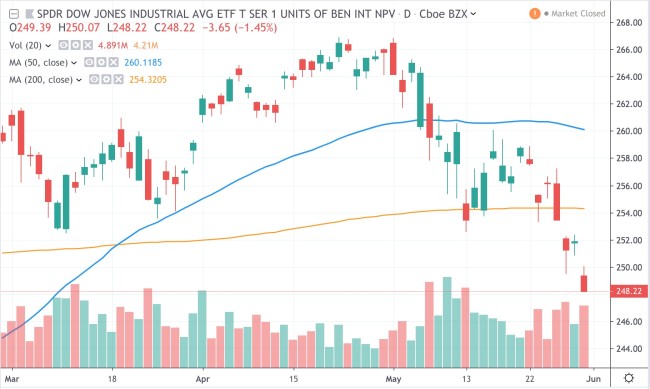

DJIA ($DIA)

More of the same from the DJIA. Since the end of APRIL we are down 1800 points or so. Not good for the LONG SIDE especially since we are now under the 200-day MA.

GOLD ($GLD)

The sector to watch this week was GOLD. Considering the overall market conditions, the setup after the double bottom and pullback after 3 days above the 50-day MA setup a nice chance to get LONG (at 2 spots).

SUMMARY

With ALL THREE INDICES (S&P, DJIA, NAZ) now trading below their 200-day MA's I would say that the writing on the wall is clear.

The failure to push to NEW HIGHS in early MAY was quickly followed by HEAVY SELLING which broke the UPTREND.

After a small bounce and stall we saw continuation to the downside this week.

And while there are still some strong stocks in the market we will wait to see if all of this selling pressure catches up to them as well.

I wouldn't chase stocks/ETF's down at this point but the next STALL or PULLBACKshould tells us how the story continues.

Until next week…GOOD TRADING TO YOU!

Tags: ETF Swing Trading, Swing Trading, Swing Trading ETF's, Swing Trading Price and Volume