The week of going nowhere!

After a decent GAP UP Monday morning the market followed through with…nothing really.

Low volatility and volume usually lead to "sideways" type price action and that is exactly what we saw this week.

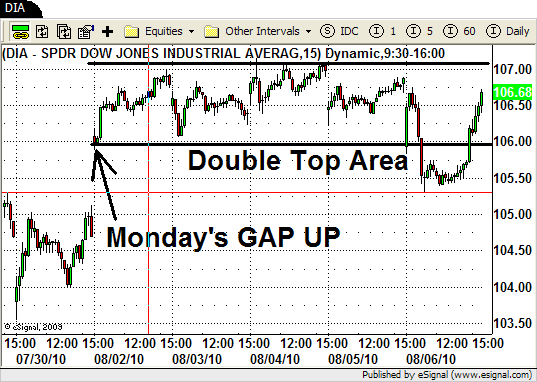

The 2 blue arrows above indicate the "double top" area that we posted in last week's BLOG.

Monday morning's GAP UP brought us up above this level and ended up trading above it for almost the entire week.

Friday we saw the market GAP DOWN and then rally a bit only to ROLL OVER to the DOWN SIDE prior to an afternoon reversal which brought the market back over the "double top" area.

Here is a look at the 15 minute chart so you can we what we mean.

Monday through Thursday you can see the "sideways" price action we encountered.

Although the INTRADAY price action was great this type lack of follow thorugh can be very frustrating for Swing Traders.

Most (not all) of our positions did exactly as the market did this week…went almost nowhere.

Although the GAP UP on Monday and the Friday afternoon reversal indicate that there are buyers at this level in the market it is still a sign of overall indecision (so far) to move this market higher or lower.

There are still a lot of stocks that have great chart patterns that my be setting up for some nice trades in the week ahead.

CHKP, NTAP , ALK, BAX and CAL are a few that we will be watching.

The Steel Sector has also been very strong as of late so we will continue to watch SLX, X, CLF, AKS, and STLD.

With the decent rally (and lack of DOWNSIDE follow through) in the GOLD MINERS this week we will watch to see how these stocks shape up during next weeks trading.

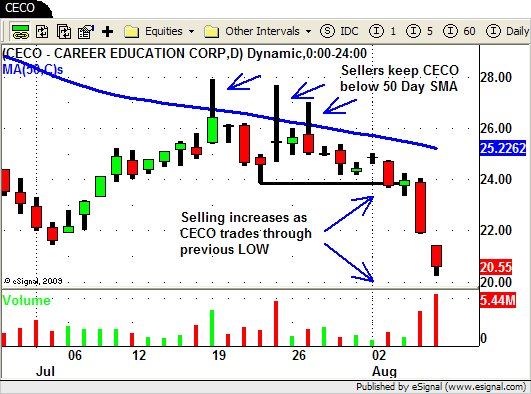

A exception to the LOW VOLATILITY theme of this BLOG post this week was the Education Stocks.

APOL, DV, COCO and CECO all had nice chart patterns that setup some great SHORT trades on Tuesday.

Take a look at these charts and you will see great example of the PRICE and VOLUME relationship.

Also as a reminder our next PVT (Price, Volume and Trend Lines) Trading Tactics class will be held next Saturday August 14th.

If learning how to use Price Action and analyze Volume to make trading decisions in stocks and/or ETF's is of interest to you then be sure not to miss it!

Our new Swing Trading BOOTCAMP, Swing Trading Strategy Class, and FREE webinar schedules will be coming out this week so we hope to see you at one (or all) of the upcoming events.

Until next week…Good trading to YOU!

Tags: 50 Day SMA, ABX, AKS, ALK, APOL, BAX, CECO, CLF, COCO, DIA, DV, ETF, ETF Swing Trading, NTAP, SLX, STLD, Swing Trading Blog, Swing Trading Chart Patterns, Swing Trading Price Action, Swing Trading Strategies, Swing Trading Volume, Trend Lines, X

[…] Swing Trading Blog – Swing Trading Price Action аחԁ Volume Strategies | Swing T… […]

[…] Swing Trading Blog – Swing Trading Price Action and Volume Strategies | Swing Trading Boot Cam… […]

[…] Swing Trading Blog – Swing Trading Price Action and Volume Strategies | Swing Trading Boot Cam… […]

[…] Swing Trading Blog – Swing Trading Price Action and Volume Strategies | Swing Trading Boot Cam… […]