In last weeks Swing Trading BLOG post we said that this would be a pivotal week in the market.

Well after the dust settled this week it was VERY CLEAR that the BEARS are in charge!

After Monday's "inside day" price action and volume spoke LOUD and CLEAR on Tuesday as the market gapped down and continued to sell off until the week came to close on Friday.

The last few weeks have been tough for Swing Traders and this week was no exception.

This week was tough for Swing Traders for a few reasons:

Starting in early June we had nine days where we basically went straight up and now we have had about ten days of trading where the market has gone straight down!

If you are "pullback" trader like we are there has not been many chances over the past month or so for you to implement your trading strategy.

If you did not have a plan in place and were NOT prepared for Tuesday then you may have "missed the boat" when the market gapped down and sold off for the rest of the week.

This has been a "fast market" and by that we mean that there ARE chart patterns and pullbacks to trade BUT these pullbacks are shallow, maybe a day or so, and then they continue to move.

This type of price action creates "fast" trend channels and for most traders these are much more difficult to identify and trade.

Lets take a look at some of the stocks we have been following lately to show you what we mean.

Last week we walked you thorough our entry into Nemont Mining (NEM) on a LONG Swing Trade.

This is the chart from last week.

As we told you we were able to exit some of our position at $61.67 during last Friday's afternoon rally and we were holding on to the rest with a trailing stop.

Here is how the chart looks at the end of this week.

NEM broke out to NEW HIGHS last week so we were expecting some type of follow through to the UP side this week.

Monday NEM stalled and was followed by two days (Tuesday and Wednesday) of slightly UP price movement combined with decreasing volume.

This combination should be a BIG FLASHING YELLOW LIGHT to you just as it is for us.

Our trailing stop was hit at $60.75 on Thursday as NEM traded down through the low of the previous day.

We have marked both of our exits (Exit 1 and Exit 2) on the chart above.

Still a profitable trade but not what we expect from a stock breaking out to new highs.

At pivotal times in the market we often have a few LONG positions and a few SHORT positions and more often than not we get stopped out of the trades that end up being on the wrong side of the market.

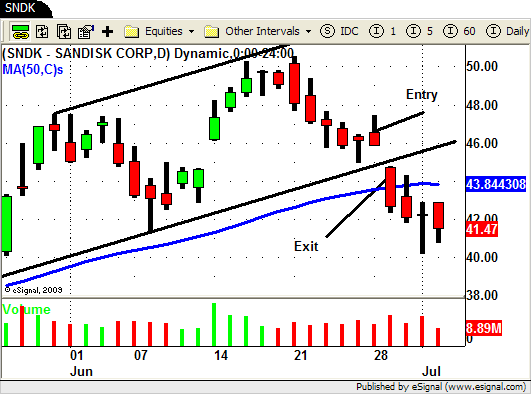

One of our losing trades (we had a few) this week was in Sandisk (SNDK).

Here is the chart of SNDK to give you the context…strong stock making higher highs and higher lows.

During this weeks trading action MONDAY was the make it or break it day in our opinion.

We have been following the recent strength in SNDK so after last weeks pullback we were ready to get LONG again on the first sign of strength.

Monday we got what we were looking for as SNDK traded through Fridays high just as the market also attempted to trade higher.

Our entry was triggered at $47 and our initial stop was set at $44.92 for a $2.08/share risk.

When the market did not follow through on Monday SNDK reversed midday and ended right at the low of the day.

One of the hardest situations that Swing Traders face is what to do when you have a BIG opening gap (up or down) in the market.

Tuesday morning that is exactly what the market did as it opened up the day down significantly from Mondays close.

Like most stocks SNDK was no exception and gapped down with market and opened at $44.76 which was BELOW our initial stop.

Our exit strategy when this happens is dependent on the context of the overall picture that the market, sector and individual stock is painting.

in this specific example the strategy calls for an exit on the open for a number of reasons.

Our actual exit price was $44.74 so we actually lost $2.26/share…MORE than initially planned.

Here is a zoomed in version so you can see the details a bit better.

This losing trade in SNDK shows you why having a position sizing and money management strategy in place is so important.

Due to the frequent overnight gaps we face as swing traders we recommend that you have a "buffer" built in to your position sizing strategy to allow for a "worst case" scenario.

When strong stocks like ALK, NTAP, SNDK and MELI start to break down at pivotal times that usually means our SHORT positions (weak stocks or ETF's) are continuing to sell off.

The "weak" Retail (RTH) ETF continued its sell off this week but you almost had to be in this position coming into the week.

The other noticeably weak sector, the Homebuilders (XHB), offered you yet another opportunity to get SHORT as it broke to NEW LOWS on Tuesday's "gap and go".

Other SHORT trades that worked out nicely were LPNT, ERTS, X, and MGM.

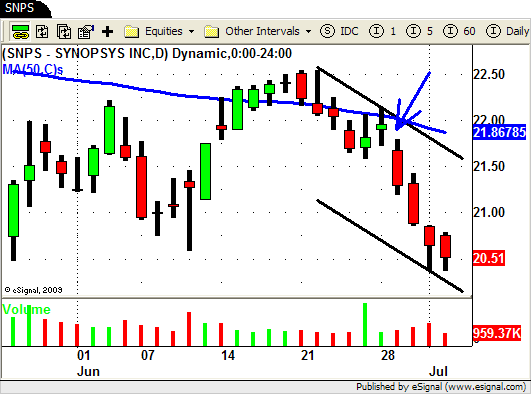

I mentioned above about this being a "fast" market and here are a few example of stocks with "fast channels" to demonstrate my point.

In all of the charts above you can see that after pulling back from their recent highs all of them attempt to move higher on Monday.

They all fail to move higher the next day essentially creating a one day UP move before continuing to sell off.

If they all would have moved higher for another day or so the chart pattern would have painted a more clear picture for those traders not yet skilled at identifying this type of "fast" trend change.

Probably the best example of just how 'fast" this market has been is to look at the overall market ETF's for the DJIA (DIA) and the S&P 500 (SPY).

You can see how the market sold off everyday last week as it put in its first pullback after the 9 day up move.

Monday you can see how price "stalls" and creates an inside bar.

Tuesday the market "gaps down" and sells off for the rest of the week not giving swing traders much of a pullback to SHORT.

In order to capitalize on this type of "fast" price action you need to learn how trends transition and use price action and volume as your leading indicators.

These are the exact strategies we teach in our PVT Trading Tactics class so if you would like to learn more you can check it out HERE.

Until next week…Good Trading to YOU!

Tags: Dow Jones Sell Off, ETF Swing Trading, Retail ETF, RTH, Sector ETF's, SHORT SWING TRADING, Swing Trading Chart Patterns, Swing Trading Price Action, Swing Trading Strategies, Swing Trading Volume