Well after a mild continuation sell off that started last week the markets finally put in a decent move to the upside to finish positive for the week.

Monday we watched the market continue lower but we noticed the this move was not accompanied by strong volume.

We were focused on the 9835.09 level in the Dow as a possible level of support.

9835.09 is the low of the reversal day that happened on February 5th and was essentially the starting point for the 1400 point that followed.

The chart below is the WEEKLY chart of the DJIA to show you the level we were looking at.

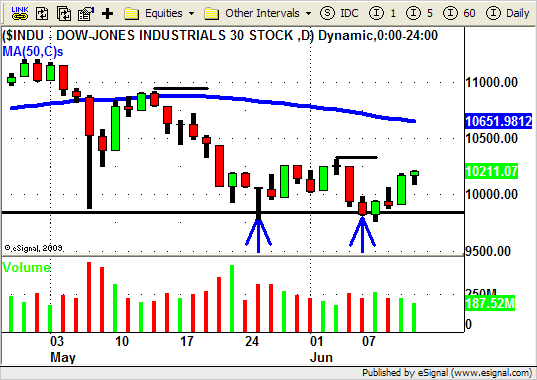

And here is the daily chart of the DJIA which shows you an additional "touch" of this area back on the 25th of May.

Watching the price and volume action around this level would give us a "clue" to what the market may do next.

Tuesday the market did head lower to break through the 9835.09 level once again but by the end of the trading session you could almost feel the tide turning.

We were able to cover most of our SHORT positions (DOW, KLAC, UPS) into this down move on Tuesday as price reached our initial profit targets.

We tightened up our stops and were stopped out of the remainder of our positions on Wednesday morning as the market rallied to new highs around 11am.

Tuesday and Wednesday's price action told us that a "bounce" or "retrace" had begun (at least for the short term) so it looked like the 9835.09 would once again hold as support.

Anticipating the possibility of a "bounce" we also had several stocks on our watch list that were showing signs of relative strength during the recent down move.

Our strategy was to buy a few of these strong stocks if price firmed up around the 9835.09 level and began to show signs of moving up.

As the morning progressed Wednesday we did enter into a few new LONG swing trades.

One of the "strong" stocks we have been watching is NTAP.

After a nice run up to NEW HIGHS you can see how NTAP put in a pretty text book retrace from the HIGH of last Thursday to the LOW of Tuesday's trading.

This pullback from NEW HIGHS was happening as the market was headed lower from a LOWER HIGH into a possible support area…a good sign of strength.

Tuesday's price action in NTAP gave us the "heads up" for it's next possible leg up.

Wednesday, when the market gapped up, we payed close attention to NTAP and once we saw the relative strength in the overall market and NTAP we were able to enter into a LONG position at just over $38.

The market rolled over hard into the close Wednesday and NTAP actually closed well below our entry price after being UP almost $1 in this position.

This is more often than not a sign that our trade will not work out but instead of jumping the gun we just followed of rules like every other trade we put on.

Our STOP for this trade was set at 1 ATR or $1.70 in this case.

The late day reversal on Wednesday brought NTAP within .09 of stopping us out of this trade as the market closed.

From a HIGH of nearly $39 NTAP traded all the way down to a LOW of $37.39 by the close.

Since $39 minus $1.70 is $37.30 (our trailing ATR stop level) that shows you just how close we were to being stopped out.

Thursday the market gapped up a bit a NTAP had an "inside day" on LOWER VOLUME.

No sign for panic but not a great sign for us as the market moved higher.

Friday we got the follow through in NTAP that we were looking for…a nice move UP on INCREASED VOLUME.

As NTAP closed today at just under $40 we trailed our stop up accordingly and, absent any HUGE gap down, have locked in at least a small profit on this trade.

Follow your trading plan and don't try to outguess the market!

Until next week…GOOD TRADING TO YOU!

Tags: Swing Trading, Swing Trading Blog, Swing Trading Chart Patterns, Swing Trading Price Action, Swing Trading Volume

See, I would like the majority of of the blogs I look at would just be truthful in what they say. I think thats why I keep coming back here because not only is the material you provide useful, you also keep it “real”…LOL.

@Adolph

Thank you for the positive feedback!