Swing Trading BLOG – Swing Trading BOOT CAMP

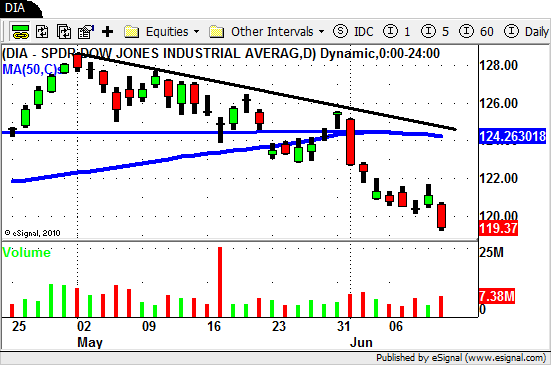

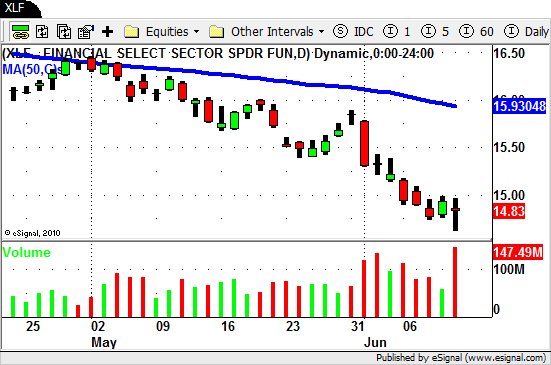

The overall market SOLD OFF this week as sellers stepped and drove stocks lower.

The SELL OFF came in INCREASED VOLUME after the market pushed higher last week on less than stellar volume.

The SELL OFF has traders looking to INVERSE ETF's for possible trade setups in the very near future.

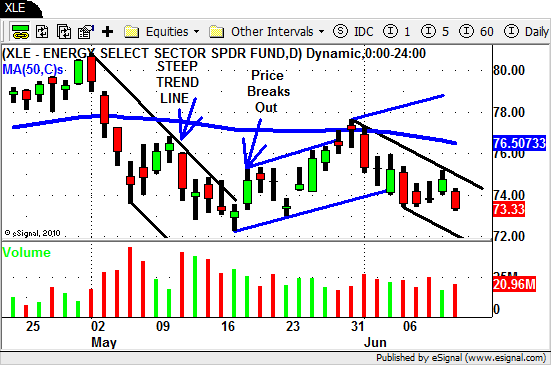

The Energy and Oil ETF's took a hit and and going to be sectors to watch moving into next week.

Agriculture ETF's continue to show weakness and the Steel sector could be headed towards a NEW LOW.

You can see a Technical Analysis walk through on one of the weak Agriculture stocks ($MOS) by clicking HERE.

The Retail and Semiconductor ETF's and holding up very well during this recent PULL BACK in the market.

Despite the recent selling pressure just remember that the market is still trading above its 50 day SMA.

The are more Swing Trading opportunities on BOTH sides of the market now so that tells us that we are at a pivotal point.

There are still plenty of strong stocks to watch ($R, $INFA, $K, $WLK, $ERTS, $M) so make sure to have a plan for next week.

If we trade higher on good volume next week the market could continue its move up.

If we trade higher and volume doesn't follow through then we could be in for another leg down in the near term.

Until next week…Good trading to YOU!