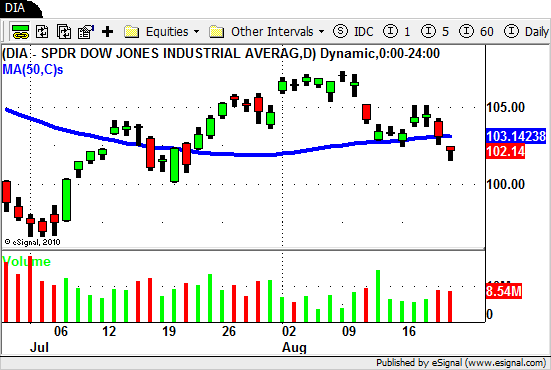

After the retrace back to the 50 Day SMA last week we saw the DJIA put in a bit of "bounce" to start out this week of trading.

After a nice GAP UP on Tuesday we saw the market stall on Wednesday as it failed to trade above Tuesday's HIGH.

Sellers jumped back into the market on Thursday and pushed the market lower to close the week in negative territory.

In last week's BLOG POST we posted about how we saw the market "transition" last Tuesday and Wednesday.

The type of price action transition we noticed had us looking for some SHORT Swing Trading setups coming into the start of this week.

As the market "bounced" to start the week we patiently waited for the WEAK stocks and ETF's to trigger a SHORT entry.

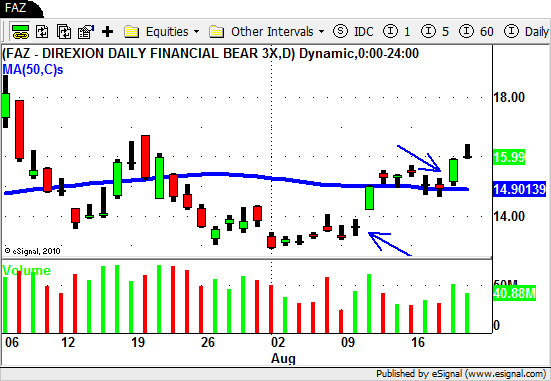

After posting about the "Inverted Head and Shoulders" chart pattenr in the Financial ETF (XLF) we followed up last week with a nice trade in the Inverse Financial ETF (FAZ).

This week FAZ setup yet another LONG trade entry as the weak Financial sector headed lower again.

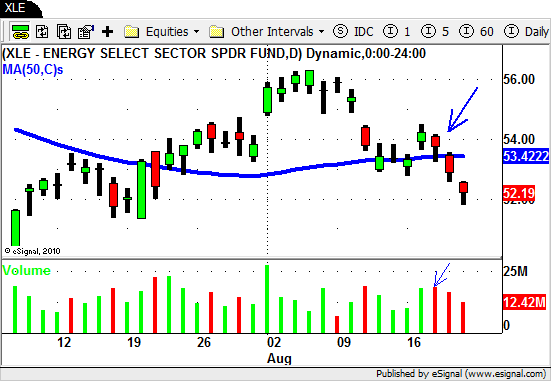

Another sector ETF that gave us a clue to look for SHORT trades was the Energy ETF (XLE).

After putting in a nice up move on Tuesday we watching as XLE reversed it's upward move and head straight down on Wednesday on INCREASED VOLUME.

This created a confirmed "lower high" a put our new down channel in place.

This move in the ETF had us looking through the charts of individual stocks in this sector for possible SHORT trade setups Wednesday afternoon.

APC, SLB and CVX all had nice chart patterns with clearly defined risk levels in place.

This is a good example of how to use sector ETF's to look for Swing Trading opportunities in stocks that a closely related or correlated to that sector.

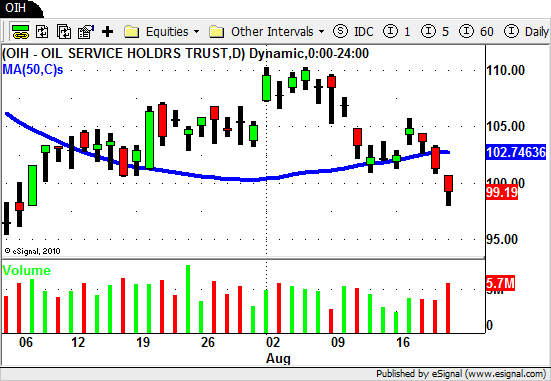

The Oil Services ETF (OIH) had a nearly identical chart pattern.

DO, BHI and NBR we good candidates in this sector.

On the flip side of the coin we saw the GOLD and GOLD MINERS ETF's have a nice week to the UP side as their recent relative strength continues.

Stocks to watch in this sector going forward are AU, EGO, AEM, NEM, ABX, GG, and GG.

Also keep an eye on the Retail ETF (RTH) in the days to come.

We have noticed some strong BUYING in the some of the retail names this week.

This could be a sign of things to come but as always we need confirmation to declare the down trend has come to an end.

As we go into next week there are a few things that we have noticed that have us wondering whether or not this most recent down move has any legs.

We still have a TON of stocks that are holding up (showing relative strength) despite the selling we have witnessed the last two days of this week.

AKAM, MELI, INFA, MO, SNPS, and VRSN to name a few.

Although the DJIA and S&P have technically put in a "lower high" AND "lower low" the Nasdaq has only put in a "lower high" and has yet to confirm a "lower low".

No one knows for sure what we will do come Monday morning so as always be prepared for anything so that you can take the appropriate action when the market tells you it's true intentions.

Until next week…Good Trading to YOU!

P.S

Would like to learn more about how we locate our short term trades in stocks and ETF's?

If so feel free join us Friday, August 27th for our "Finding Swing Trading Opportunities in Today's Market" webinar.

You can register for this absolutely FREE Swing Trading webinar HERE.

Tags: APC, DIA, ETF Swing Trading, Financial ETF, Retail ETF, SHORT SWING TRADING, Swing Trading, Swing Trading Blog, Swing Trading Chart Patterns, Swing Trading Volume, XLE, XLF