Swing Trading Blog Post-

What a difference a week makes.

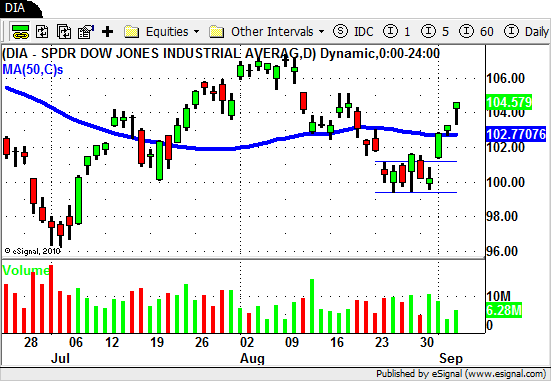

In last week's BLOG post we told that their were buyers at the 10,000 level in the DJIA.

We saw the buyers step in and hold the market up last week and again on Monday and Tuesday of this week.

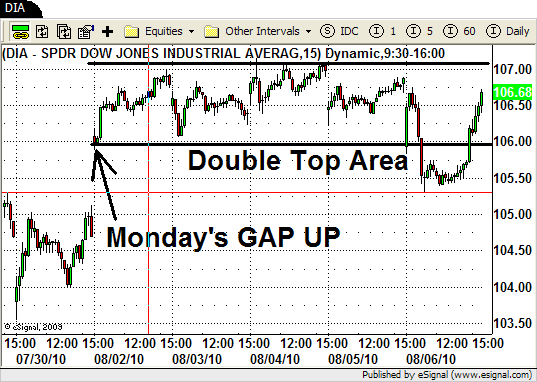

Wednesday is when the real fun started.

After a big GAP UP Wednesday morning we saw the market rally the rest of the day to finish just off the high of the day.

Thursday brought more of the same and then the GAP UP, sell off and intraday reversal during Friday's session is a clear sign that buyers were in control.

The market continues it's erratic behavior and if you have trading for any amount of time you know that the month of September is likely to bring more of the same.

Last week we posted about the strength in the Agriculture related ETF's…DBA and MOO.

We gave you the "head's up" to watch this sector as it seemed ready for it's next move to the UP side.

Both ETF's followed through nicely this week as the market pushed higher to end the week.

Several of the other "strong" ETF's rallied to new multi month highs this week.

The Real Estate (IYR) and Utilities (XLU) are on this list as well as a few International ETF's like THD and BZF.

We also saw the Energy (XLE) and Retail (RTH) ETF's break their short term down trend lines.

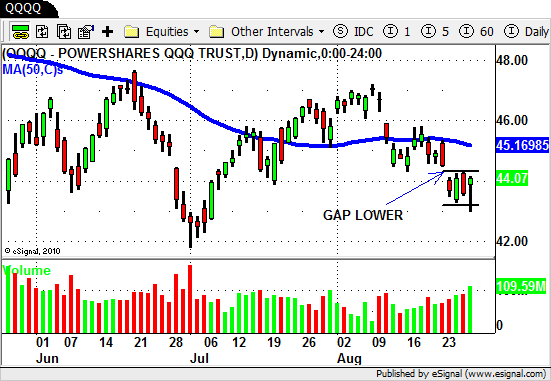

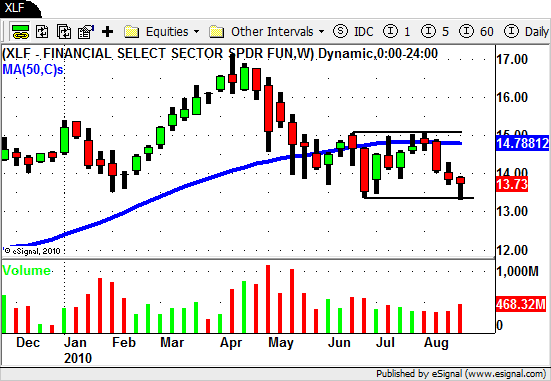

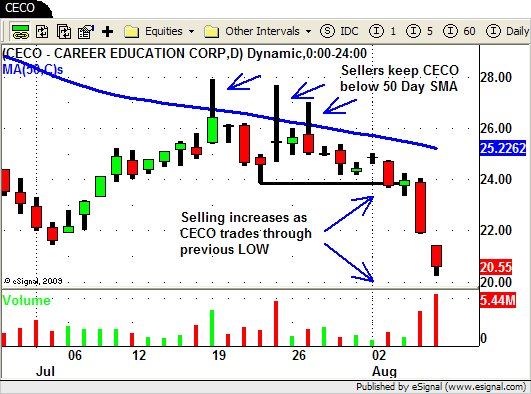

The weak sector's we identified last week…the Semiconductor's and FInancial's…put in a decent bounce off of their recent low's.

We wondered last week if these sector ETF's were going to "bounce" back to their 50 Day SMA's or if they were ready to push to NEW LOW'S.

We got our answer although the "bounce" in the semiconductor's was really less than impressive.

The last 3 trading sessions have taken the market and several stocks to near short term "over bought" levels.

We are not going to chase the market at this point and will simply wait for the next opportunity to initiate some trades.

We will let our current trades play out and manage our positions accordingly.

September is notorious for being a slow, choppy month for trading so be patient and wait for your ideal setups to get into the market.

Until next week...Good Trading to YOU!