Swing Trading BLOG – Swing Trading BOOT CAMP

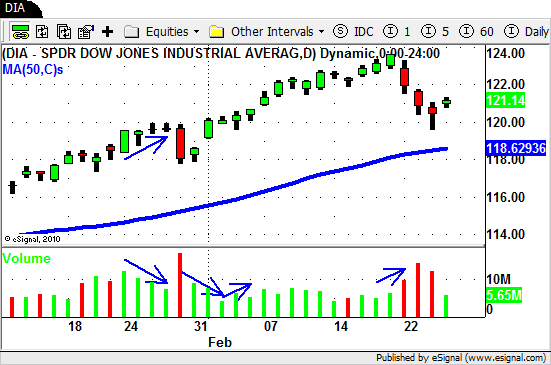

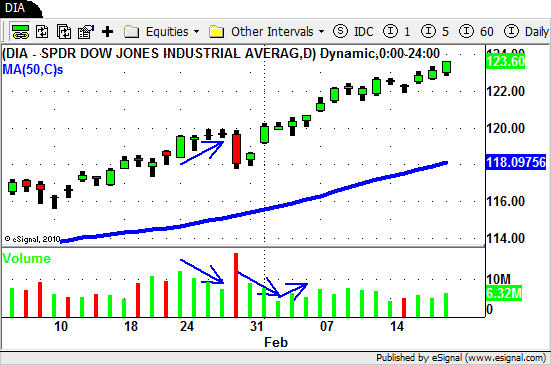

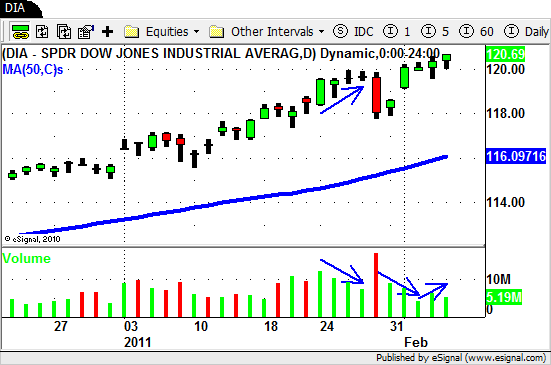

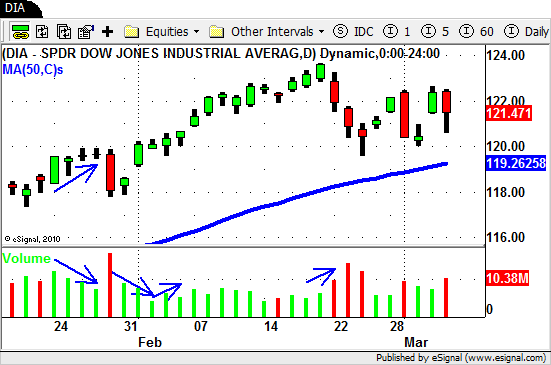

After a BIG sell off on Tuesday the overall market rebounded a bit Wednesday and Thursday.

Friday the SELLERS came back out to play and drove the market lower once again.

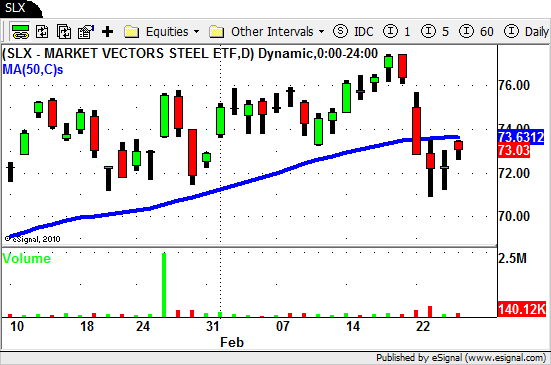

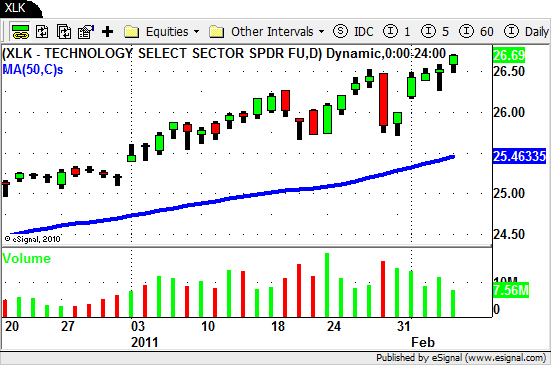

It is definitely a "mixed bag" out there with several stocks and ETF's holding up while others are falling apart.

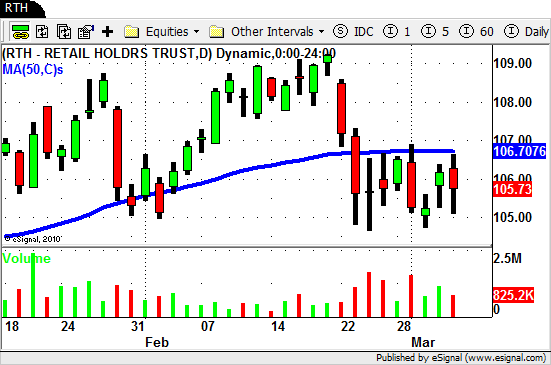

The Retail sector ($RTH) and Homebuilders ($XHB) are still showing weakness as they trade just below their 50 day SMA.

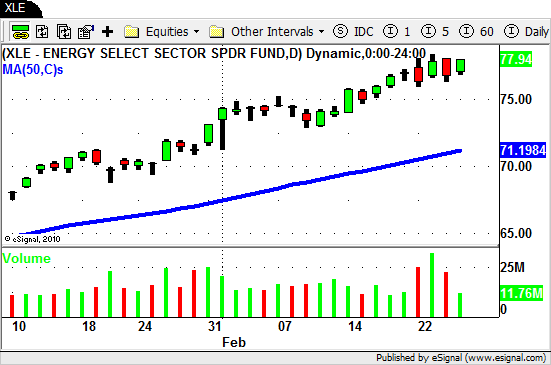

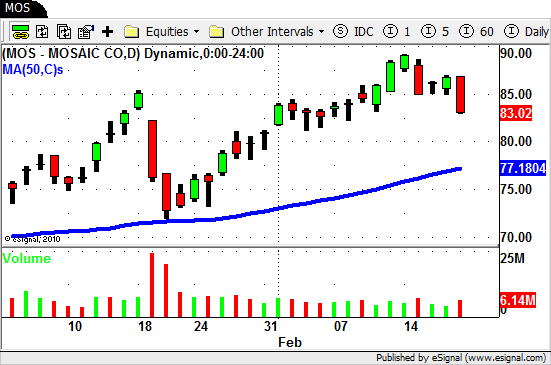

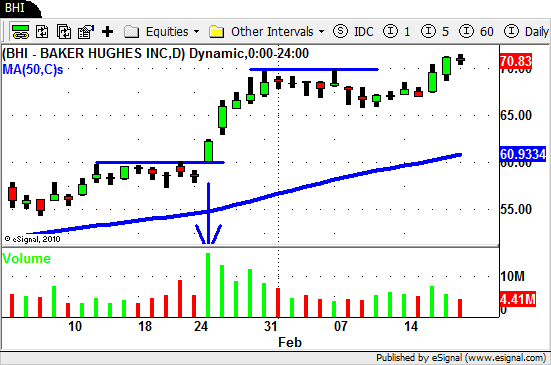

Oil Services ($OIH), Energy ($XLE) and especially the US Oil ETF ($USO) all remain strong.

As we wrote in last weeks BLOG post we are back into taking positions on both sides of the market.

This week we will approach our trading in the same "mode" as last.

Plenty of stocks are showing weakness and if there is follow through to the down side then these stocks will be the ones to SHORT.

If the market does somehow find some legs then we will turn to the stocks in the sectors that are holding up the best.

Until next week…Good trading to YOU!