Swing Trading BLOG – Swing Trading Video

Swing Trading analysis – $DIA $QQQ $SPY

ETF analysis – $XLE $OIH $RTH $SMH $XLI $XLK $XHB

Swing Trading BLOG – Swing Trading Video

Swing Trading analysis – $DIA $QQQ $SPY

ETF analysis – $XLE $OIH $RTH $SMH $XLI $XLK $XHB

Swing Trading BLOG – Swing Trading BOOT CAMP

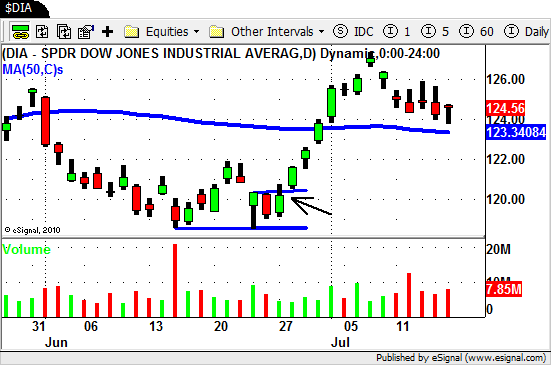

Nice follow through this week!

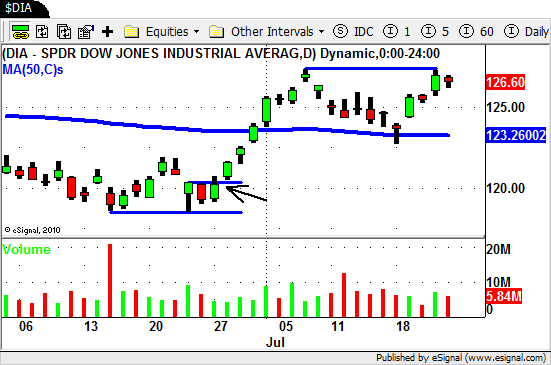

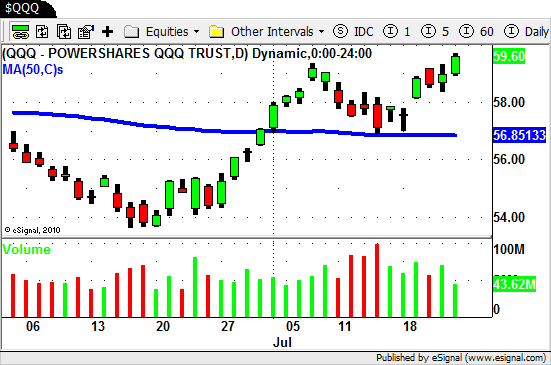

After a spike down below the 50 day SMA on Monday the market found its footing and resumed its move to the UP side this week.

As far as the indices are concerned the NASDAQ actually rallied up to a HIGHER HIGH while the DOW and S&P lagged behind a bit.

As expected the overall market did well but a few sectors really stood out.

Here is a look at the charts for a few of the sector ETF's that performed well.

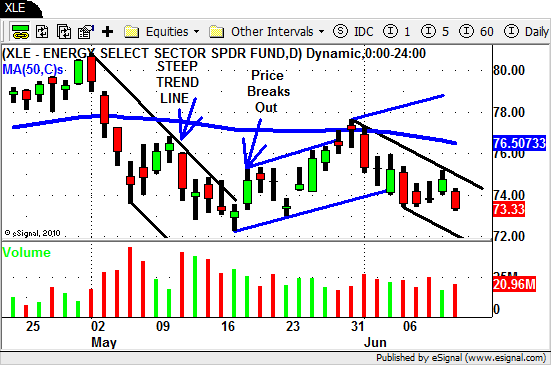

$XLE

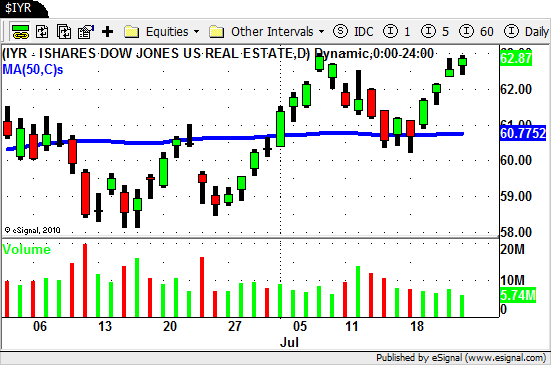

$IYR

$XLK

$OIH

In last weeks BLOG POST we mentioned several individual stocks in these sectors to watch.

The Energy and Oil Service stocks we mentioned all did well.

The Casino stocks moved up but lacked the "pop" (so far) that we were looking for.

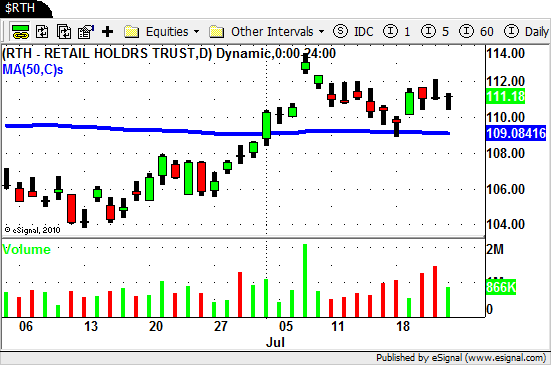

The Retail stocks (and ETF) basically "stalled" after moving higher on Tuesday.

The Gold, Gold Miners and Silver ETF's continue to hold up after putting in a nice rally recently.

Keep your eye on the Agriculture ETF's (and stocks) as we move forward since we are seeing some interesting price action and volume patterns lately.

$MOO has drifted up but $DBA is still lagging behind.

The market has moved up fast this week and is flirting with being short term overbought.

Remember though that an overbought (or oversold) market can become even MORE OVERBOUGHT.

Price action and volume paint a picture so look for the clues the market gives you.

Be prepared for anything and as always…Good Trading to YOU!

Swing Trading BLOG – Swing Trading BOOT CAMP

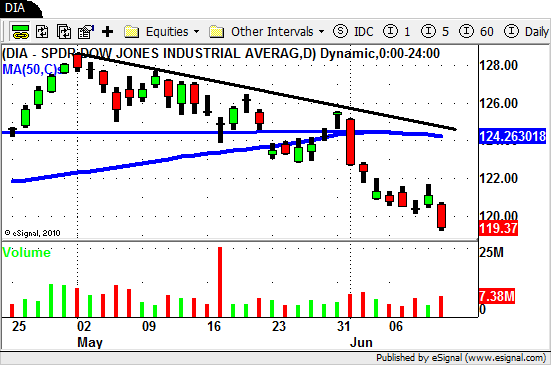

"There is no doubt that a retrace in the market will happen…it is just a matter of when."

That was a line from last weeks BLOG post.

Well that "when" was this week!

Tuesday the market GAPPED DOWN (again) and continued to show weakness for the entire week.

The major indices are now hovering around their 50 day SMA's are trying to figure out where to go from here.

The strong sectors we mentioned last week (Real Estate, Technology, Retail) have all pulled back after their recent run up.

The Semiconductors and the Financial sector continue to UNDER perform the market.

The Broker/Dealer ETF ($IAI) actually traded down to NEW LOWS for the year this week.

Several stocks started to show signs of life by weeks end so they are worth a watch as we begin trading next week.

The Energy and Oil Service stocks are showing some good trading patterns.

$APC, $COG, $SLB, $HAL and a few on the smaller names are on our list.

We also have our eye on the casino stocks $WYNN, $LVS, $MGM, etc.

Of course we still have the Retail stocks and our "list to watch" from our last BLOG post on this weeks Watch List as well.

After the nice pull back we saw in the market this week we should see some interesting price action next week!

Oh and don't forget to have some SHORT candidates on your list as well…just in case.

That way you can act on whatever the market decides to do from here (heard that before?).

Until next week….Good trading to YOU!

Swing Trading BLOG – Swing Trading BOOT CAMP

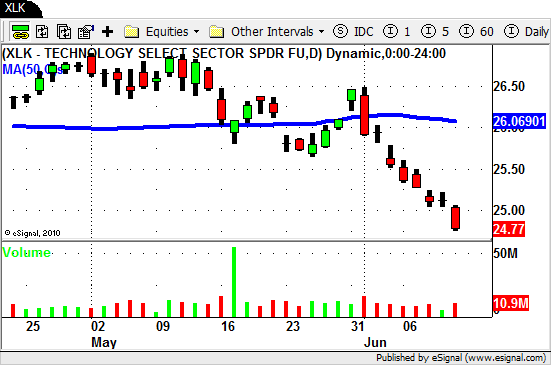

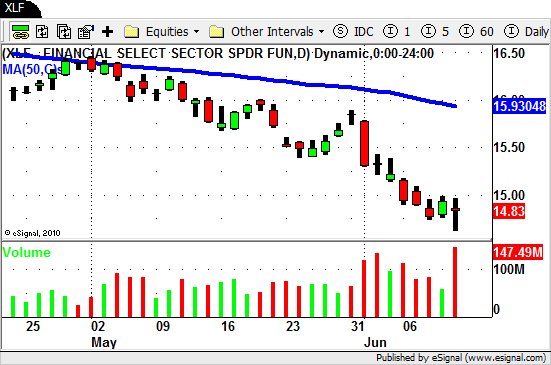

And DOWN WE GO!

Inverse ETF's rally and the SHORTS come out in droves.

Traders watched the overall market continue its sell off this week.

After four days of sideways trading the sellers stepped in again on Friday and pushed the market down to new multi month lows.

Almost every sector on the map felt the pain.

Technology related ETF's continued to fall.

Real Estate and Financial ETF's got pummeled.

The Energy and Oil ETF's that were showing signs of strength last week are now not looking so strong.

If these sectors break down through the near term support levels they definitely have room to fall.

The market looks ripe to continue to move lower as the strongest stocks look to be "rolling over".

If you are looking to the SHORT side for trades try to find stocks or ETF's that are not yet extended to the downside.

If you are not comfortable with SELLING SHORT then you can always look to "get long" some Inverse ETF's.

As always be prepared for anything and act accordingly.

Until next week…Good Trading to YOU!

© Swing Trading Boot Camp 2026