The SELL OFF continues!

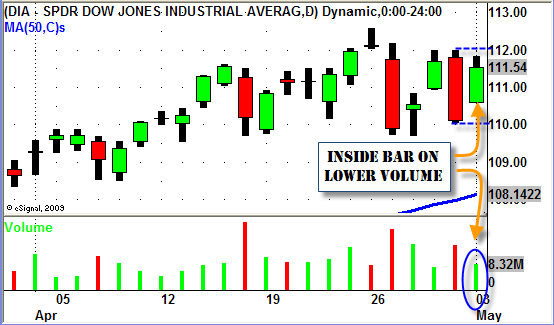

Another volatile week in the markets this week as the sellers came out in droves driving the Dow back down near the lows we saw on May 6.

In last weeks Swing Trading Blog post we notified you of the numerous SHORT Swing Trade setups we had on our "Watch List" for Thursday (May 13th) morning.

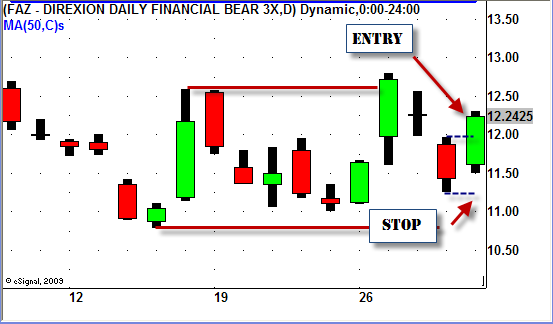

Our strategy was to locate weak sectors and individual stocks within those sectors that were giving us LOW RISK setups.

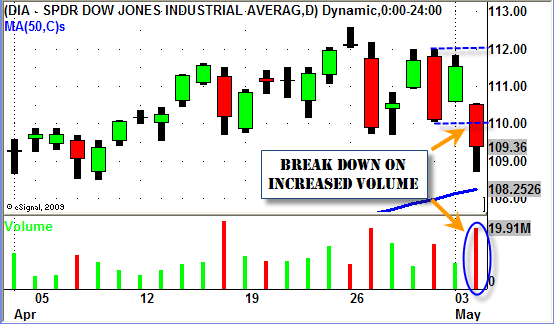

We also advised that when the market followed through to the downside we entered into several new positions.

In our Swing Trading Newsletter we highlighted the Semiconductor ETF (SMH) and several of the stocks (KLAC. LLTC, MXIM) within that sector that had nice SHORT trade chart patterns.

Some of the other stocks on our list included AXP, FDX, MET, ALL, and SOHU.

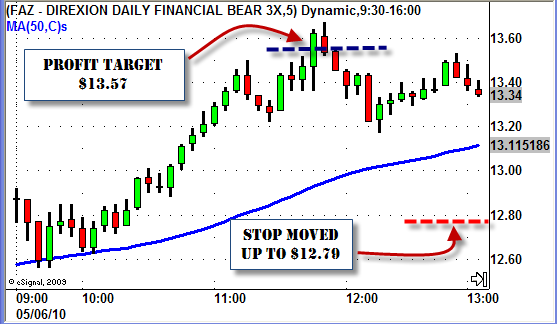

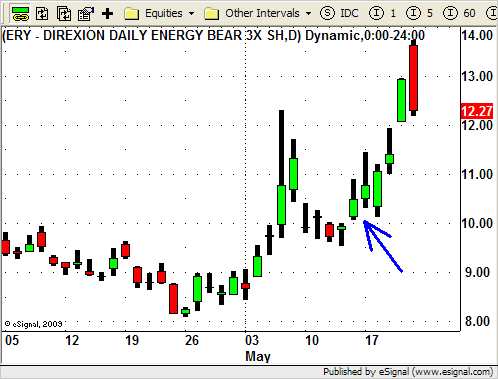

We also got LONG trades off in the Inverse Energy ETF (ERY) and the Financial Inverse ETF (FAZ).

Well needless to say these trades played out nicely this week as the market made its way lower.

We were able to scale out of our trades on the way up and when the market gapped down again on Friday we tighted our trailing stops and were taken out of most of our remaining shares.

The sellers were relentless this week taking down almost every sector along with it.

The Steel (SLX), Solar(TAN), Oil (OIH), Energy (XLE) and Agribusiness (DBA) ETF's all made new yearly LOWS this week.

Some of the previously strong sectors also came down with the market during this weeks sell off.

Retail (RTH), Real Estate (IYR) and the Homebuilders (XHB) finally broke under their 50 day SMA's and headed lower.

The Gold (GLD and GDX) and Silver (SLV) ETF's came off of their recent highs to put in a lengthy and somewhat concerning pullback.

Fridays "bounce back" tells us that a retrace could be in order going into next week.

We are currently watching some stocks that have shown signs of relative strength during the down move this week but until the obvious negative sentiment changes we will continue to look for additional SHORT trading opportunities.

If you would like to learn more about our Swing Trading Strategies and Techniques please feel free to join us at any one of our upcoming courses or webinars.

Until next week…GOOD TRADING TO YOU!