Well it has been another wild week in the market!

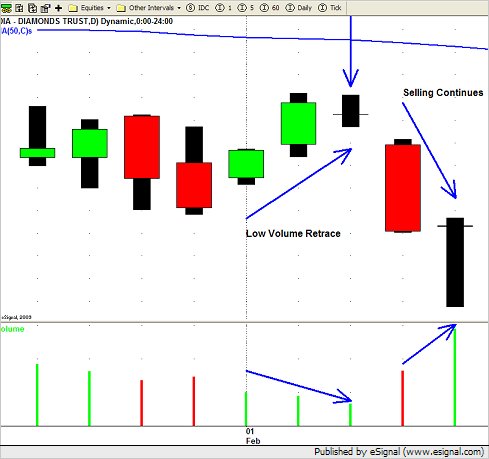

Monday and Tuesday saw the markets climb giving some traders and investors a sense that the market may have found some support.

Wednesday's lackluster performance was quickly followed up by another round of HIGH VOLUME SELLING on Thursday.

Fridays market action was quite volatile with selling continuing early in the day.

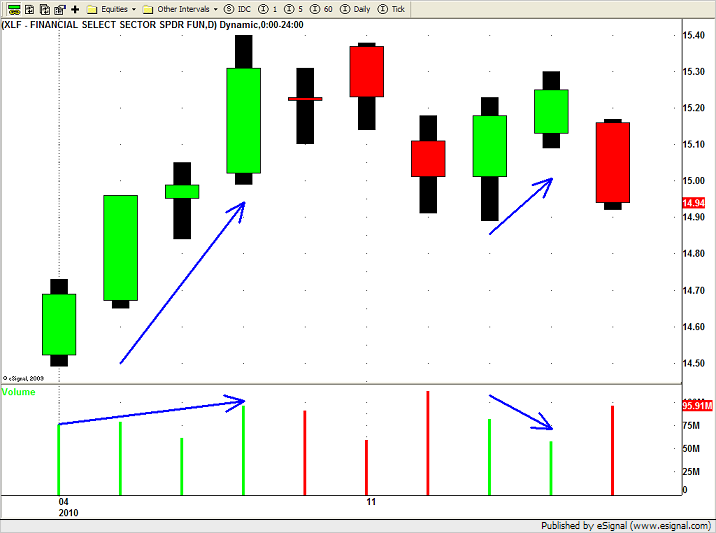

Buyers stepped in after lunch time and turned the market around by rallying about 160 points to end the day near break even.

So after Friday afternoons reversal what can we expect going into next week?

As always we let the charts tell us what to do.

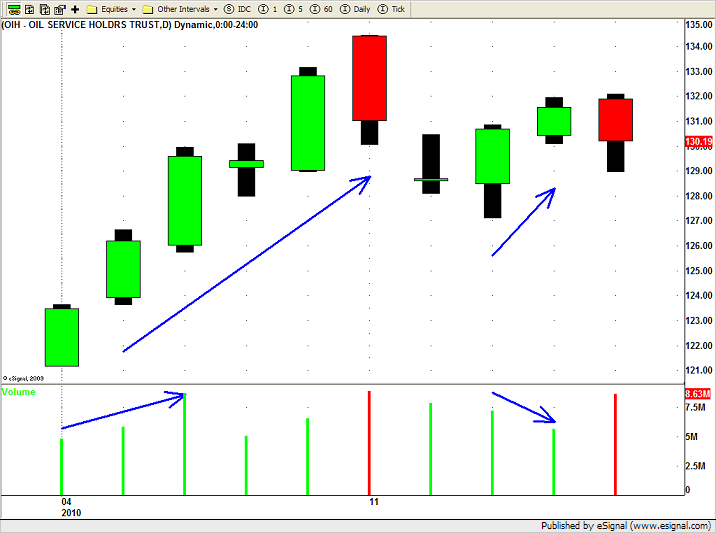

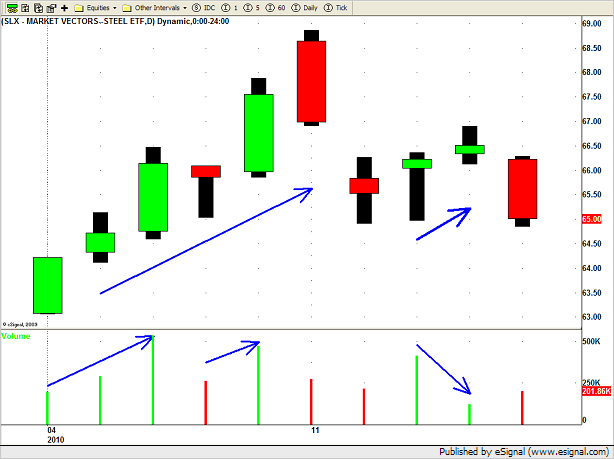

Last weeks price action was "picture perfect" when it came to SHORT swing trade set ups.

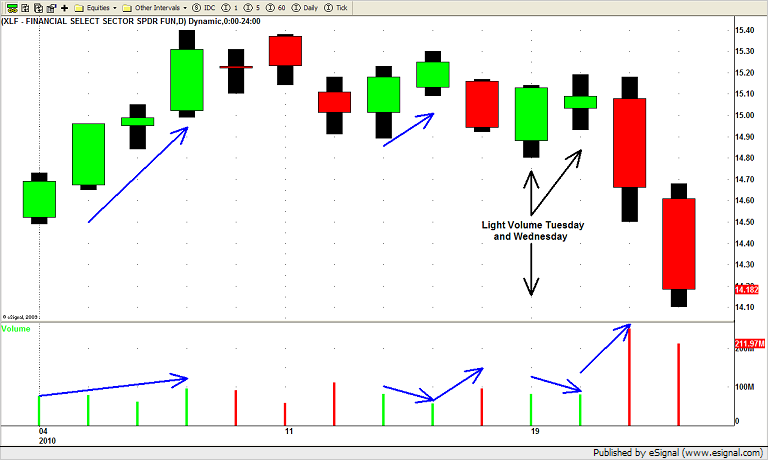

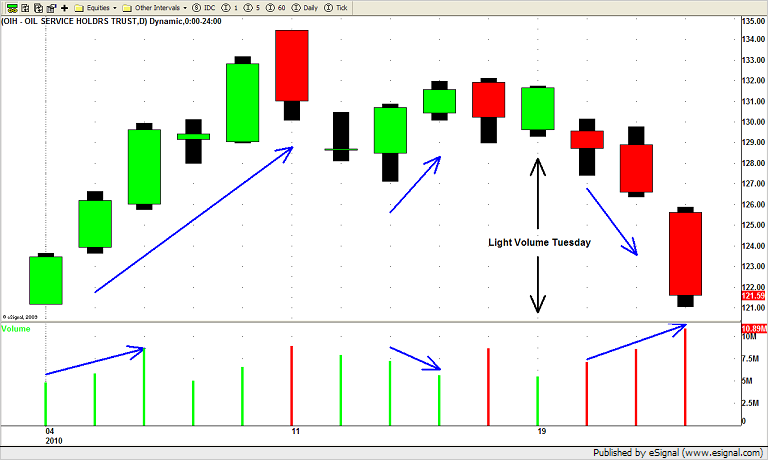

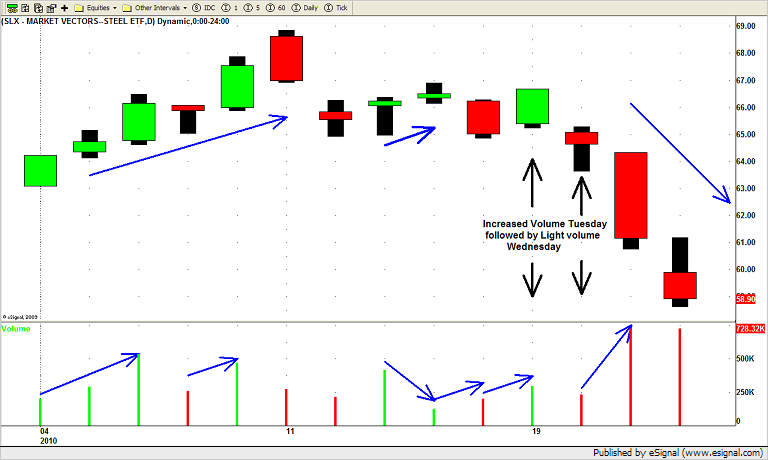

Monday and Tuesdays low volume up move we quickly identified as simply a retrace in a down channel.

Wednesday's inside day, again on low volume, created perfect chart patterns for SHORT SWING TRADE opportunities.

The trigger came on Thursday when the selling came back into the market after the retrace.

If you would have gotten SHORT on Thursday and managed your swing trades the right way, Friday's reversal day would NOT have been a big deal to you.

You could have covered your positions into the downward momentum on Thursday and even into Friday morning.

If you chose to only cover a portion of your positions then the worst case scenario was to move your stop down to break even (at least) on the remaining shares.

Next week's market action should be very interesting after Fridays impressive late day rally.

If you are prepared for battle (have a solid trading plan) it shouldn't matter what the market does since you are prepared for EACH and EVERY situation the market throws at you.

Until next week…Good Trading to YOU!