Swing Trading BLOG – Swing Trading BOOT CAMP

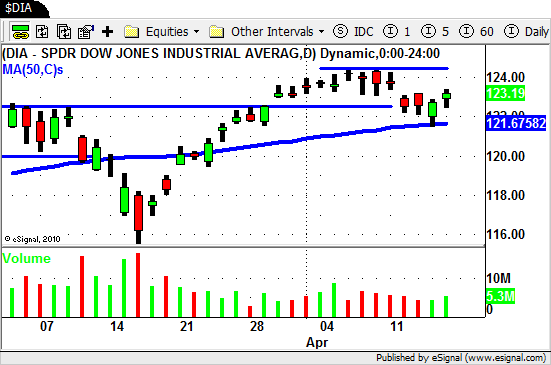

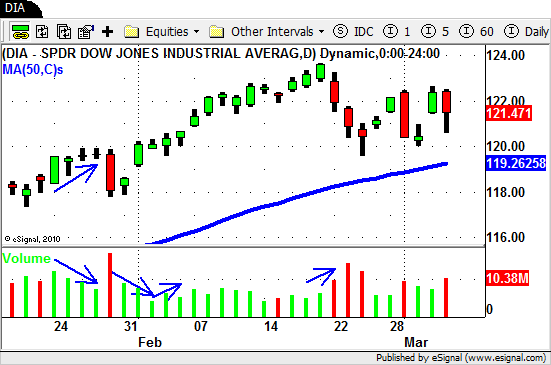

Swing Traders watched as the Dow Jones Industrial Average moved to NEW HIGHS this holiday shortened week.

Earnings news in the Technology sector influenced the markets early in the week and lead to a nice GAP UP on Wednesday.

This news brought buyers into the market and lifted the Technology ETF ($XLK) back above its 50 day SMA by weeks end.

The Semiconductor sector ($SMH) also got a lift this week and is also now trading back above its 50 day SMA.

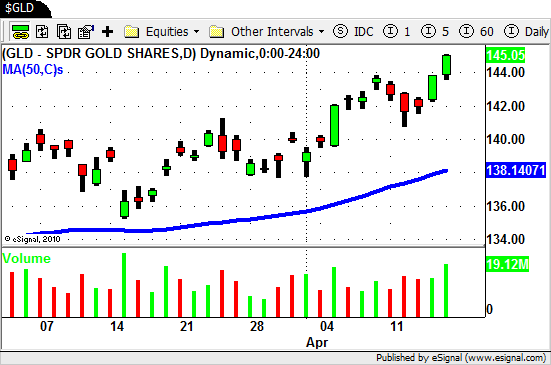

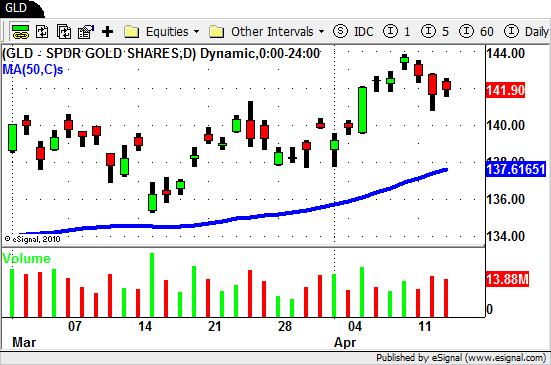

Silver and Gold continue to show their strength with both sector ETF's ($SLV $GLD) trading to new multi month highs again this week.

Looking around at some individual stocks there still seems to be a bit of indecision in some sectors.

There are great stocks like $LULU, $SINA, $WLK and $SIRO.

Then there are not so great stocks like $CREE, $WFC and most of the airline stocks.

It will be interesting to see how these stocks do if the market continues to move higher.

Next week we will watch to see if the S&P 500 follows suit and BREAKS OUT to NEW HIGHS as well.

We are still in LONG only mode but we will be prepared for whatever the market decides to do from here.

Until next week…Good Trading to YOU!

**No charts this week due to a problem with Esignal data**