Swing Trading BLOG – Swing Trading BOOT CAMP

The week of the Good, the Bad and the UGLY!

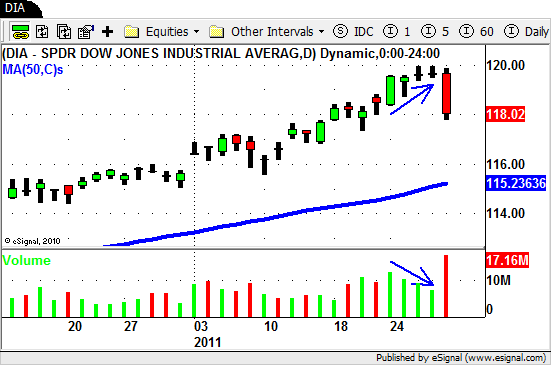

Well the GOOD news is that the DJIA moved to NEW HIGHS again this week AND both the S&P 500 and NASADAQ follwed suit.

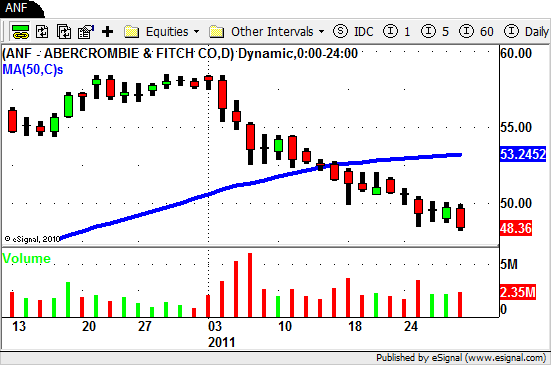

The BAD news is that once again the price action in the individual stocks paints a different picture.

We have been saying this for a few weeks now but as more and more stocks start to show signs of weakness it is something to take note of.

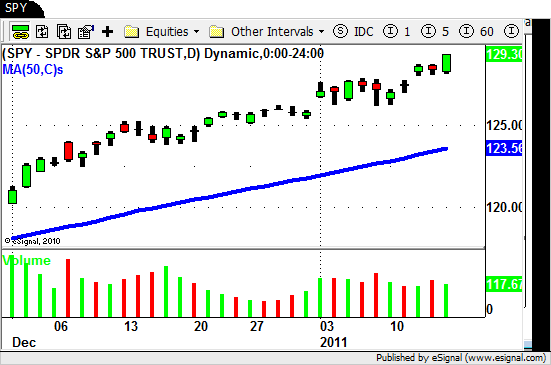

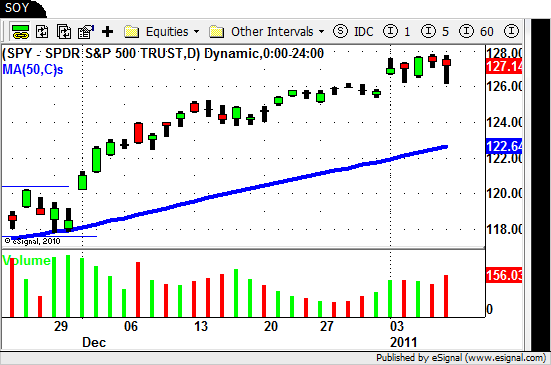

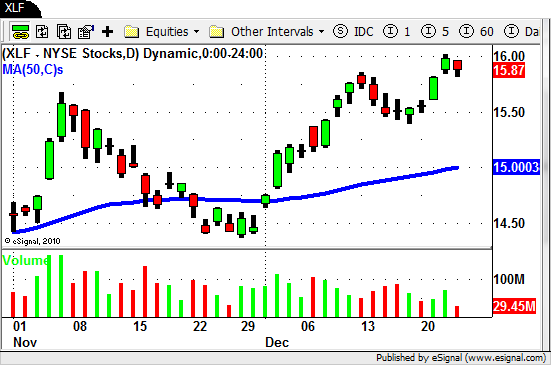

This weeks UP move in the market was on DECREASING VOLUME and Friday the volume finally picked up but…it was on the SELL side!

Look at the chart above to see what we mean.

A market moving higher on lower and lower volume is never a good sign but as always how the market follows through will be key.

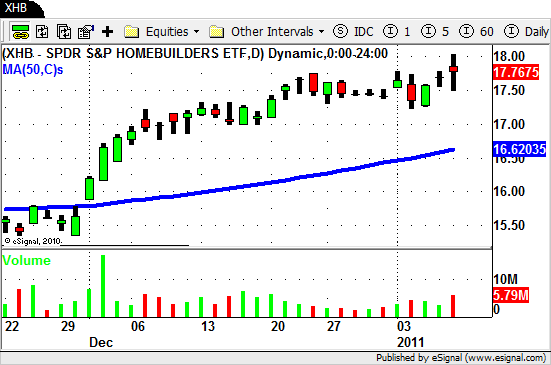

If you are trading the major index ETF's ($DIA, $SPY, $QQQQ, etc.) then all has been very good for you on the LONG side and this week was no different.

If you Swing Trade both stocks and ETF's then you may have actually been able to make some trades on the SHORT side as well these past few weeks.

It really depends on the type of Swing Trader you are and how often you need to trade to reach your goals.

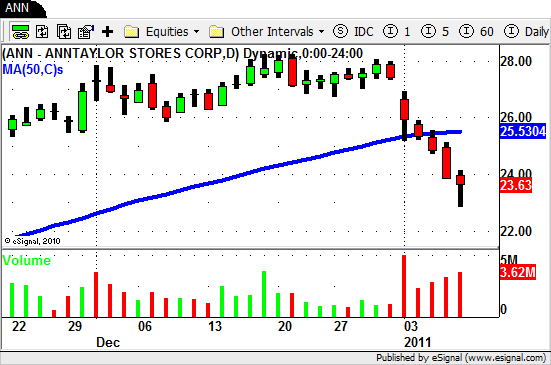

We have been posting about the weakness in some of the individual Retail names for a few weeks now.

$ANN, $M, $ANF, and $TIF are a few that come to mind.

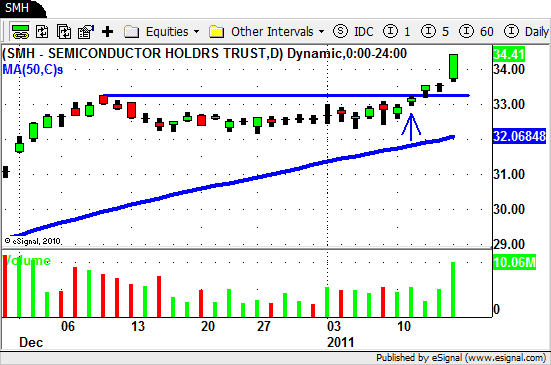

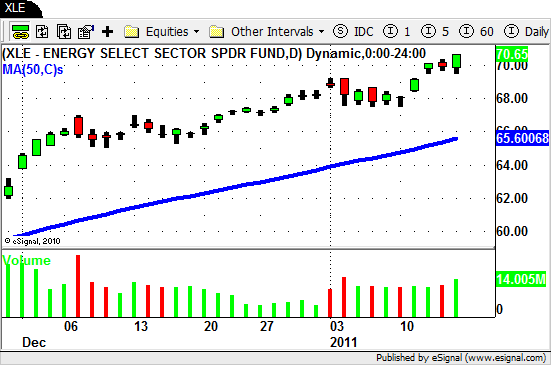

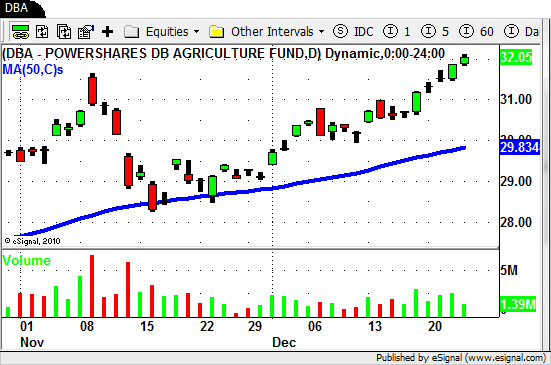

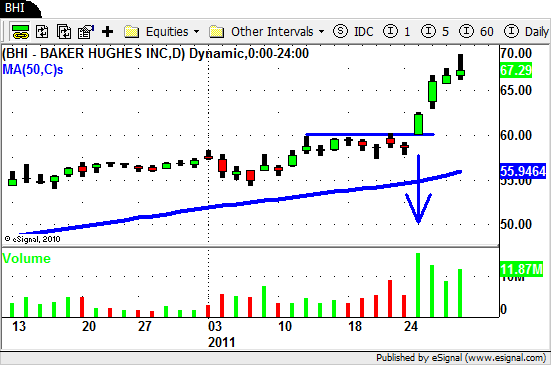

On the LONG side we have mentioned the Energy ($XLE) and Semiconductors ($SMH) were holding up well and this week both sectors moved a but higher.

$BHI, $COP and $SUN popped this week as did $KLAC, $NVLS and $ATMI.

As we look through the charts from this week that biggest thing that stands out is the BIG VOLUME coming into these stocks as they sell off.

Take a look at a few charts like $MWW, $IDSA, $F and $FDX to see what we mean.

Fridays sell off was a BIG ONE and the volume that accompanied it should grab your attention.

This market has gone UP and UP and UP for a long time so when and if we get any kind of correction it could be a decent one.

Don't try to outguess the market…simply be ready for whatever the market throws your way.

Next week should be interesting for sure!

Until next week…Good Trading to YOU!