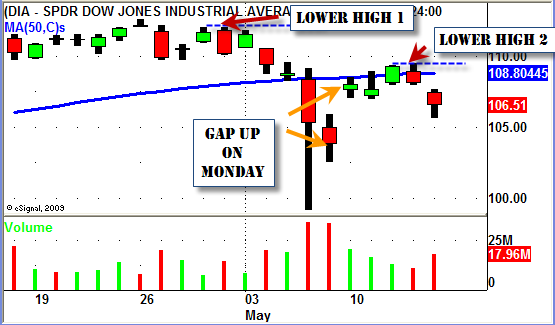

Gap DOWN and roll over, Gap DOWN and RIP, Gap UP and roll over!

After all is said and done the roller coaster came to a stop and finished down about 60 points for the week.

Not bad considering that we gapped down HUGE on Tuesday and traded down to new yearly lows intraday.

All in all the week was a rather boring one for our Basic Swing Trading strategies.

If you were not already short coming into the week it was a little late and difficult to initiate any new SHORT positions.

Most of our basic bread and butter strategies are "with trend" strategies which means that we focus on swing trade setups in the same direction as the overall market and sector.

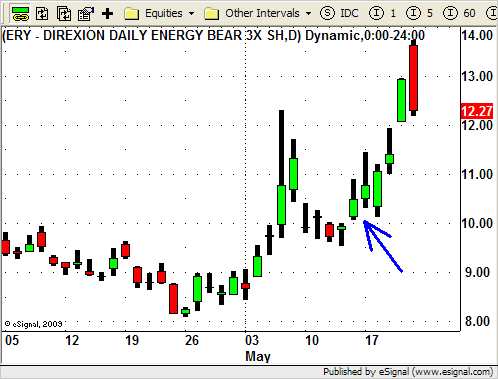

If the market is in a DOWN trend or DOWN channel these strategies focus on SHORT Swing Trading setups (or LONG Inverse ETF's).

If the market is in an UP trend or UP channel then of course we look for LONG Swing trades.

Some of our more advanced Swing Trading strategies are actually designed as "counter trend" strategies.

These strategies are designed to trade and profit from "bounces", pullbacks and retraces and trade in the opposite direction of the dominant trend.

An example of this would be buying into a LONG position in a DOWN trending stock as it comes into a possible area of support.

The are of course other factors to consider when using "counter trend" strategies and these should strategies should only be used by experienced swing traders.

I mention these advanced strategies because this week we saw a good opportunity to use them.

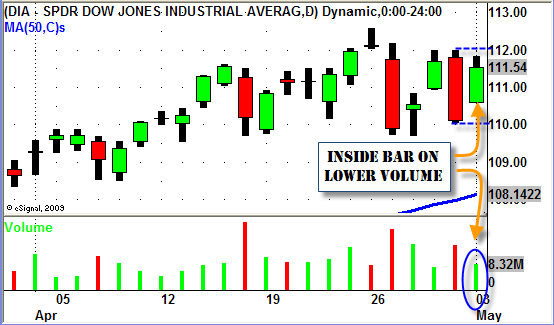

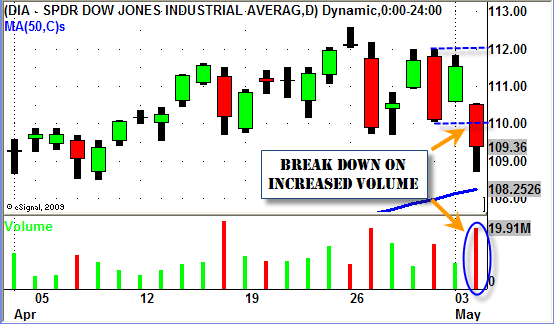

On Tuesday we noticed that the HUGE gap down brought us down to levels in the S&P and Dow that we saw in the beginning of February.

After such as extended move DOWN over the past 2 weeks you had to think that there MAY be some support in the area.

We did NOT blindly buy into the GAP down but instead we waited to see how the market traded around this level.

By mid morning on Tuesday the strength in the market was obvious…there were buyers picking up stock at these new lows.

As the market started to follow through the rest of the day we were able to initiate a few LONG trades.

We looked for relatively strong stocks that were either OVERSOLD or showing signs of holding a support level.

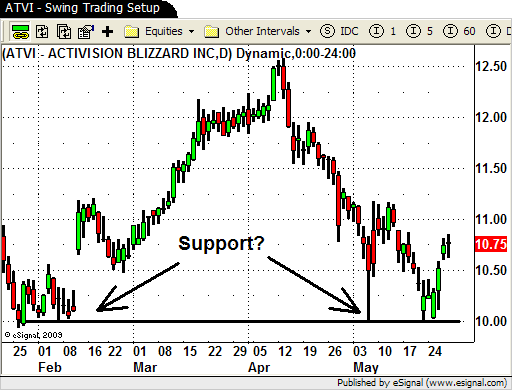

Stocks like ATVI and MCHP.

Both ATVI and MRVL were SHORT TERM OVERSOLD as they traded into their LONGER term support levels.

Tuesday's GAP and RIP gave us any opportunity for a low risk trade in both stocks.

We exited ATVI today (Friday) for a nice gain as it reached SHORT TERM OVER BOUGHT levels into the close.

MRVL was not yet OVER BOUGHT as of the close so we exited a portion of position and are trailing the rest with a tight stop.

We did stay away from some of the other stocks with similar patterns due to their recent weakness.

AXP and X come to mind as well as some of the other financial stocks.

We put these stocks on our "DO NOT TRADE" list because both sectors have been the leaders to the DOWN side in recent weeks.

The recent "bounce" in the market could simply be a pullback before the next down move.

If so we have a bunch of stocks that are setting up nicely to the SHORT side.

If the market finds some legs and continues UP from here we have a few positions on and we will trail our stops accordingly.

We will also look for opportunities to get into some of the strong stocks like FDO, SNDK, ALK and WSM.

No one knows for sure which way we go from here but by being able to trade the market by using some advanced strategies you should be able to make profitable trades in any environment.

Until next week…GOOD TRADING TO YOU!