Swing Trading BLOG – Swing Trading BOOT CAMP

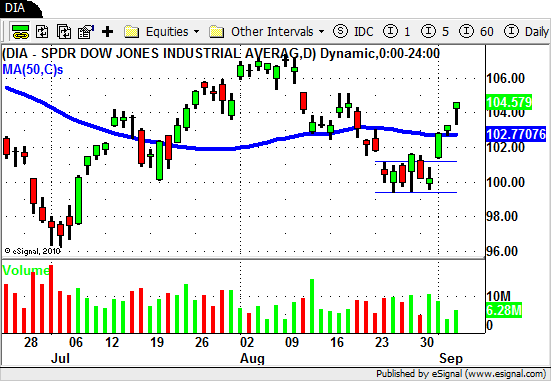

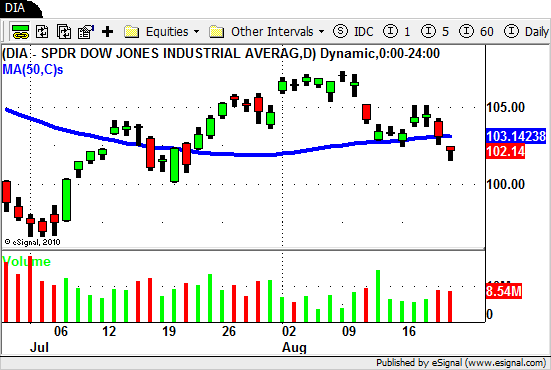

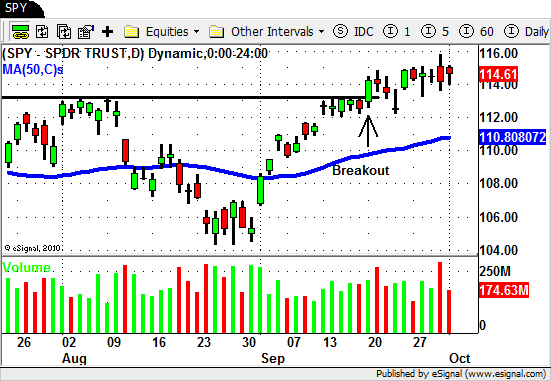

Well after the long awaited BREAKOUT we saw last week the market followed up with…a nice long week of NOTHING!

Coming into this week there was a lot of optimism based on the recent bullish action we have seen in the overall market.

Traders (including us) were expecting at least a little follow through this week but instead were met with yet another frustrating week of consolidating price action.

Most of the stocks and ETF's did the exact same thing as the overall market.

A few were up slightly as the week came to an end but nothing to write home about.

There were a few exceptions as we saw the Energy and Oil Services ETF's have nice continuation moves this week.

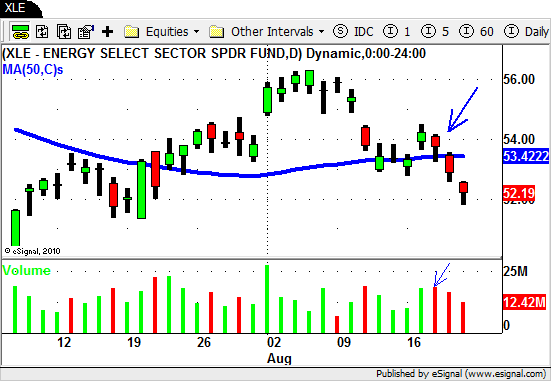

In last weeks BLOG post we showed you our entry into XLE and the pullback that followed.

This week XLE continued its UP move despite the "stall" in the overall market.

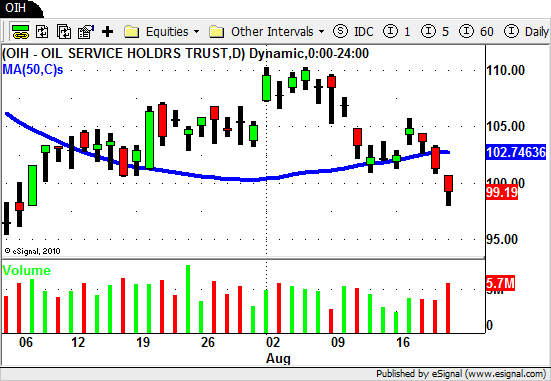

As you would expect the Oil Services ETF (OIH) had a strong week.

RIG and DO were two stocks in this sector the gave us LONG trade signals this week.

GOLD and the GOLD MINERS (GDX) came back to life this week as well and SILVER (SLV) is acting just as bullish.

With last weeks news in the AIRLINE sector we saw the Airline ETF (FAA) trade up to a NEW HIGH for the YEAR.

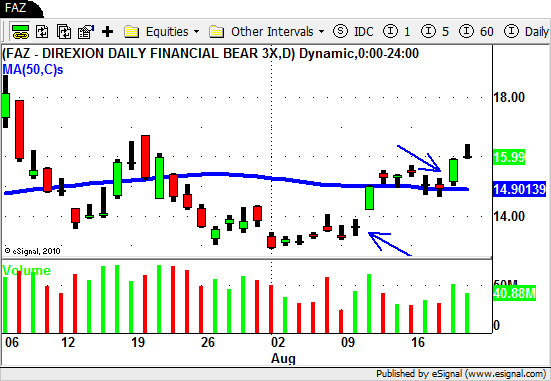

Technology, Retail, Real Estate, Financial and the Homebuilders all had a lackluster week.

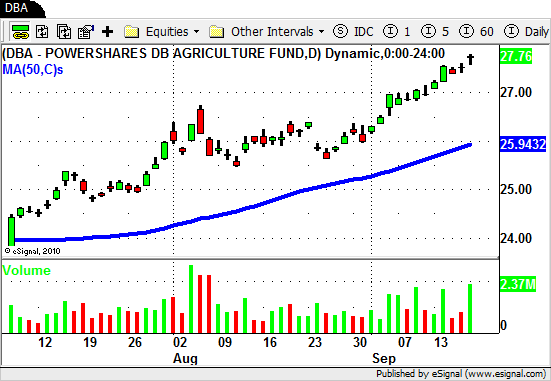

One sector to watch moving forward is going to be Agriculture.

This week we saw big time selling come into some of the stocks in this recently strong sector.

MON, MOS, CF and ADM all sold off this week despite the market holding up above its BREAKOUT level.

The Agriculture ETF's (DBA and MOO) have now put in their first significant pullback after last months nice run up.

This pullback may be a good time to look to buy some of the stronger names in this sector but the caution light is now flashing as we move forward.

This type of price and volume action is not yet a transition from a "bullish" to "bearish" bias for this sector but it is something to watch for in days/weeks to come.

The overall market is still very strong as almost every major sector ETF is trading above its 50 day SMA.

Last weeks "consolidation" is telling us that the buyers and sellers are playing a big game of tug-of-war at this level.

Obviously anything is possible next week.

A continuation move to the UP side wouldn't surprise us but neither would a retrace back near the 50 day SMA.

The key (as always) is to be prepared with a plan of action for either outcome.

What stocks and/or ETF's will you look to buy if the UP move continues?

What will you do if the market sells off on Monday indicating that the market is pulling back?

Will you SHORT anything or simply sit on the sidelines and wait?

You know what they say..."failing to plan is planning to fail".

Have your plan is place and execute when the time is right!

Until next week…Good Trading to YOU!