Swing Trading BLOG – Swing Trading BOOT CAMP

And DOWN WE GO!

Inverse ETF's rally and the SHORTS come out in droves.

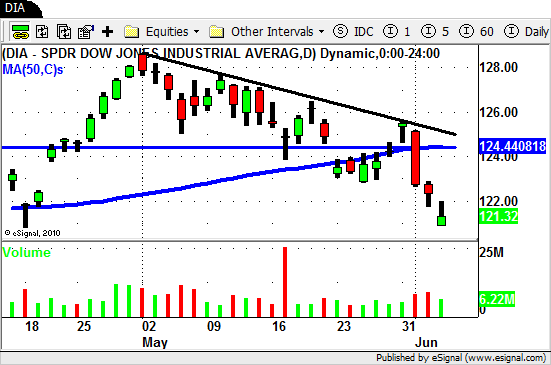

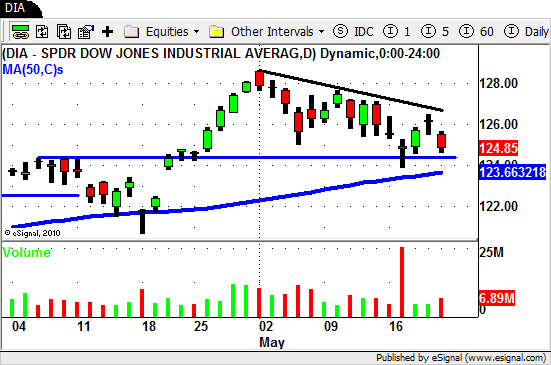

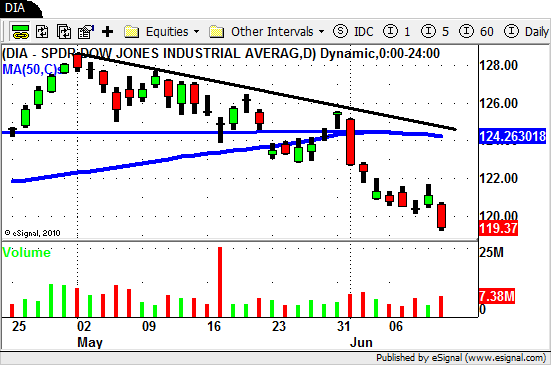

Traders watched the overall market continue its sell off this week.

After four days of sideways trading the sellers stepped in again on Friday and pushed the market down to new multi month lows.

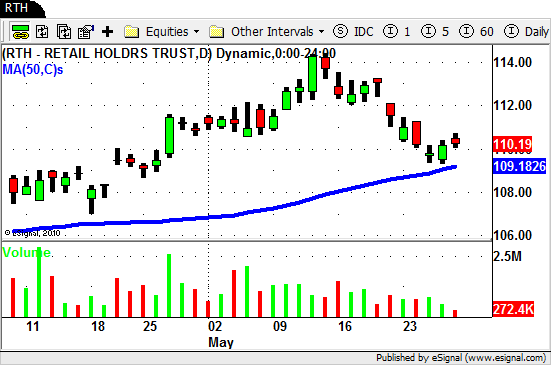

Almost every sector on the map felt the pain.

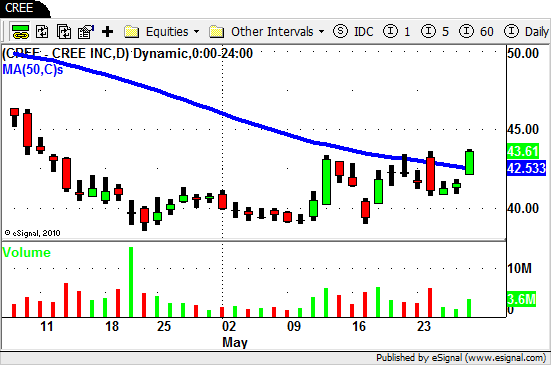

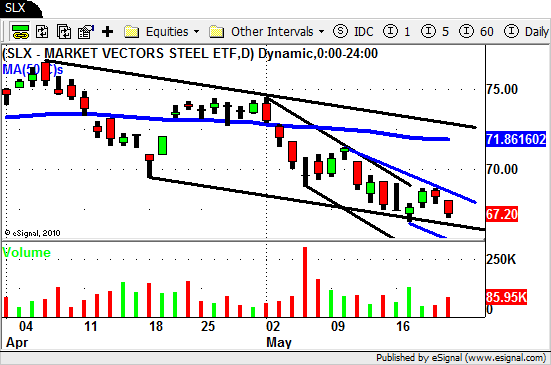

Technology related ETF's continued to fall.

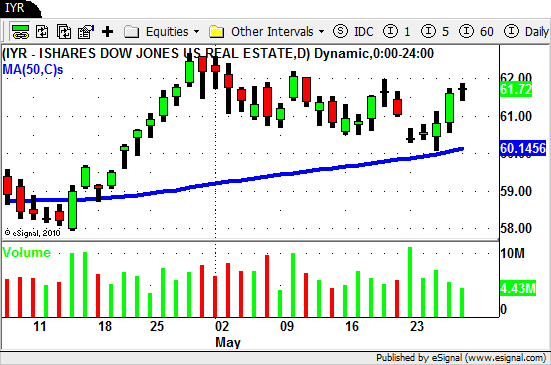

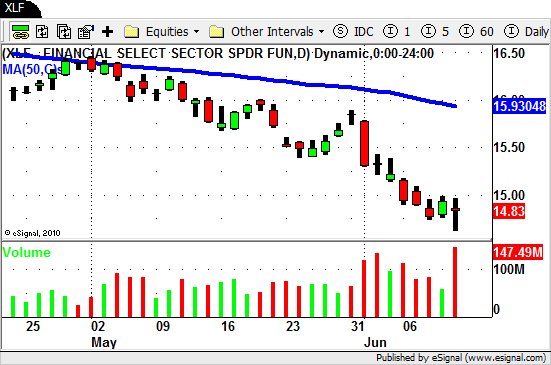

Real Estate and Financial ETF's got pummeled.

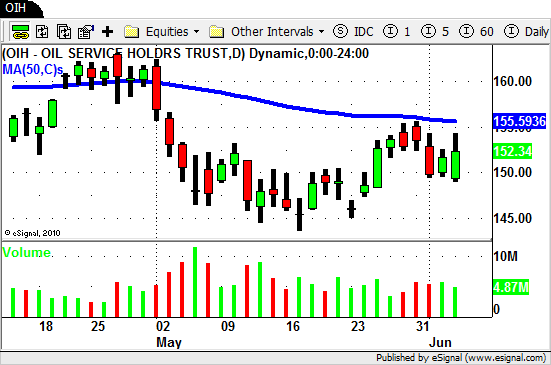

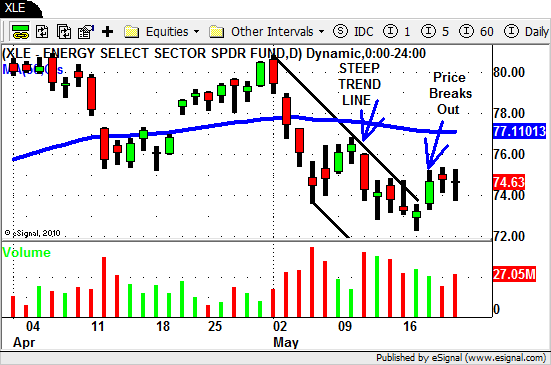

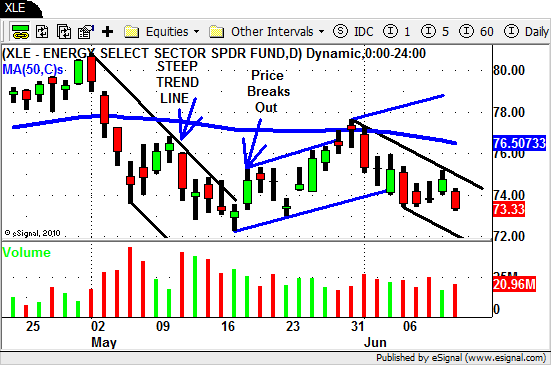

The Energy and Oil ETF's that were showing signs of strength last week are now not looking so strong.

If these sectors break down through the near term support levels they definitely have room to fall.

The market looks ripe to continue to move lower as the strongest stocks look to be "rolling over".

If you are looking to the SHORT side for trades try to find stocks or ETF's that are not yet extended to the downside.

If you are not comfortable with SELLING SHORT then you can always look to "get long" some Inverse ETF's.

As always be prepared for anything and act accordingly.

Until next week…Good Trading to YOU!