Swing Trading BLOG – Swing Trading BOOT CAMP

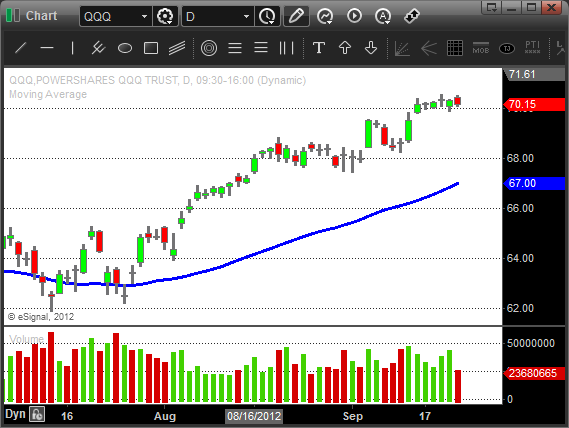

After a nearly two week rally the market finished a "sideways" trading week on Friday.

Swing Traders expected a bit of a pullback after the strong run up but only the S&P has noticed.

The DJIA has barely retraced and the NASDAQ actually made NEW HIGHS mid week before stalling out Thursday and Friday.

The strength is good of course but as we have talking about moves like this become tricky to trade.

The market will retrace, that is for sure, but when and how much?

No one knows for sure but time will tell.

If the market moves in to new high territory Monday morning are you a buyer?

Should you be?

Understand that if the market takes off out of this sideways price pattern that you are dealing with a different animal.

A move up out this consolidation would be (what we consider) a "continuation" move.

These type of moves happen once a market has run quite a bit, pauses and then takes off again.

More often than not the second time it takes off the move is short lived.

The move draws in a lot of traders and traps them once the market turns.

Up moves without retraces haven't shaken out the sellers yet.

The buyers are still LONG and not selling yet.

The SHORTS haven't stepped in yet but they are waiting patiently.

Once the move starts to lose steam it usually does it quickly.

The LONGS hit the bid and the SHORTS pile in driving the market lower in a hurry.

When trading these situations you need to adjust your expectations.

Trading a continuation move really deserves its own trading strategy or at least trading rules that take this pattern into account.

As we looked through the charts after the market closed Friday we see a lot of stocks and ETF's that have put in small retraces.

Most of these are also trading above their 50 day SMA's.

The strongest sector ETF's (Homebuilders, Gold, Gold Miners, Silver) are all still at on very near their highs.

The Financials ($XLF $IAI) and Oil and Energy ETF's have pulled back a bit ($USO got whacked!).

There are lots of individual stocks setting up nicely for some LONG trades.

As we move into next week make sure you update you Watch List and takes your trades as planned.

Understand which phase of the market you are in and look for the clues that the market gives you.

Remember to let your trades come to you and until next week….Good Trading to YOU!

Tags: ETF Swing Trading, Swing Trading Blog, Swing Trading Chart Patterns, Swing Trading Price Action, Swing Trading Strategies