Swing Trading Blog – Swing Trading Boot Camp

Price action and Volume always tells a story.

Once you understand how price and volume work together you can start to understand the "flow" of the market.

Doing so can often time keep you out of trouble by helping you define the right side of the market.

This week was a good case in point.

It was very obvious that there were some traders who got caught SHORT and had to cover during the rally on Friday.

By understanding that the market was in a retrace in a short term UP trend those traders might have been able to avoid some losing trades.

Now if you only typically hold positions for a day or two this might not be a problem. We know because this is the average holding period for our own STS trades.

The price action of the market moves in waves. If you are familiar with Elliot Wave Theory you will know exactly what we are talking about.

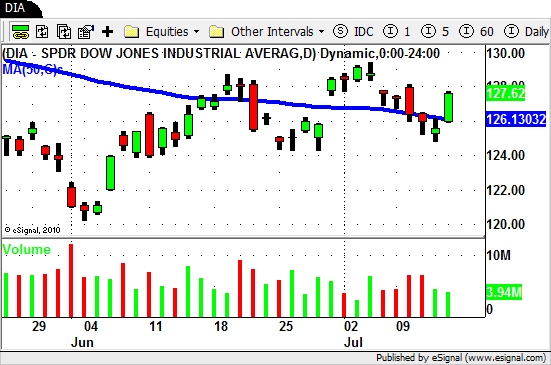

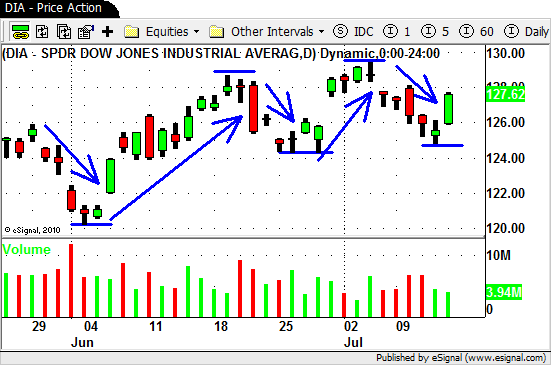

Take a look at the current chart of the $DIA below to see what we mean.

Notice how the market moves in one direction for awhile then the other in a wave like pattern.

Starting in early June you can see how the market rose until just about the middle of the month.

Then the market moved the other direction (down in this case) for a few days before moving up again at the end of June into early July.

Notice that the move this time was higher the the high in mid June…a true higher high chart pattern.

July 5th was the top of that move and once again then market begins to go down again.

This is called a retrace. Price is retracing its previous steps or moving in the direction after a move of strength.

On Friday price starts to move higher again (after a retrace) putting in a higher low.

This wave type price action pattern of higher highs and higher lows is what Technical Analysts and traders define as a classic UP TREND.

Based on that knowledge we can see that the $DIA has been in a UP trend since bottoming out in early June.

We also now know the right (or strong) side of the market is to the LONG side.

We can also understand that the move we were in until Thursday was a retrace in this UP trend.

Now if your trading strategy considers the overall trend of the market you would know that, at some point, this retrace would end and price would once again move higher.

We may not know for how long but it will in fact move higher at least temporarily.

Take a look at some of the strongest stocks in the market ($TGT, $WMT) and notice how they basically shrugged off the entire retrace…an obvious sign of relative strength.

These are type of charts patterns we want to focus on as short term traders. Stocks stronger than the overall market that start to take off despite an obvious pullback in the overall market.

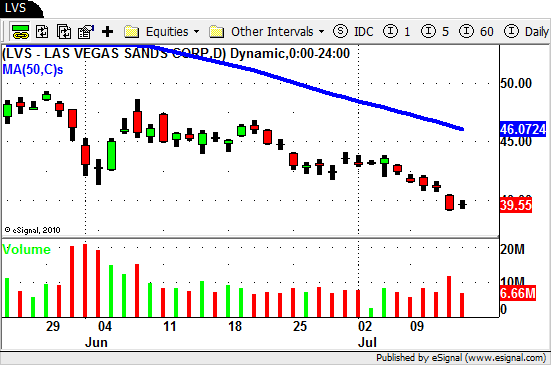

The SHORTS trades we did notice had charts that looked like death. Take a look at $MGM $LVS and $BRCM.

Notice that these stocks are weaker than the market and, for us, SHORTING them was an appealing option.

Although the strong side of the market was the LONG side we were able to time our trades once the retrace in the overall market started.

By doing so we are essentially shorting the weakest stocks in the market when the market hovers in an area of indecision (near the 50 day SMA).

The volume we saw on Friday was on the low side.

That being said we will see if the market can sustain its upward momentum or if we a change of heart as we head deeper into earnings season.

Until next week…Good Trading to YOU!

Tags: Swing Trading Blog, Swing Trading Price Action, Swing Trading Strategies, Trading Price Action