Swing Trading BLOG – Swing Trading BOOT CAMP

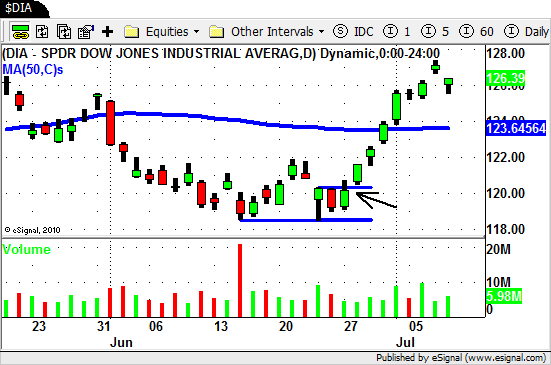

Traders watched as the indices pushed higher this holiday shortened week.

One thing to point out this week is the fact that an oversold or overbought market can still become MORE oversold or overbought.

A lot of Swing Traders were prepared to SHORT this latest rally but when the market moved higher Wednesday and Thursday some were caught in the mix.

Now if you have a tried and true (and tested!) strategy for trading against the market then have at it!

There are a million ways to make money trading so far be it from us to tell you how to trade.

What we are saying though is don't start trading by the seat of your pants using the latest overbought/oversold indicator or oscillator.

There is no doubt that a retrace in the market will happen…it is just a matter of when.

Friday's price action (Gap Down and Reverse) tells us that the BUYERS are still there.

When we open for trading on Monday that could all change but for now don't try to guess what what the market will do.

As we look at the charts for next week we can see that the market is still extended a bit.

There are a ton of good looking charts to watch in the future.

One sector that stood out this week was Real Estate.

Here is a look at the chart for the Dow Jones Real Estate sector ETF ($IYR).

From a technical analysis perspective $IYR put in a higher low at the end of last month.

As the market rallied recently $IYR has traded up to a NEW HIGH for the year on Thursday.

The Retail sector ETF ($RTH) has also rallied nicely as is flirting with NEW HIGHS.

Watch out for the possible overhead resistance in the $114 area first though.

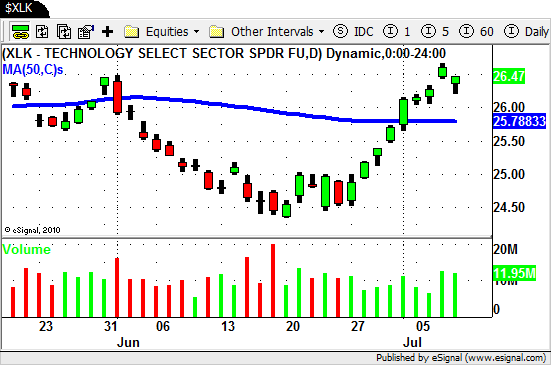

The Technology sector is also on our Watch List as we move forward from here.

Here is a look at $XLK…

As far as individual stocks go keep an eye on $AMZN, $ERTS, $JAZZ, $ELN, $LULU and $HAL just to name a few.

Like we said earlier there are a TON of stocks that should be on your list this week.

The volatility is likely to continue so keep that in mind as we head into trading this week.

As always have plan in place for whatever the market decides to do from here.

Until next week…Good Trading to YOU!

Tags: ETF Swing Trading, Learn Swing Trading Strategies, Swing Trading Blog, Swing Trading Price Action, Swing Trading Technical Analysis