Swing Trading BLOG – Swing Trading BOOT CAMP

The DOWN move continues!

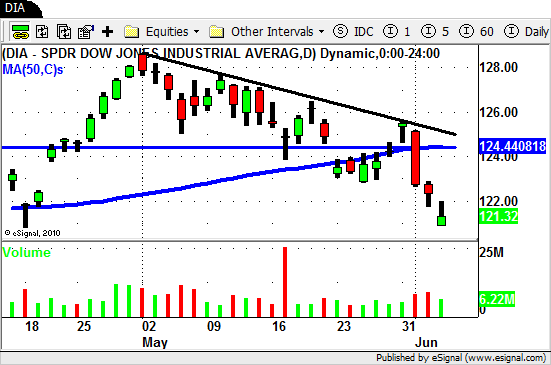

After one day of trading above its 50 day SMA the DJIA sold off for the rest of the holiday shorted week.

The push lower takes the markets to a new six week low.

Most (not all) sectors followed suit as the sellers came out in force.

The Financials ($XLF) and the Homebuilders ($XHB) were hit hard.

Technology ($XLK) and more specifically the Semiconductors ($SMH) also had a rough week.

Retail ($RTH) was holding up but finally gave way to the selling this week as well.

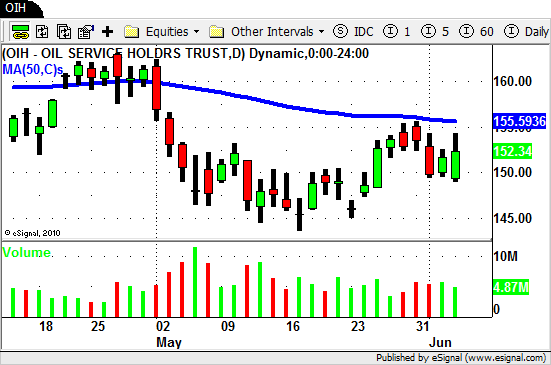

The Energy ($XLE) and Oil ($OIH) ETF's actually held up rather well this week.

Who knows if this SHORT TERM relative will hold up but it is something to watch as we move forward from here.

The Agriculture ETF's ($DBA $MOO) also are showing some signs of strength.

The overall market is pretty near a SHORT TERM oversold level so keep that in mind as we go into next week.

Don't chase the market down and wait for your setups to develop.

Be prepared for whatever the market does from here and as always…Good Trading to YOU!

Tags: 50 Day SMA, DIA, ETF Swing Trading, Financial ETF, Retail ETF, Sector ETF's, Swing Trading Chart Patterns, Swing Trading Strategies, Swing Trading Volume