Can you "swing" trade intraday?

This seems to be a question that comes up a lot.

"Swing Trading" is typically defined as…a method or strategy used to profit from short term (1-4 day) price moves in the market.

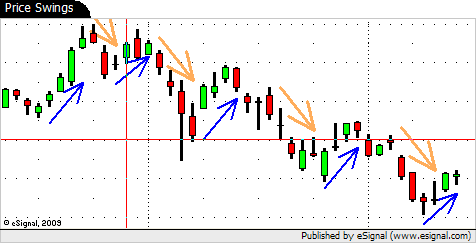

Although the standard definition defines the typical length of time in a trade (1-4 days) another definition for "Swing Trading" is used to describe a method or strategy used to profit from "price swings" in the market.

This definition can be used for a trading strategy or method regardless of the time frame.

A "price swing" is used to describe the ebb and flow of price action.

As price moves from one point to the next it typically does so in back and forth wave like motions.

When price moves from a low point on the chart to a higher point this is typically identified as an "up swing".

The opposite is true for a "down swing" in price.

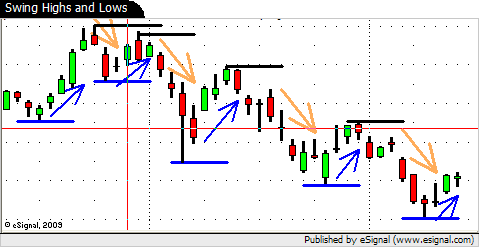

In the chart below we have identified the UP price swings with a BLUE arrow and the DOWN price swing with an ORANGE arrow.

The alternating "swing" extremes are further identified as "swing highs" and "swing lows" once they begin to retrace from their highest or lowest point.

Here is the same chart with the "swing" highs (black horizontal lines) and "swing" lows (blue horizontal lines) in place.

So now that we have the terminology and definitions out of the way lets get back to the original question.

Using the second definition of a "Swing Trader" you can surely see how a day trader can trade the "price swings" in the market.

In fact in the two charts above you probably cant even tell if they are DAILY charts or INTRADAY charts since the price and time data has been removed.

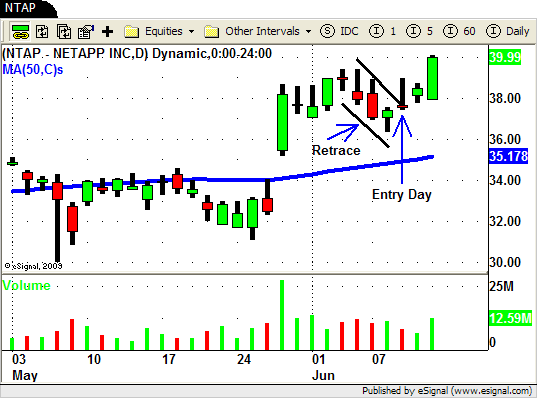

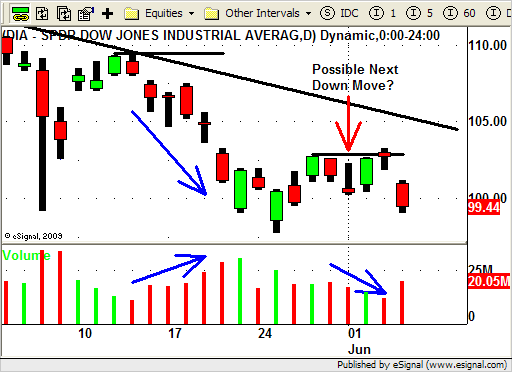

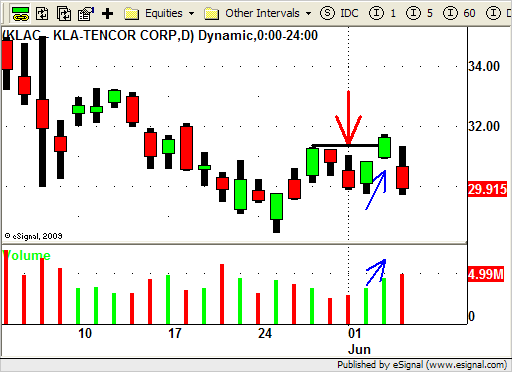

Our main strategy for overnight Swing Trading is based on locating strong or weak stocks (and sectors) in relation to the market and trading these stocks (and ETF's) based on the context of the overall market conditions.

When we trade the "price swings" intraday we use the exact same strategy!

If the market is strong we are scanning the market looking for the strongest stocks and ETF's.

Once we locate thees strong stocks we then use technical analysis (price action, volume and trend lines) to locate and hopefully profit from the intraday "price swings".

We want to be in sync with the market so if the market has run up (UP swing), retraced (DOWN swing), we are looking for LOW RISK trade setups in the strongest stocks and ETF's.

That way if the market decides to make another UP swing we can enter into and hopefully profit from this next price swing in the market.

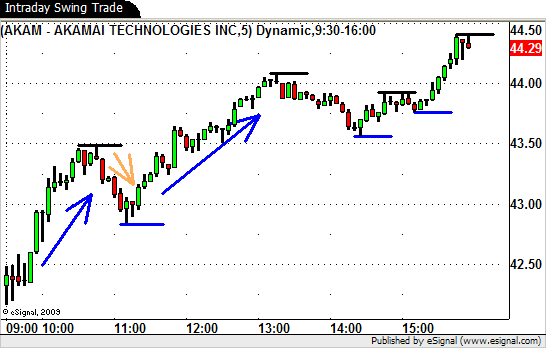

On the intraday (5 minute) chart below of AKAM you can see the first UP swing as price rallies from the open all the way up to just under $43.50.

AKAM then heads lower (retraces) creating a DOWN swing (orange arrow).

Overall the market was strong and the strength in AKAM from the open was obvious.

We are then anticipating another UP swing in AKAM if and when the market starts to show some signs of also moving up.

We were able to enter into this intraday swing trade in AKAM just over $43 as the new "swing low" was put in place and the next UP swing in price began.

Although we are never sure how long the next "price swing" will last in this example AKAM ran up to just over $44 ( a one dollar move) before starting its next DOWN swing.

This is just one example of how you can "swing trade" intraday.

Although they may need some tweaking the potential strategies and ideas that you have for overnight swing trading can surely be utilized on an intraday basis.