Well after the indices continued to rally and make NEW HIGHS for the year early in the week, the market finally ran into some selling pressure on Friday.

The interesting thing to notice, also on Friday, was the HIGH VOLUME the accompanied the sell off.

A few sectors actually started their sell offs a day earlier.

Last week we posted that we noticed that the Energy, Oil and Semiconductor sectors did NOT participate in the recent rally.

And while the Semiconductors (SMH) actually started to show some strength early in the week both the Energy (XLE) and Oil (OIH) ETF's sold off sharply on Thursday and Friday.

Some of the strongest sectors during this last rally, Retail and Gaming, had mediocre weeks but look good moving forward into next week.

Keep an eye on the Retail stocks, the RTH and gaming stocks like MGM, LVS, and WYNN.

One sector that continues to rally strong is Real Estate.

IYR, and stocks like KIM, DRE, O and SPG, all had a good week and also show some potential new BUY set ups for next week.

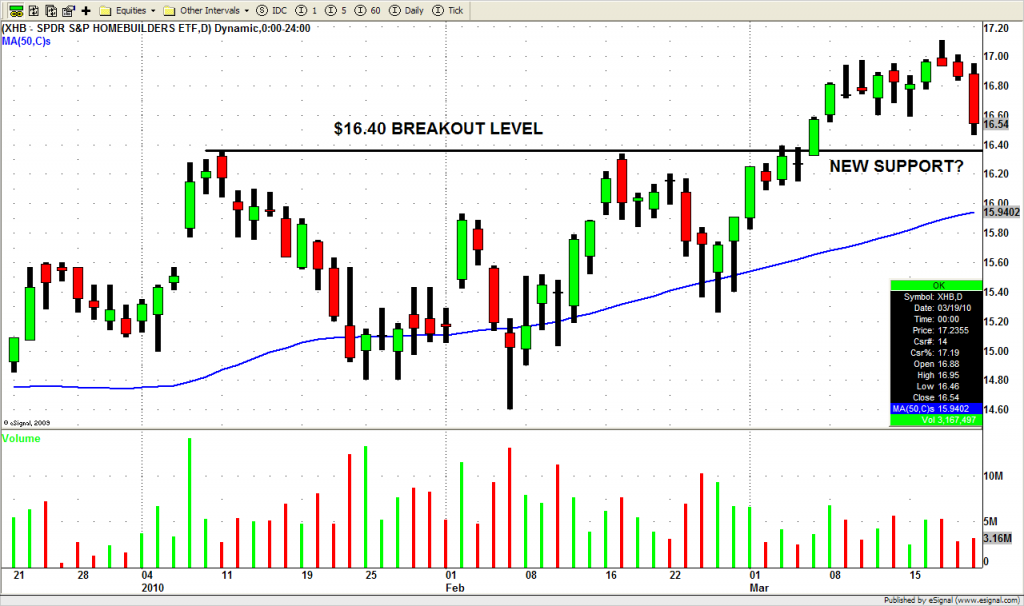

The Homebuilder sector, (XHB), which has also been showing tremendous strength after breaking above the $16.40 level, has an interesting chart going into next week.

You can see how XHB ran up to just over $17 after it finally broke out above the $16.40 level.

XHB did sell off a bit on Thursday and Friday on relatively light volume.

This is the exact situation you want to see during a pullback AFTER a BREAKOUT!

As XHB pulls back into the BREAKOUT level of $16.40 we will look for this previous RESISTANCE LEVEL to hold as a new SUPPORT LEVEL.

So after Fridays HIGH VOLUME SELL OFF what can we expect next week?

Well it does seem that the market is a bit overdue for a pullback but, as Swing Traders, we need to be prepared for whatever the market decides to do.

Since the market is SO STRONG we will continue to look for LONG Swing trade set ups in STRONG stocks that are trading in the STRONGEST sectors.

Until next week…Good Trading to you!