The Cup and Handle Pattern – Swing Trading Strategies

The cup and handle pattern (also called cup with handle formation) is technically a bullish continuation pattern.

Swing traders should learn to spot and trade this proven pattern in an up trending market.

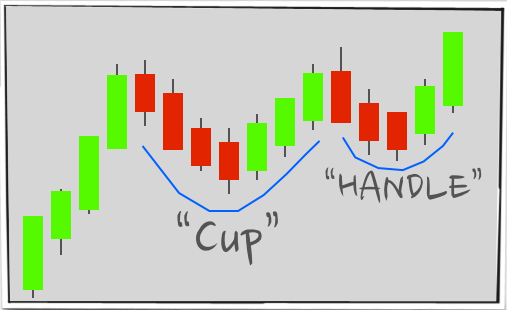

The pattern represents a "cup" on the left side of the chart followed by a "handle" on the right side.

The U shaped "cup" forms when price moves higher on the chart and then retraces. After the retrace price again moves up to a level near or equal to the previous high before retracing one again.

The "handle" forms when this second retrace is very swallow compared to the first. This indicates that the selling pressure is drying up and is often accompanied by low volume.

The pattern is confirmed once price breaks through highs that create the original cup.

Lets take a look at an example of the Cup and Handle Pattern…

Swing Trading Strategies for the Cup and Handle Pattern

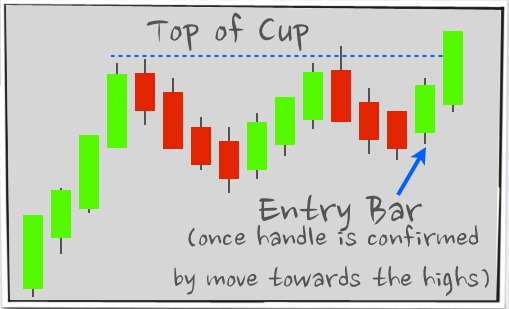

The most aggressive strategy is to enter into a LONG trade once the "handle" is confirmed.

This entry is aggressive since it has not yet broken through the highs created by the sides of the "cup".

The potential for these highs to act as overhead resistance is a concern but if the breakout follows through you will be looking at a very profitable trade.

Here is where we would enter if we were using this aggressive option…

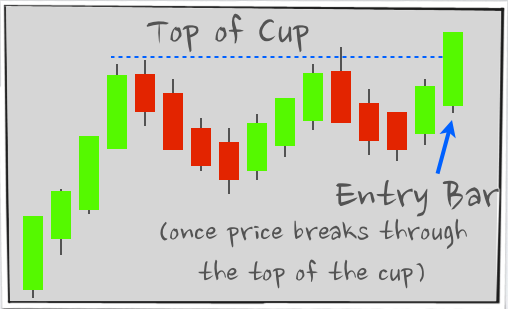

Another option is to wait for a completed "cup and handle" pattern and enter once you get confirmation.

In this case you would enter into a LONG position once price broke through the highs that formed the "cup" portion of the pattern.

This pattern is called a cup and handle breakout and often times leads to a very good move to the upside.

Here is how we would enter this trade…

These are just a few swing trading strategies that you can use to trade this powerful pattern.

Determine which strategy is best based on your personal trading beliefs and the rules you have developed for your trading plan.