Swing Trading Blog – Swing Trading Boot Camp

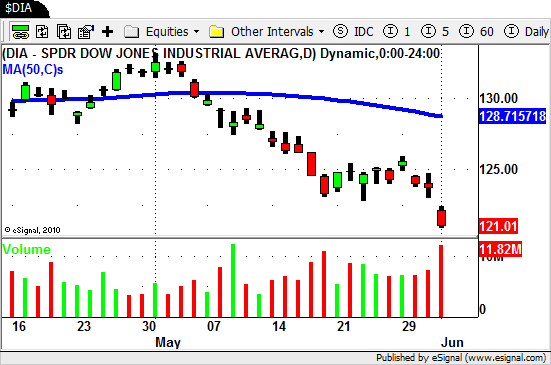

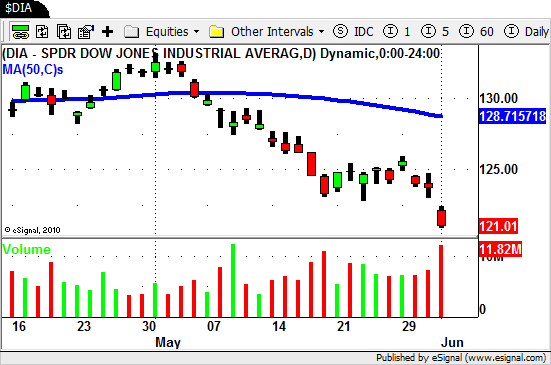

After finding some temporary support last week the markets SOLD OFF hard this week.

After being closed on Monday traders watched the market GAP UP on Tuesday.

On Wednesday though all hopes of a meaningful bounce disappeared as the market GAPPED DOWN and the sellers stepped in to drive the market lower.

Another big GAP DOWN on Friday and continued strong selling pushed the market NEW LOWS for the 2012.

It's amazing what can happen in 1 month.

On May 1st we hit NEW HIGHS for 2012 and here, exactly 1 month later, we are looking at NEW LOWS for the year.

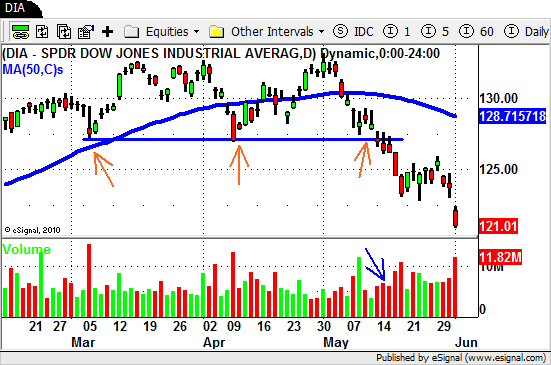

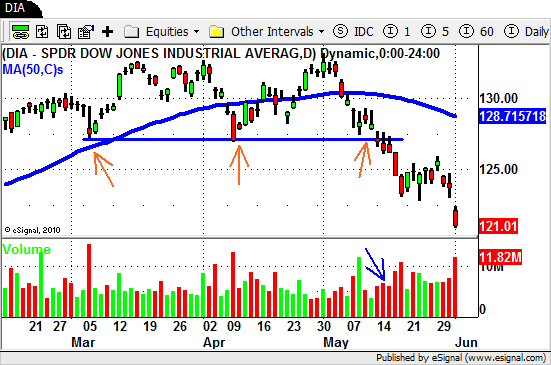

Let's take a look at the transition from BULL to BEAR…

In February we traded to NEW HIGHS and then sold off a bit in early March.

Buyers stepped back in and once again brought the market higher (1st Orange Arrow).

After some sideways trading we once again hit NEW HIGHS on April 2nd but once again we couldn't go any higher.

Sellers stepped and drove the market down to the same level it hit in early March (2nd Orange Arrow).

These levels were accompanied by BIG VOLUME which tells us that there is a lot of activity at that level in the market.

The BUYING volume obviously won since we once again drifted higher to close out the month of April.

We opened up the Month of May by hitting NEW HIGHS once again.

We immediately stalled and another sell off began this time on volume.

This sell off took the market right back to the key area in the market that we touched 2 times before (3rd Orange Arrow).

It is around these key levels (of support this time) that we look for the clues the market gives us.

In mid May we finally BROKE DOWN through this support level as volume picked up (Blue arrow).

The mode of the market had now changed. Sentiment was different.

This BREAK DOWN on INCREASED VOLUME is what we needed to see to change from BULLISH to BEARISH.

Once this level was broken it was time for us to aggressively move the the SHORT side of the market.

If you follow the market and analyze PRICE ACTION and VOLUME it can paint a very clear picture for you.

Until next week…Good Trading to YOU!