And here we go again!

The Dow and S&P finished down 2% for the week while the Nasdaq held up a little better by losing ONLY 1.7%.

Sounds pretty plain and simple but the trading during the week was a little bumpy.

The holiday week started off with yet another GAP DOWN in the market.

We know that the buyers have been defending the area just above 10,000 in the Dow as this GAP DOWN brought us right into this area.

The market rallied right from the open but late day selling came into the market and pushed the market down to close below its open…a true reversal day.

Wednesday the buyers stepped back into the market at near the same levels (just above 10,000) pushing the market higher right into the close.

Thursday the market GAPPED UP a bit but quickly fizzled out and closed near its mid point of the day.

Then Friday comes and BAM!…down we go again.

Sellers aggressively took the market lower with the Dow finishing down over 300 points for the day!

This was an important week in our opinion.

Not because of any significant financial related news or event.

We think it was important because of the lesson you could learn from this weeks trading action.

If you are a short term trader then the valuable lesson to be learned from this week's price action is to have "re-entry" plan in place.

Let's rewind a bit and look at the charts to see what we mean,

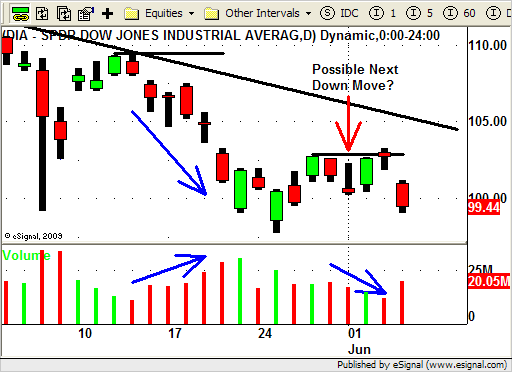

After last Friday's lackluster performance it appeared that Tuesday was setting up for the next leg lower in this down trend.

As a matter of fact there were a TON of SHORT Swing Trading setups on our "watch list".

We notified our newsletter subscribers of several SHORT stock setups and several possible LONG Inverse ETF setups for Tuesday morning.

The market GAPPED DOWN on Tuesday and the late day sell off actually triggered several of our SHORT swing trades near the close.

We did notice however that by the close the volume levels for this "reversal day" were low…not exactly what you want to see when the market reverses.

Trading price action is our primary focus but this volume "clue" was a caution flag for us.

On Wednesday the market rallied right from the open and closed near its high for the day…another bad sign for our SHORT positions.

Our best trades usually work right from the start and with the market moving up so strongly we were now "taking some pain" in our positions.

Another thing we noticed is that in some of our positions the volume INCREASED as price rallied on Wednesday.

We know from understanding the PVT Method that price moving UP as volume INCREASES is classic UP trending price action.

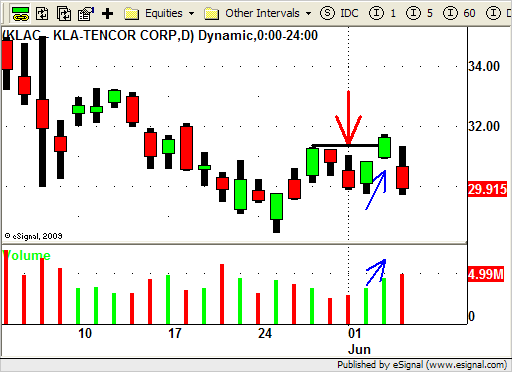

Look at the chart of KLAC below.

You can see where we entered out SHORT position (RED ARROW) and then look at Wednesday and Thursday's price and volume action.

KLAC trades higher on INCREASING VOLUME (blue arrows) and closes above the recent swing high and our STOP LOSS point (black line).

Friday KLAC heads lower on INCREASING VOLUME confirming the "two stage" retrace.

Some of our other SHORT positions went up a bit with the market on Wednesday but on LOWER VOLUME (a clue of things to come?).

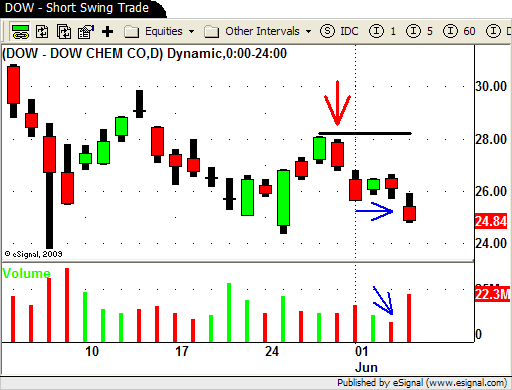

Let's look at one of our "good" SHORT positions.

Notice on the chart of DOW Chemical (DOW) below how unlike KLAC price actually moves sideways both Wednesday and Thursday.

This sideways price action is accompanied by LOWER, DECREASING VOLUME a good sign for our SHORT position.

DOW follows through to the down side nicely on INCREASING VOLUME as the market sells off on Friday.

As you can see from the charts above things played out pretty much as anticipated.

We got stopped out of some of our SHORTS that continued to rally on increased volume on Thursday.

Can you guess by now which positions stopped us out?

Our other positions that went up a bit with the market on LOWER volume (like Dow Chemical) ended up closing under their recent swing highs so we were able to hold onto to these.

We thought that Thursday's move in some of these stocks was possibly a "two stage" retrace so we were ready by Friday to re-enter our SHORT positions if price action called for it.

Friday the market GAPPED DOWN again and after about an hour of sideways trading rolled over and finished the day DOWN over 300 points on INCREASING VOLUME!

Our "good" short positions followed through nicely and, as planned, we re-entered into some of our positions that stopped us out just the day before.

By using both price action and volume we avoided getting "shaken out" of some of our SHORT positions.

Getting STOPPED OUT for a loss or near break even is not fun but by following our "re-entry" rules we were able to get back on the right side of the market and hopefully profit from our analysis.

Until next week….GOOD TRADING TO YOU!