Swing Trading BLOG – Swing Trading Boot Camp

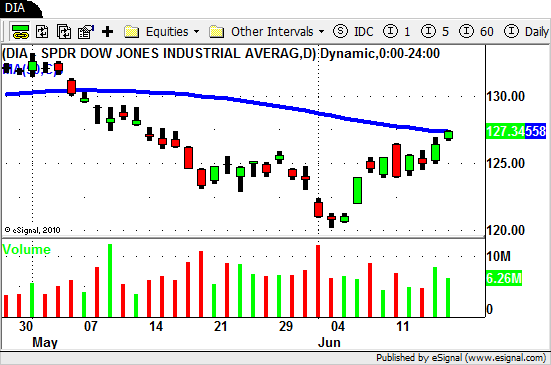

Despite two big GAP DOWNS on Monday and Thursday that market finally found its legs.

Friday trades watched as the market GAPPED UP and finished the week with a nice rally to the close.

The rally actually started at the end of the day on Thursday which gave swing traders a clue of things to come for Friday morning.

Paying attention to intraday price action can often times give you a "heads up" to what the big money is doing since a lot of orders go in during the last two hours of each trading day.

Once we saw the rally Thursday afternoon (along with the volume that accompanied it) we were pretty sure that the market was going to lift off the next day.

This would mean that some of our SHORT positions would not follow through and would probably stop us out.

So what did we do?

Nothing. Absolutely NOTHING DIFFERENT.

Did we cover our SHORTS? Did we flip those SHORTS to LONGS?

No and No.

Simply put we traded our plan.

We have learned over the years that we should never try to out guess the market.

In hindsight it east to say that we would have been smart to COVER and even FLIP TO THE LONG SIDE but that is not always the case.

Being almost positive that you are right can cost you…big time.

Our trading plan is very specific.

We enter our trade and place our stops. We set our profit target(s) and manage our trade per our plan.

Then we let it play out one way or the another.

Either we get stopped out OR we hit our profit target.

We don't change our rules based on what we think the market is going to do.

We told you last week that we trade both sides of the market and get stopped out (on the wrong side) once the market finds its true direction.

This week was a great example of this.

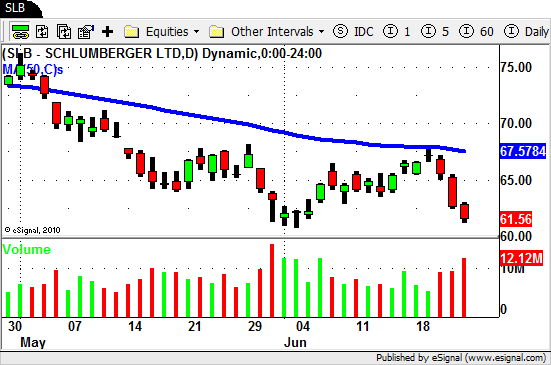

When the SHORT trades stall and STOP GOING DOWN that should tell you something.

A lot of good looking SHORT set ups didn't follow through and actually created a higher low this week.

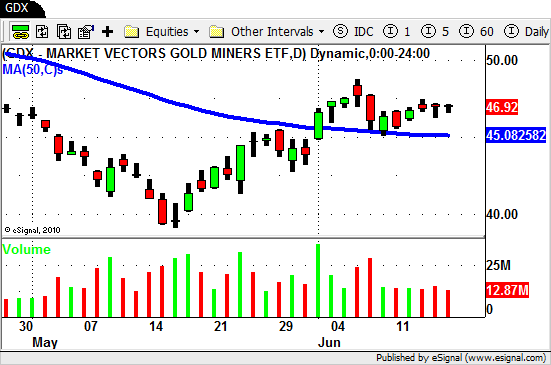

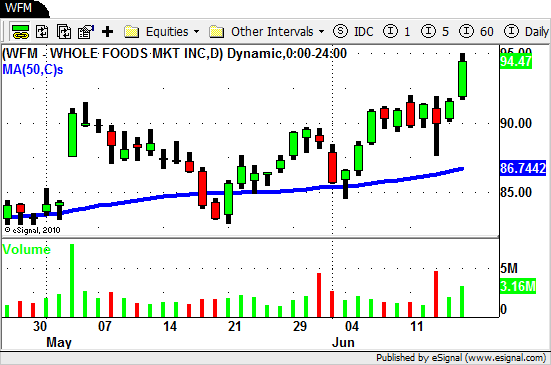

When your LONG trades are breaking out on good volume that should tell you something as well.

Learning to read the price action and volume during these times is crucial to identify turning points in the market.

This is exactly what we mean when we say to "listen to the market and act accordingly".

Until next week…Good Trading to YOU!