Swing Trading BLOG – Swing Trading BOOT CAMP

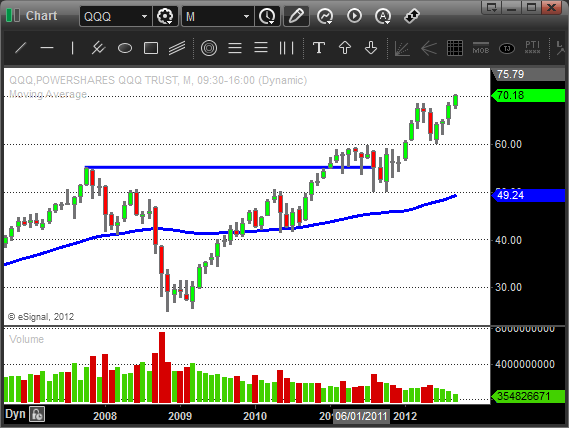

Swing Traders finally get the pullback that they have been waiting for.

After trading "sideways" last week the market put in a much anticipated retrace this week.

Thursdays UP move was the only decent UP move the market saw this week.

The low volume that accompanied Thursdays price action has us wondering if the next move to the UP side was really upon us.

Take a look through your charts and you will see what we mean.

A lot of stocks and ETF's had moves to the UP side but look at the volume.

You will that many of these moves came on very low volume.

We always like to see price action and volume moving together.

This does not always guarantee that the trades we make when these two are moving together always work out.

More often than not though when the price action and volume patterns work together we get a move in our favor.

Putting the current market action into proper context is very important in most trading situations and this is no different.

After such an extended run up in the market we are always cautious of taking trades after brief pullbacks.

This most recent pullback only gave us 2-3 days of pulling back after breaking out to new highs.

In that case we would like to see a few more days of selling before we jump back in to the market.

It takes experience and honestly a little luck to not jump on every trade in such a strong market.

The traders that did jump back in on Thursday had to wonder if they make the right decision come Friday.

Some stocks and ETF's look like they weathered Fridays action pretty well.

As we look through the charts we see a lot of inside bar patterns.

If you have followed us for any amount of time you know how important these inside bars are in our trading strategies.

The bars are what we consider to be "stalls" in the market.

These "stalls" can give us clues to where the market is headed next.

Continuations out of a "stall" can gives us another chance to enter into a stock or ETF that we may have missed.

If price breaks down after a "stall" then this tells us the short term sentiment has changed.

Some of the sector ETFs with inside bar patterns are $GLD $SLV and $XLK.

The Homebuilders ETF ($XHB) actually has a double inside bar pattern.

Next week put these on your Watch List if they aren't already and just watch HOW they break out of these patterns.

As we look forward to next week we are still looking mostly to the LONG side.

There are however a few signs that have us looking to the SHORT side…just in case.

Two sectors that stand out to us are the Steel ($SLX) and the Semiconductors ($SMH).

Both sectors are weak but the semis actually broke down this week.

Being prepared for ANYTHING is crucial to your success as a trader.

Next week we could see the market rip or fall apart.

Have a plan for both outcomes and take action once it happens.

Until next week…Good Trading to YOU!