Swing Trading Boot Camp – Day Trading the Intraday Swing Trading Strategy

We thought we would take this opportunity to walk you through one of our day trades from this morning.

Our Intraday Swing Trading Strategy is very similar to our overnight swing trading method.

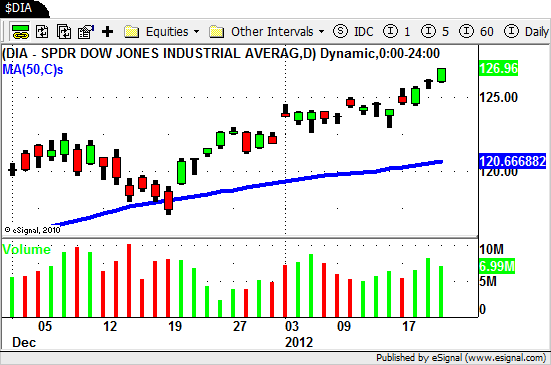

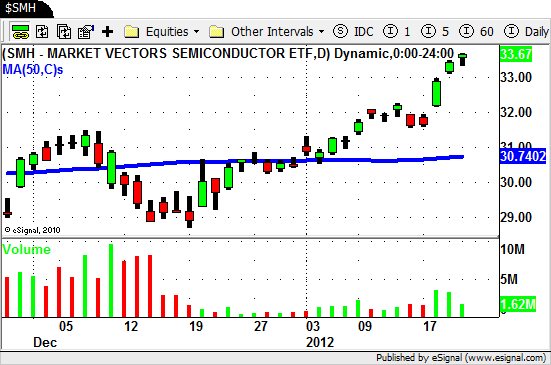

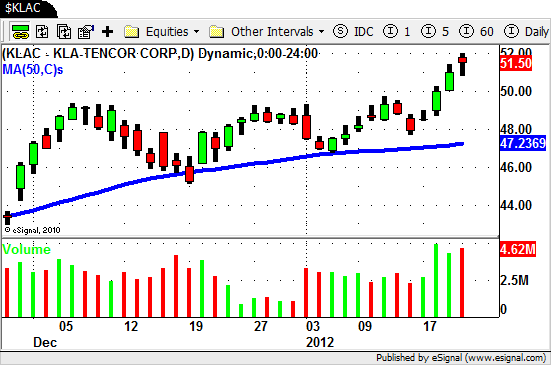

We use relative strength to locate and trade strong stocks (or ETF's) when the overall market is strong.

This morning was a good example of locating a sector ETF ($XLE) that was showing signs of relative strength AND also had a great chart pattern to trade.

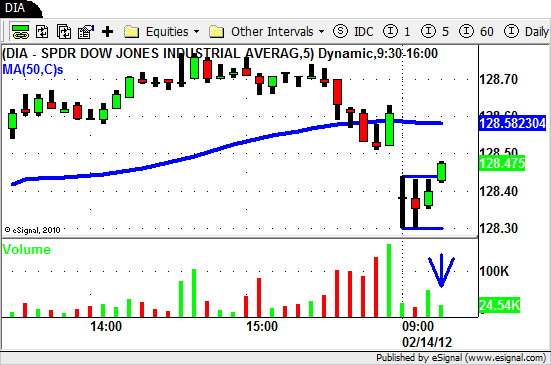

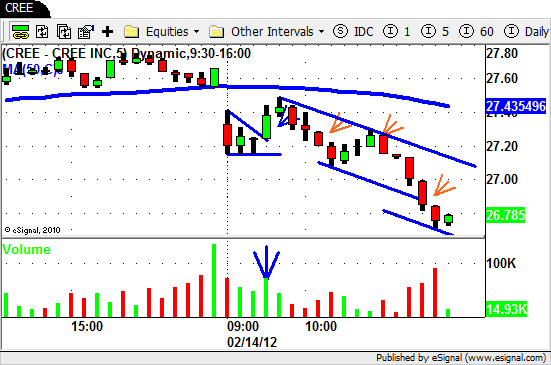

Here is the first chart for $XLE…

Notice how on the chart above $XLE broke out to new highs in the early morning and rallied up until a little after 10am.

After a brief pullback $XLE was setting up again for a nice LONG trade. A move to the upside on increased volume was the confirmation we needed (BLUE ARROWS).

Our trend line was drawn in and we let the trade progress.

On the chart above you can see how $XLE rallied to new highs again putting in 2 channel expansions before the "stall" (equal bar high) marked in orange.

This entire move happened on decreasing volume so we were on high alert looking for the signs of this move reaching its potential.

The"stall" was followed 2 bars later by a new high but this bar quickly reversed course and put in a bullish engulfing candlestick.

This bar combined with the failure to reach the top of the channel is a good sign that the move has come to an end and a good time for us to exit our trade.

The next bar followed through to the downside but we noticed that volume was drying up.

The bar after the bearish engulfing bar reversed and closed near its high. Two bars later a new breakout was underway.

We didn't want to enter into a new LONG trade at this point since the move in $XLE was already extended a bit.

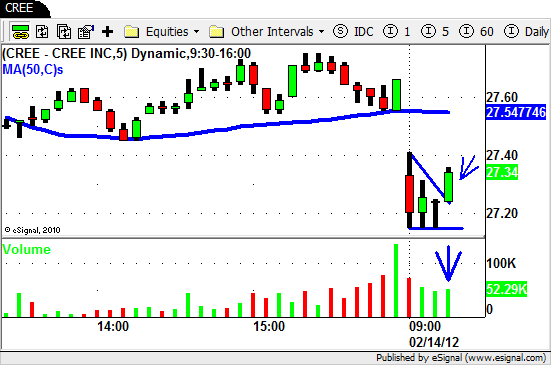

Below you can see how the new breakout stalled and basically traded sideways for the next 6 bars before finally breaking down and out of the upward trending channel.

Even if the new breakout would have continued we aren't really concerned about it.

We are NOT trying to catch every single bit of every move.

For our STS trades we typically set our target at a 2:1 risk/reward ratio and are very happy taking our profits at this level just as we did here.

As day traders our intraday swing trading strategy helps us locate (and hopefully profit from) price "swings" in the market just like you see here.

We hope this sheds some light on the strategies and tactics we use to trade the market day in and day out.

Until next time…Good Trading to YOU!