Swing Trading BLOG – Swing Trading BOOT CAMP

Well 2013 started with a BANG now didn't it?

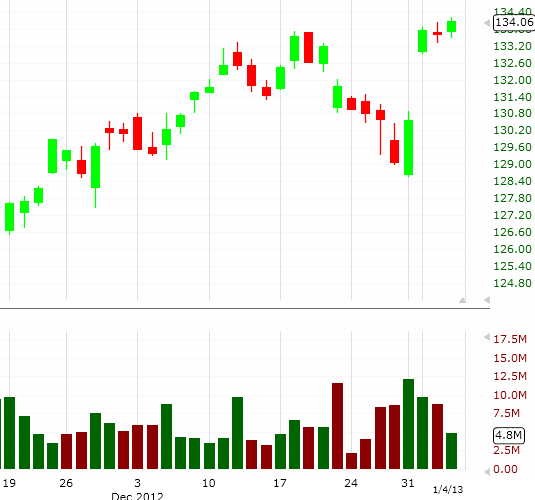

This holiday shortened week started out with a rally on BIG VOLUME on Monday.

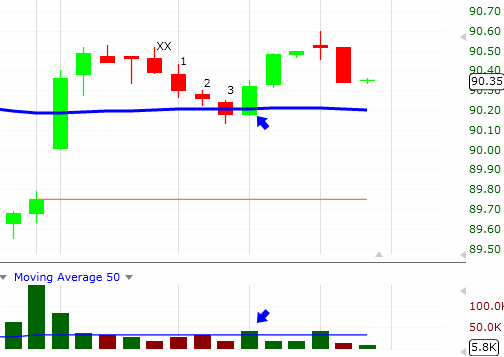

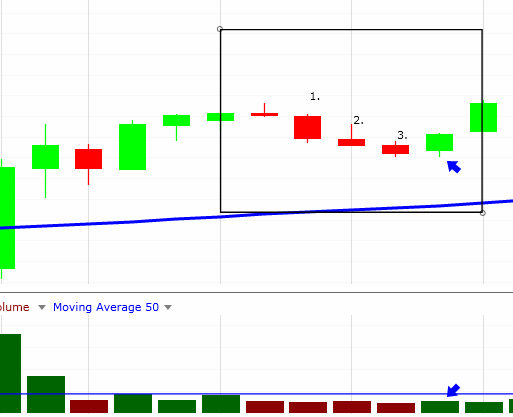

The price action we saw created a bullish engulfing bar on the charts. This type of chart pattern was a sign for the shorts to cover as the longs pilled in!

Once the news of the fiscal cliff deal came out the marked GAPPED UP in a big way on Wednesday after being closed Tuesday.

This GAP UP left a lot of traders scratching there heads on where they could enter into the move.

As a SHORT TERM trader the day to get long was on Monday…not on Wednesday.

The move that happened Wednesday classifies as a continuation move for us.

We were looking to SELL our SHORT TERM trades towards the end of the week…not enter into new positions.

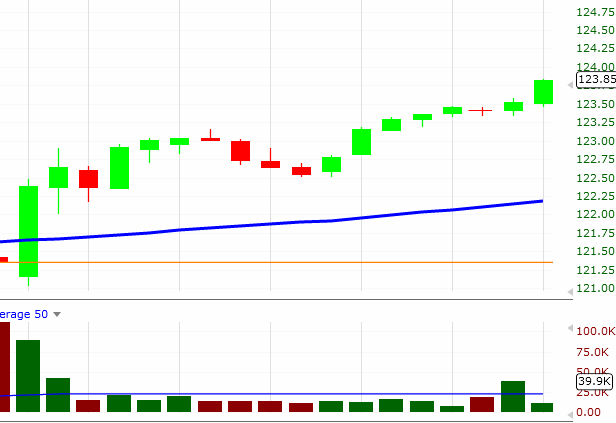

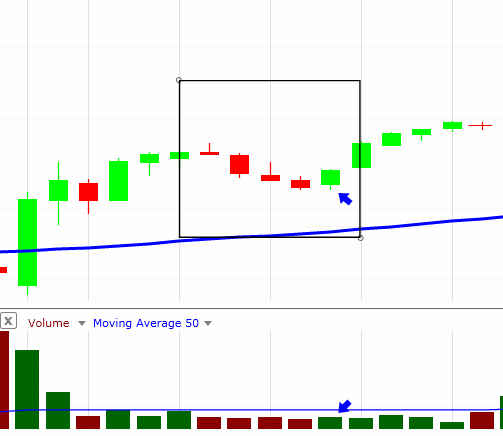

As you look through the charts you will see nearly the same chart pattern on each one of them.

The sector ETF's look the same although some were better candidates then others.

The Financials ($XLF $IYF) and Homebuilders ($XHB) had some nice setups.

The Steel ETF ($SLX) also had a nice pattern to trade if you caught it in time.

As far as individual stocks go there are too many to list. Lets just say that there were tons of good looking charts out there to trade. ($GOOG, $NSC, $GS, $MA, $V, etc)

Next week will be the true test to see how real this rally is.

Keep you eyes on stocks that start to pullback to see how the hold up in relation to the overall market.

If the rally continues there will be plenty of time for more good trades.

There is no need to chase the market up.

As always have a plan and prepare for whatever the market throws your way.

Until next week…Good Trading to YOU!