Swing Trading BLOG – Swing Trading BOOT CAMP

The sell off continued to start out the week on a negative note.

By Thursday however we saw the buyers step back in and give the markets a lift to close out the week.

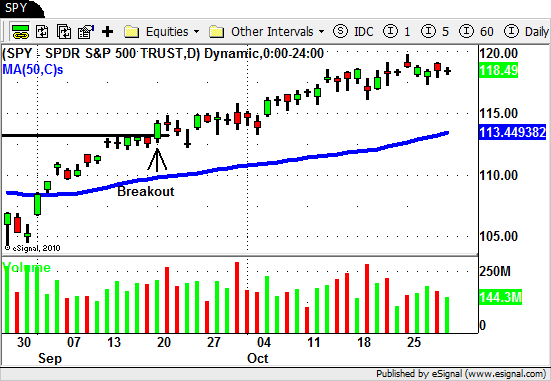

This recent sell off has taken the major indices back near their 50 period SMA's on INCREASING VOLUME which is a bit concerning.

The "inside day" we saw in the markets on Wednesday was followed by less than impressive volume as the market rose Thursday and Friday.

It looks like we are at another pivotal level in the market and as always follow through (and how it does) is the key.

This low volume "bounce" could be quickly followed by MORE BUYING and an increase in volume.

This would be a great short term sign that the bulls are still in charge.

If however this low volume "bounce" is followed by AGGRESSIVE SELLING then the market could be in a for a significant move lower.

Some of the sector ETF's preformed quite well to close out the week while others are showing signs of tremendous weakness.

The Oil Services (OIH) and Energy ETF's (XLE) had nice moves to the upside.

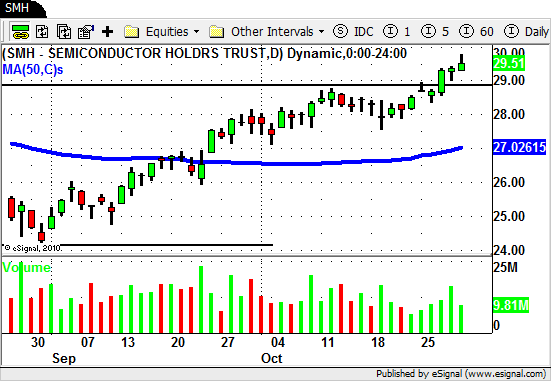

The Semiconductor ETF (SMH) remains strong after it's recent BREAKOUT and we will continue to look for signs of follow through in this sector.

Silver (SLV) also made it's next UP SWING after a decent pull back from it's most recent high.

The two sector's we focused on in last weeks BLOG POST…The Financial's (IYF, XLF) and the Homebuilders (XHB)…have now pulled back to a level that is BELOW their recent breakout points.

Both sector's are hovering around their 50 DAY SMA's and are still in a "zone" that COULD hold as support but this type of deep pullback after a HIGH VOLUME breakout is NOT a great sign.

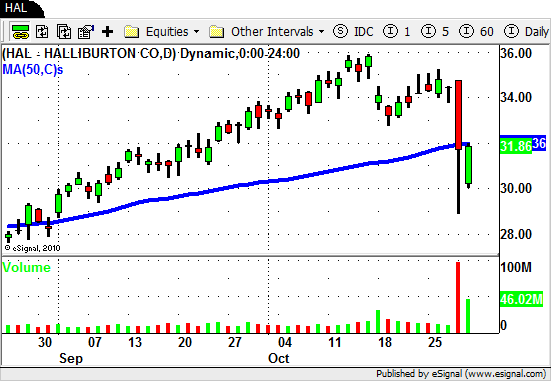

Even though the market is showing a bit of weakness recently there were still plenty of opportunities to take some LONG trades this week.

Several stocks on our Watch List set up for some nice trades this week.

Stocks on this list were $LULU, $COG, $MRVL, $WLK, $X, $BRCM, $TIF, $MEE and $HAL (to name a few).

Even though the market is still technically in a very BULLISH phase it is at, what we believe, at very pivotal level.

For the first time in several weeks we are actually seeing a number of SHORT trade setups.

During this recent sell off in the market several stocks have actually started to show signs of weakness.

$ERTS, $LLY, $G, $K, and $MED are a few on our list that are relatively weak.

The Real Estate sector (and the stocks within) have all been hit hard during this recent sell off.

$SPG, $DRE, $KIM and $O have sold off hard recently and a "bounce" could happen in the very near future but the price action and volume we have seen during this sell off has us looking to the SHORT side in this sector.

Next week should give us a good indication of where the market is headed from here.

You may have heard this before but…BE PREPARED FOR ANYTHING!

Until next week…Good Trading to YOU!