Swing Trading BLOG – Swing Trading Boot Camp

And the Weekly Chart…

Sectors

and the $XLE

Swing Trading BLOG – Swing Trading Boot Camp

And the Weekly Chart…

Sectors

and the $XLE

Swing Trading BLOG – Swing Trading BOOT CAMP

And off we go!

Traders watched as the recently stop and go market finally got up and went.

After weeks of indecision (with a bullish skew) the markets finally picked a direction in a big way this week.

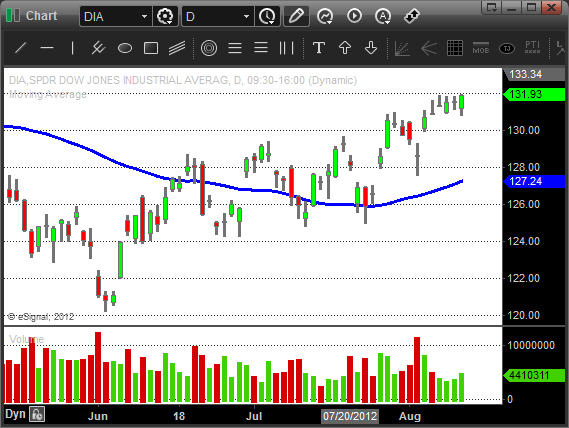

The most recent pullback brought the market back (once again) to their 50 day moving average to start the week.

After finding some support there the market once again found its footing and moved back up on Thursday.

Friday traders watched as the markets GAPPED UP and finally broke out above there short term overhead resistance levels.

The chart pattern was sound.

The support at the 50 day SMA. Confirmation of a higher low on Thursday. Continuation and BREAKOUT on Friday.

The UP TREND continues!

As a swing trader you have to recognize these chart patterns and take action when they present themselves.

Although the overall market has been a bit chaotic you should have had some on the strong stocks and ETF's on your Watch List.

Once you noticed the potential of the market finding support around the 50 day you had to start thinking about the LONG side of the market.

ETF's that have been STRONGER than the overall market and a good place to start.

Take a look at the Oil and Energy ETF's ($XLE $OIH).

Stronger than the market and great chart patterns to trade.

Look at the charts. Study them. Take a look at the price action and volume. Damn near perfect patterns to trade.

Drill down to find some stocks in those sectors and you find the same thing.

$MRO and $SUN had some nice follow through after pretty text book setups.

Once again price action and volume paint a very clear picture.

The Retail sector ($RTH) also broke out to NEW HIGHS this week.

We have been talking about $WMT for weeks and this week had yet another opportunity for a profitable swing trade.

There are still plenty of "lagging" sectors but if the market continues to strengthen you might look for clues that these sectors are turning.

This most recent move in the market brings us back up to a level that will obviously entice some sellers.

Don't be afraid that you will miss the bus if you are looking to get long.

Let the trades come to you and take action once they do.

Pay close attention to the clues (price action and volume) that the market gives you and be prepared for anything.

Next week should be fun!

Until then…Good Trading to YOU!

Swing Trading Blog – Swing Trading Boot Camp

Price action and Volume always tells a story.

Once you understand how price and volume work together you can start to understand the "flow" of the market.

Doing so can often time keep you out of trouble by helping you define the right side of the market.

This week was a good case in point.

It was very obvious that there were some traders who got caught SHORT and had to cover during the rally on Friday.

By understanding that the market was in a retrace in a short term UP trend those traders might have been able to avoid some losing trades.

Now if you only typically hold positions for a day or two this might not be a problem. We know because this is the average holding period for our own STS trades.

The price action of the market moves in waves. If you are familiar with Elliot Wave Theory you will know exactly what we are talking about.

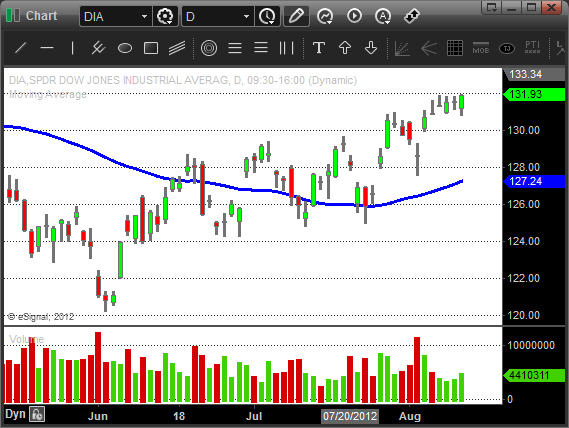

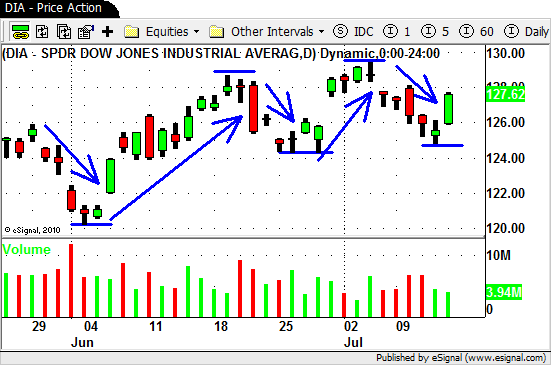

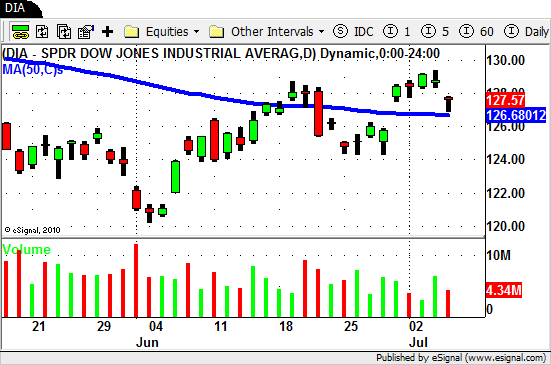

Take a look at the current chart of the $DIA below to see what we mean.

Notice how the market moves in one direction for awhile then the other in a wave like pattern.

Starting in early June you can see how the market rose until just about the middle of the month.

Then the market moved the other direction (down in this case) for a few days before moving up again at the end of June into early July.

Notice that the move this time was higher the the high in mid June…a true higher high chart pattern.

July 5th was the top of that move and once again then market begins to go down again.

This is called a retrace. Price is retracing its previous steps or moving in the direction after a move of strength.

On Friday price starts to move higher again (after a retrace) putting in a higher low.

This wave type price action pattern of higher highs and higher lows is what Technical Analysts and traders define as a classic UP TREND.

Based on that knowledge we can see that the $DIA has been in a UP trend since bottoming out in early June.

We also now know the right (or strong) side of the market is to the LONG side.

We can also understand that the move we were in until Thursday was a retrace in this UP trend.

Now if your trading strategy considers the overall trend of the market you would know that, at some point, this retrace would end and price would once again move higher.

We may not know for how long but it will in fact move higher at least temporarily.

Take a look at some of the strongest stocks in the market ($TGT, $WMT) and notice how they basically shrugged off the entire retrace…an obvious sign of relative strength.

These are type of charts patterns we want to focus on as short term traders. Stocks stronger than the overall market that start to take off despite an obvious pullback in the overall market.

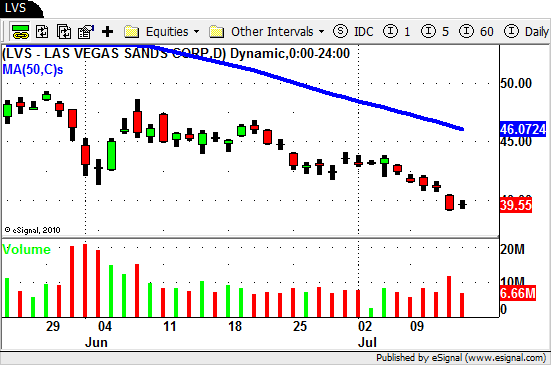

The SHORTS trades we did notice had charts that looked like death. Take a look at $MGM $LVS and $BRCM.

Notice that these stocks are weaker than the market and, for us, SHORTING them was an appealing option.

Although the strong side of the market was the LONG side we were able to time our trades once the retrace in the overall market started.

By doing so we are essentially shorting the weakest stocks in the market when the market hovers in an area of indecision (near the 50 day SMA).

The volume we saw on Friday was on the low side.

That being said we will see if the market can sustain its upward momentum or if we a change of heart as we head deeper into earnings season.

Until next week…Good Trading to YOU!

Swing Trading BLOG – Swing Trading Boot Camp

Swing traders enjoyed the early part of this holiday shortened week but the news at the end of the week brought on a reality check.

With the dismal jobs report numbers came increased selling bringing the market down on Friday.

The indices basically finished flat for the week but traders had opportunity to take their profits off the table well before Friday came.

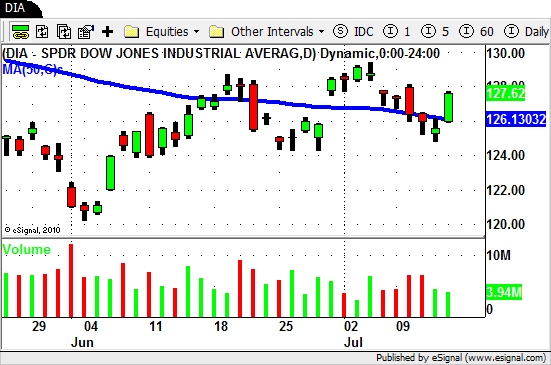

All three indicies put in a "higher low" at the end of last month are now back above their 50 day SMA's.

As the earnings season approaches we will see if they can hold above these levels and continue the uptrend.

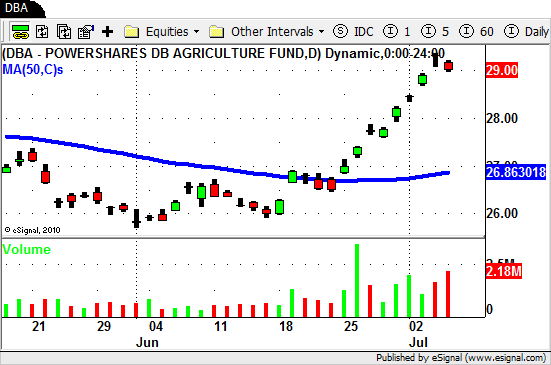

When it comes to the different sectors in the market we still have a bit of a mixed bag.

Several ETF's are showing some great relative strength.

Real Estate ($IYR), Retail ($RTH) and the Agriculture ($DBA) sectors are rocking.

The Semiconductors ($SMH) and the Broker/Dealers are still lagging a bit.

On the individual stock front we have more of the same.

We have breakouts ($ALK $WMT $O $V) and breakdowns ($ADM $AET $MRVL $LRCX).

You have to come to expect this type of price action when the market in so indecisive and trading around the 50 day SMA.

It is hard in times like these to make a strong case for just one side (long or short) of the market.

As far as individual swing trading strategies go we will look for for the market to us exactly what to do next.

If we see chart patterns forming on the long side we will need to see price action and volume confirm the next move.

If the sellers step in next week we will see a lot of these long patterns FAIL and we will look to SHORT the weaker stocks in the market.

Certainly we have some big moves in the market as we move through earnings season.

Pay close attention to what the market is telling you.

As always be prepared for whatever the market decides to do from here and act accordingly.

Until next week…Good Trading to YOU!

© Swing Trading Boot Camp 2026