Is this the market that never stops?

This is the kind of rally that a lot of traders find very difficult to trade.

"But everything has gone straight up!"… you might say.

Yes and that is the PROBLEM!

When a market rallies like it has, for the last month or so, traders that missed the initial move are STILL WAITING for the market to "take a breather" and pullback so they can get LONG!

To sum it up…THEY HAVE MISSED THE BOAT!

Now I will agree that the rally we have seen is a bit atypical and at times it seems that you would be chasing the market if you entered into any new LONG trades.

I will argue, however, that if you look at the chart patterns and price action of some of the ETF's and individual stocks you will have found plenty of opportunity to BUY strong stocks.

This is one of the main reason we like Swing Trading ETF's and individual stocks.

We can compare their performance against the overall market.

We can determine whether a sector ETF or stock is "STRONG" or "WEAK" in relation to the market.

Our Swing Trading Blog (the one you are reading right now) posts a "Week in Review" every Friday.

Using just the information posted on that blog last week you could have had a great starting point to locate some swing trades this week.

For the last two weeks we posted to the blog that the Oil and Energy ETF's (OIH and XLE) did NOT seem like they wanted to participate in the recent rally (Relative WEAKNESS).

Not the best time to look for SHORT setups since the market is making NEW HIGHS so what about STRONG sectors?

Last week we also posted on the blog that Real Estate, Retail and Gaming have been some of the strongest sectors (Relative STRENGTH) out there.

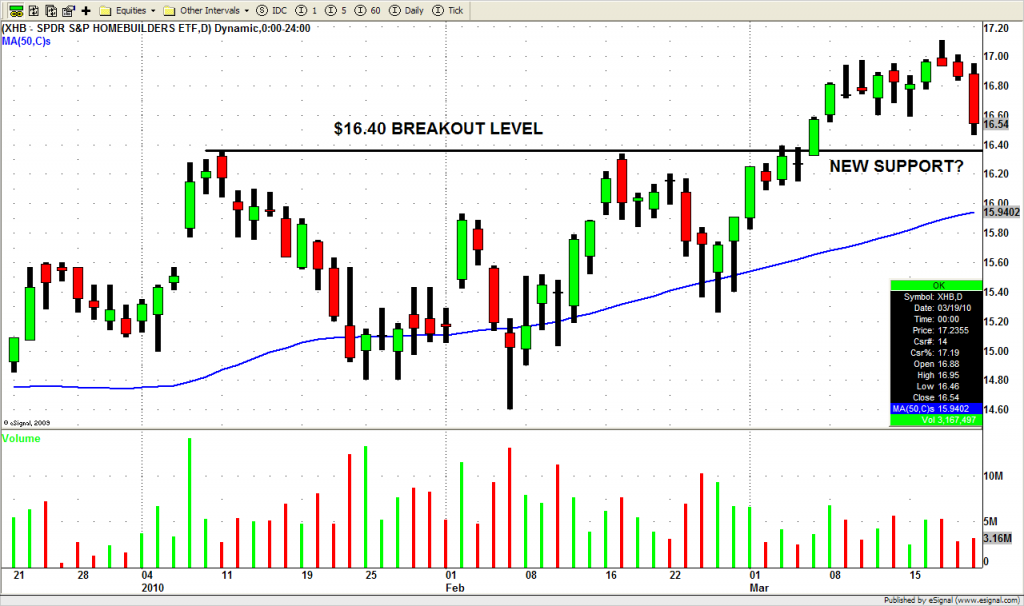

We also posted a Swing Trading chart of XHB, the homebuilders sector ETF, which has also been a very strong sector lately.

We told you we would continue to watch these strong sectors as well as the major stocks in these sectors for swing trading setups.

On Monday morning the market gapped down but never broke through last Fridays low.

Once it held this low you should have been looking to get LONG if the market were to continue its strong rally UP.

This is where a lot of traders "miss the boat".

After Fridays HIGH VOLUME sell off they think that the market has finally started to "pullback" or "retrace".

These traders then start doing their nightly scans for stocks to trade the next day.

The problem is they are looking for SHORT trades and do not even consider looking for stocks to BUY.

Because of this they are NOT prepared when the market proves them wrong (like it did).

Because of this they missed swing trade setups in stocks like WYNN, LVS, MGM, DRE, KIM and O (all from last weeks blog).

And probably also missed the swing trade opportunity when XHB gapped down into support (see charts) and then rallied nicely to NEW HIGHS!

The next they know the market moves UP strong and they are FLAT (no positions)!

The market moves up again the next day and they don't want to "chase the market " so again they dont do anything but sit and watch.

This is exactly how you miss big moves in the market like we have had over the last month!

Just remember, we never KNOW for certain what the market WILL do!

And like I said last week, as swing traders, we need to be prepared for WHATEVER the market decides to do.

That way once the market decides we, as traders, can simply follow and make the appropriate decisions.

Until next week…do your homework and BE PREPARED FOR ANYTHING!

And as always…Good Trading to YOU!