Swing Trading BLOG – Swing Trading BOOT CAMP

Swing Traders saw more of the same this week and the overall market continued to drift lower.

Tuesday traders watched as the market had a decent GAP UP but this was quickly followed by a GAP DOWN the next day which erased all of the gains.

Thursday and Friday the indices floated around on lighter volume but that didn't stop some of the sector ETF's from continuing their moves lower.

The Semiconductors ($SMH) continued to free fall as did the entire Technology sector ($XLK).

Here is a look at the chart of Inverse ETF ($SSG) for the Semiconductor sector.

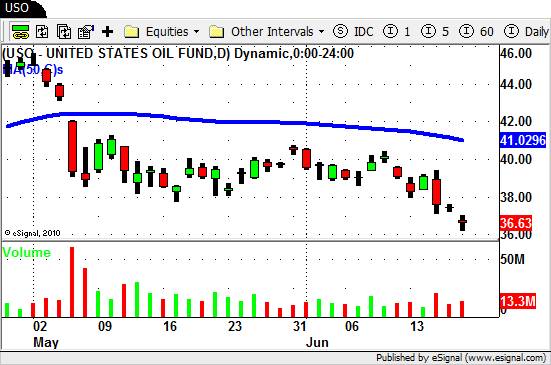

The Energy and Oil sectors also pushed lower after showing signs of losing strength last week.

$USO finally broke out of a month and half long sideways trading pattern to trade down to new multi month lows.

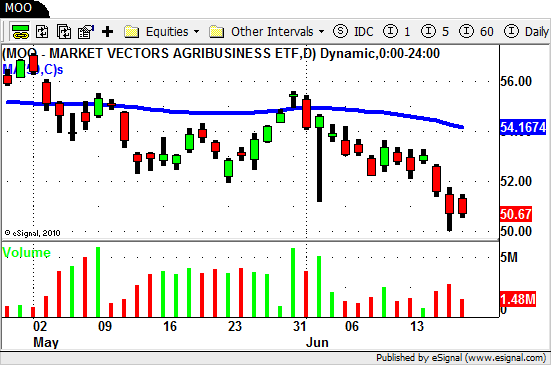

The Steel sector ($SLX) pushed to new lows and finally the Agriculture ETF's ($MOO $DBA) also became the latest to succumb to the selling pressure.

As far as individual stocks go there were plenty of SHORT swing trading opportunities this week.

$CREE and $RIMM were two notable standouts this week.

$CREE was actually on out LONG Watch List at the end of last month.

After the lack of follow through to the up side it quickly returned to a SHORT watch earlier this month.

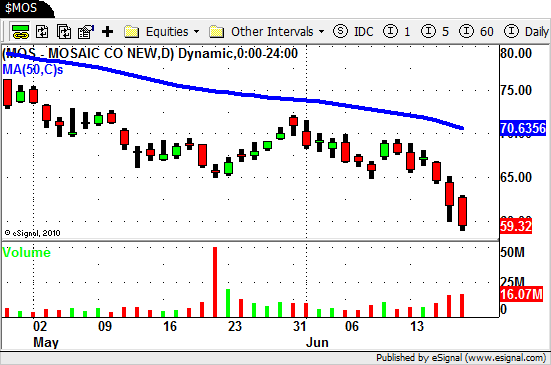

If you have followed our Swing Trading BLOG for any length of time you will know that we have been bearish on $MOS for quite awhile.

The moves in $MOS to the downside have been very "clean" moves and this week was no exception!

After a "double bottom" bounce the selling resumed Monday and the move lower was a good one.

There are still a few stocks that are holding up nicely and some are actually making new highs.

Although situations stick out to us we are clearly in a bearish phase of this market so why fight the trend (now that its clear)?

We are due for a retrace in the market so as always continue to wait for those setups with good risk reward ratios.

Until next week…Good Trading to You!