As we notified you in our last BLOG post we were mostly flat at the end of last week due to the extreme volatility we witnessed on Thursday.

We also advised that we would be sitting on the sidelines until the LOW RISK/HIGH REWARD opportunities presented themselves.

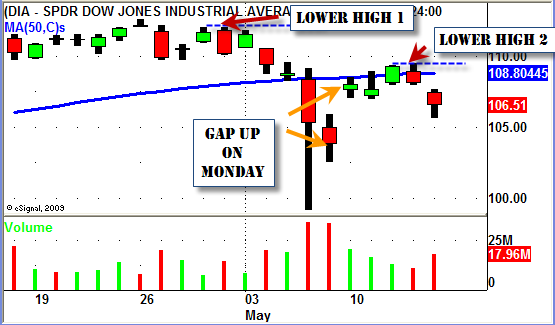

When the market GAPPED UP HUGE on Monday were sure were glad we were flat!

We actually continued to mostly watch the market while the week unfolded.

With the Dow, S&P, and Nasdaq all hovering around their 50 day SMA's we started looking for clues to tell us what the market may do next.

On Tuesday and Wednesday we noticed several stocks and ETF's that were creating almost text book SHORT Swing Trade setups.

It appeared to us that these stock and ETF's (as well as the overall market) were simply putting in a "retrace" and could possibly resume their downward movement.

It seemed that our LOW RISK/HIGH REWARD trading opportunities were now presenting themselves.

When Thursday morning finally rolled around we had a ton of potential SHORT Swing Trading setups on our watch list.

Our Swing Trading Newsletter subscribers received a very lengthy list of the stocks we were watching.

As the day progressed on Thursday several of our triggers were hit and we entered into some new positions.

Fridays price action followed through nicely to the down side and we were able to cover some of our STS shorts in the process.

One example is semiconductor equipment maker KLA Tencor Corp (KLAC).

On the chart above we see how KLAC gapped up with the market on Monday.

Tuesday we see how price spiked higher only to close the day near the middle of the candlestick.

On Wednesday we noticed how KLAC could not trade through the previous day's high despite a strong up move in the market.

Wednesday's price action actually created a LOW VOLUME INSIDE BAR (or candlestick).

This type of "stalling" price action is a sure sign of indecision and relative weakness.

The stage was now set so here is how the trading plan for this trade looked.

Our initial SHORT entry price was set at $32.55 just below the low of the day on Wednesday ($32.61).

If price traded down to this level and triggered our entry a new "Swing High" would be in place so we would set our initial STOP one penny above this high at $33.30 for a risk of 75 cents.

Due to the potential support in KLAC near the $30 level we decided to make this an STS (Short Term Swing) Trade and set our profit target at $31.05 or 2 times our initial risk.

On Thursday morning our entry price was hit and we entered into our SHORT position in KLAC.

KLAC continued to trade lower throughout the day and ended up closing near its low for the day on a slight increase in volume.

Friday morning KLAC gapped down with the market and we were able to cover our SHORT just after 10am at our profit target ($31.05).

KLAC did trade a bit lower during the day before closing just below $31.

The market closed out the week looking like it was heading lower from here.

Could KLAC continue to trade lower for the next few days if the market continues to sell off?

Of course.

Will we be upset that we "left some profits on the table" or second guess our decision if that happens?

Absolutely NOT!

This specific trade was set up as a SHORT TERM SWING TRADE (STS).

We set it up this way for a reason and once we set our plan in place we follow it "to a tee".

Some of the other trades we entered into on Thursday have a bit longer time frame and we will manage these trades "to a tee" as well and exit when our rules tell us to.

As we go forward into next week continue to look for the price action and volume clues to get a "heads up" on what the market and your stocks may do next.

Until next week….GOOD TRADING TO YOU!