Swing Trading BLOG – Swing Trading BOOT CAMP

Up Up Up and away!

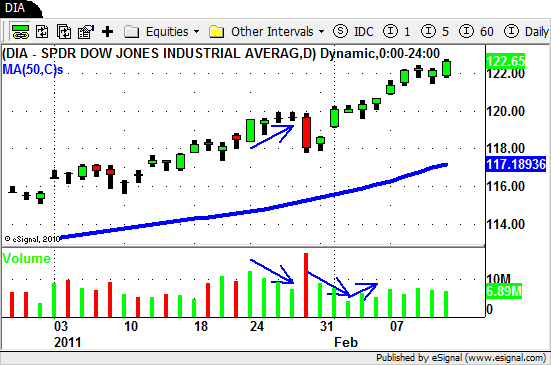

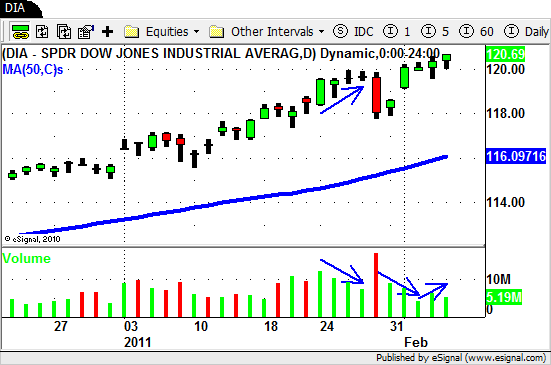

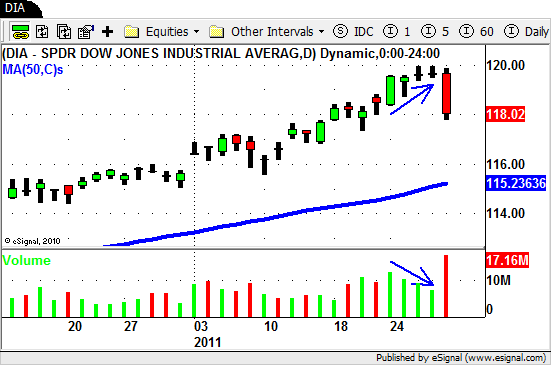

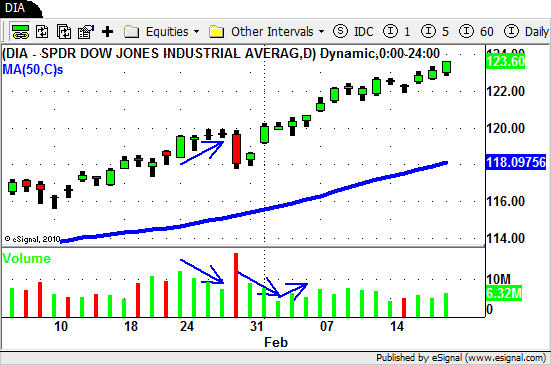

Yes the rally continues for yet another week!

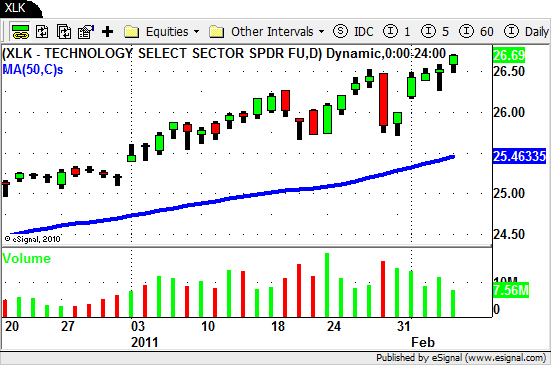

The overall market and many sector ETF's moved higher this week leaving many shaking their heads in disbelief.

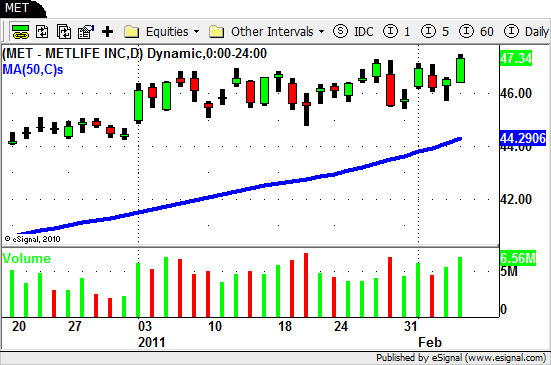

We moved back into LONG ONLY mode a few weeks back and the market has cooperated nicely.

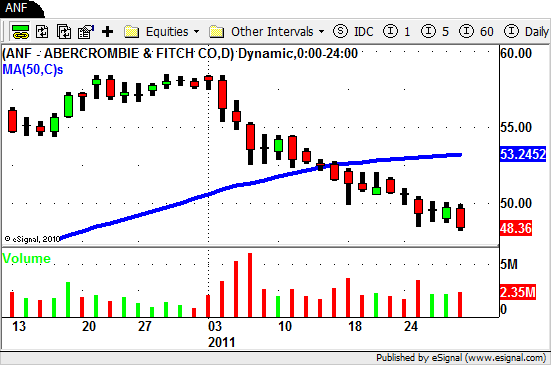

One sectors price action towards the end of the week did stand out though.

Take a look at some of the Agriculture related stocks to see what we mean.

$MOS, $CF, $AGU and $POT all put in lower high as sellers stepped in on Friday pushing these stocks lower.

The SELL OFF in these stocks happened during a very strong week in the market.

Not yet a sign to get bearish on this sector but something to watch as we move forward from here.

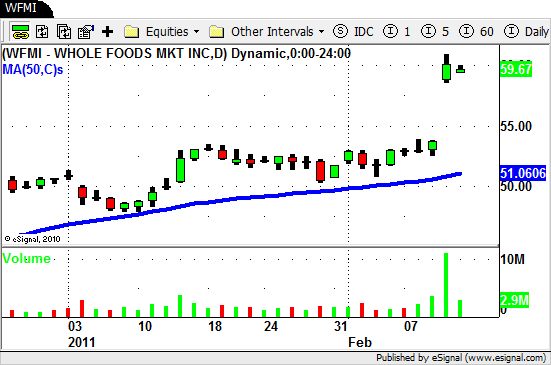

On the LONG side things are obviously much more clear.

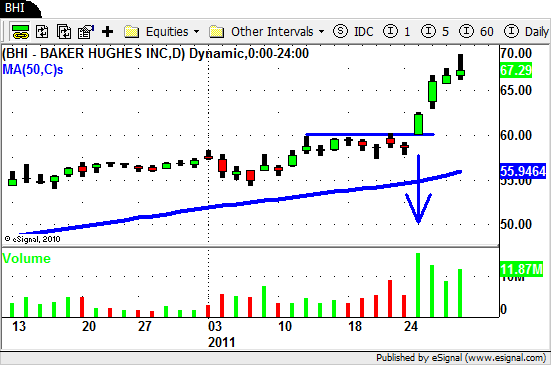

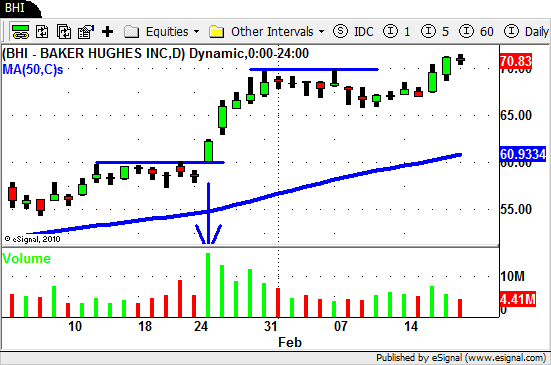

The Energy sector got a lift this week and some of the stocks we mentioned a few weeks ago broke out nicely.

$BHI, $NBR and $MRO all turned in a nice week of gains.

As we move into next week we will stick with our "Bullish" attitude and stay away from the short side.

As short term traders we realize that things can change in an instant though.

We will continue to listen to what the market tell us and attempt to profit accordingly.

We hope you will do the same!

Until next week…Good Trading to YOU!