What a GREAT week for swing traders!

The RALLY continues as the NASDAQ, S&P 500 and several sectors race ahead to NEW HIGHS for the year!

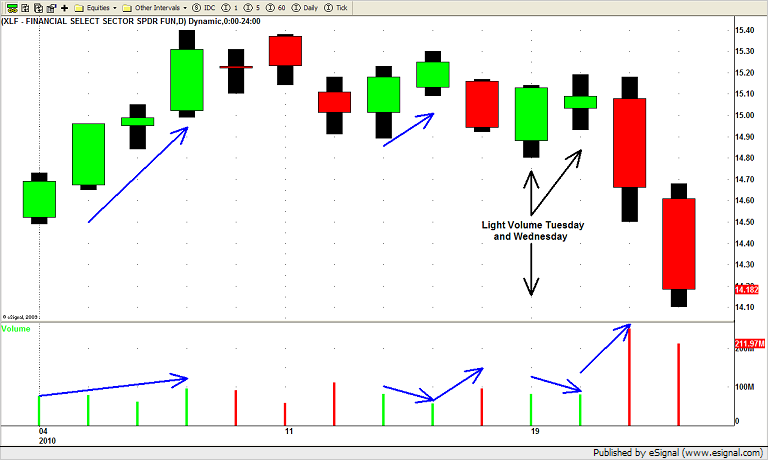

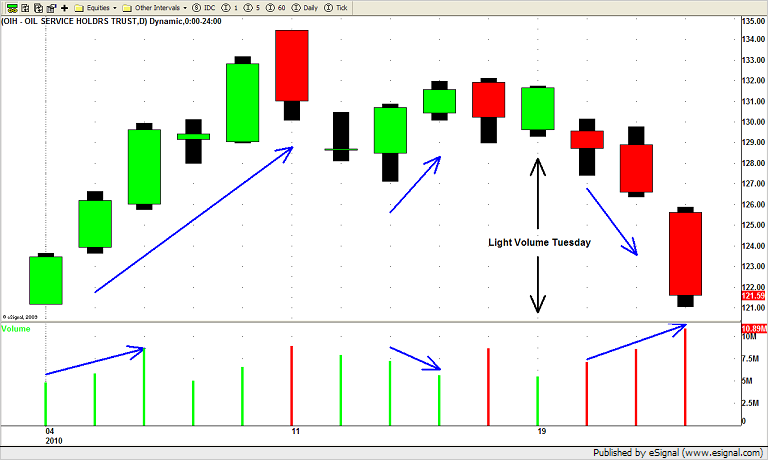

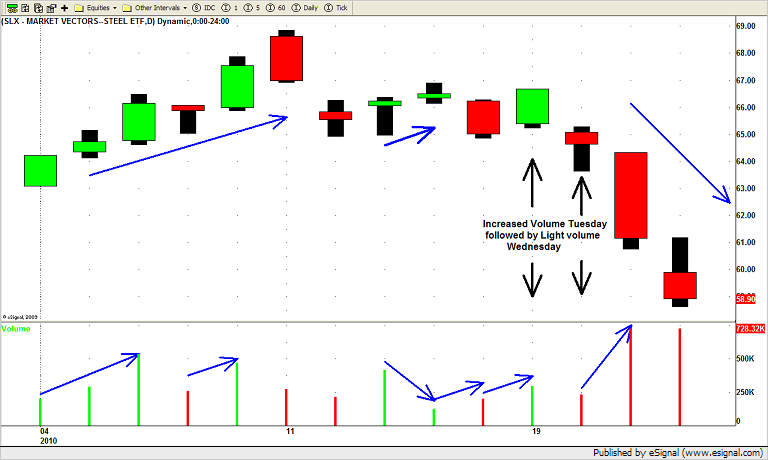

If you listen to some of the talking heads on T.V. you hear that the trading volume for this last up move was very LOW so they remain weary of the the upside potential in the weeks to come.

Now although the "low trading volume" in the broad market MAY be a concern moving forward some of the individual stocks showing great price action and volume patterns for us swing traders!

And despite the DOW's lackluster performance there were stocks all over the place making HUGE upside moves!

Apple (AAPL) closed for the week at its ALL TIME HIGH!

Research in Motion (RIMM) also had a great week, and after breaking through the $72 level it rallied to the upside and closed UP by almost 10% this week!

PCAR and LULU we also rock stars this week!

Subscribers to our Swing Trading Newsletters were alerted to numerous BUY set ups this week and a bunch turned out very nicely (if we do say so ourselves)!

CAL, WYNN, RIMM, and WYN all offered great swing trade opportunities!

One sector that really took off was the Financial Sector.

Take a look at XLF, IYF, FAS and well as some of the individual names like GS, C, and MET.

The banking sector finished UP 2.5% this week, outpacing the the S&P by more than 2 to 1.

The RETAIL (RTH) and REAL ESTATE ( IYR) sectors also continued their impressive rally with both sectors closing at their highest point of the year as well.

SPG, KIM, O and DRE continued their runs after showing great chart patterns for us last Friday.

Oil (OIH), Energy (XLE) and the semiconductors (SMH) all basically sat this last rally out.

So will these sectors play catch up or will they sell off when the market finally takes a break and pulls back a bit?

Only time will tell but for now we will continue to focus on the sectors and stocks that are showing tremendous relative strength.

Until next week…Good Trading to YOU!