Swing Trading BLOG – Swing Trading BOOT CAMP

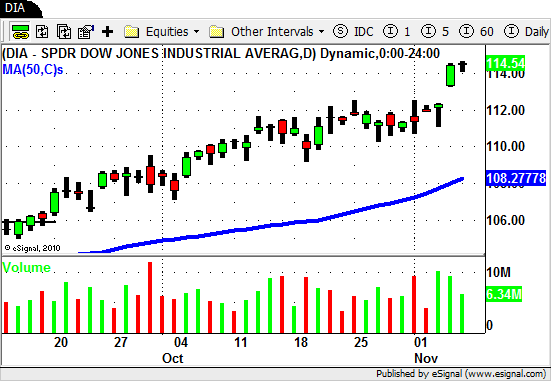

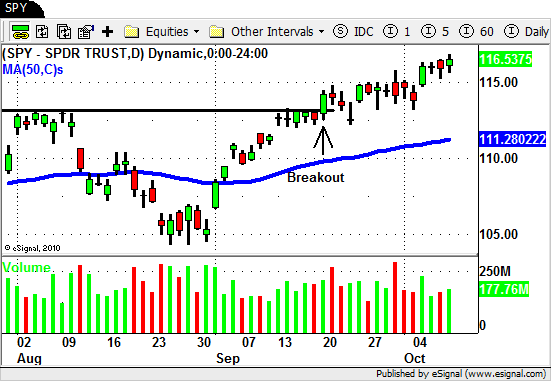

After breaking out to NEW HIGHS for the year last week the market put in a nice, orderly pullback this week.

We have seen a nice rally over the last 2 months but it looks the BEARS have had enough.

When you look at the charts for the DJIA, S&P, and NASDAQ everything still looks great.

A pullback after such a nice run up in the market is to be expected.

When you focus on the charts of the sector ETF's you start to see a few things to take note of.

Once the market traded to NEW HIGHS last week we saw the SELLERS step in and hammer some of the sectors.

The Real Estate sector ETF's broke out last week but a big sell off quickly followed and brought them right back to their 50 day SMA's.

The recent "Rock Star" Agriculture ETF's ($DBA $MOO) saw a similar outcome after last weeks break out.

We have seen this "Breakout/Sell Off" combo a few times this year and it can be quite frustrating for Swing Traders.

We saw the same pattern in a few of the strong stocks on our Watch List.

$EC has been a very strong stock as of late and like the market broke out the NEW HIGHS last week.

This week $EC took a beating as sellers drove the stock straight down for 4 days in a row.

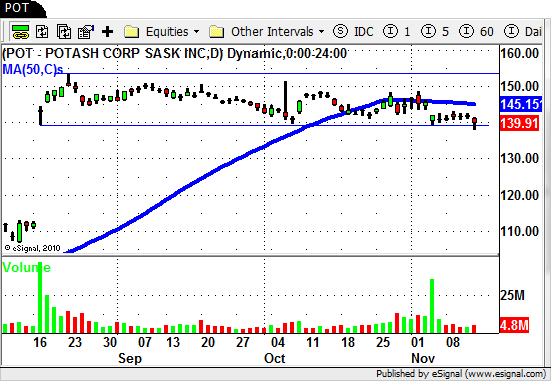

The individual names in the Agriculture sector are looking a little weak.

$ADM $AGU never made it to NEW HIGHS last week and sold off this week as well.

$POT traded lower and is trading near the bottom of its multi-month lateral channel.

$POT has a BIG GAP below and a break down from this level could take this stock significantly lower.

$MOS is having a hard time breaking out of the $70-$75 price level.

Now like we said earlier overall the market is still looking good and remains very strong.

This recent pullback is a good thing and some of the other stocks an sector ETF's on our Watch List are, as of now, setting up nicely.

The Retail, Energy, and Semiconductors ETF's still look strong.

Two sectors we will be focusing on will be the Financials and the Homebuilders.

In last weeks BLOG POST we posted about their breakout through some important overhead resistance levels.

Both sectors are now pulling back to these same important levels.

Once resistance is broken often times it becomes a new "support" level.

We will now need to see price and volume give us "confirmation" that this level will hold as new support and if it does we can act accordingly.

The market has pulled back this week but there could be more to come.

Use this time to watch how the stocks and ETF's on your Watch List react to the sell off.

Are they holding up nicely by pulling back on decreasing volume?

Or are they selling off MORE than the overall market and breaking down through key levels on increased volume?

Stick to your trading plan (you have one right?) and be prepared for whatever the market has in store for us in the days to come.

Until next week…Good Trading to YOU!