Swing Trading BLOG – Swing Trading BOOT CAMP

Finally!

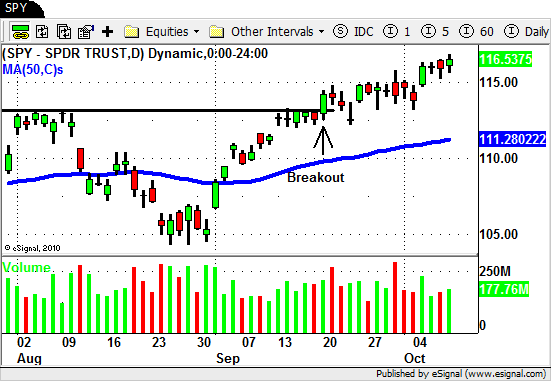

This week the UP move continues as we saw the major indices break out of last weeks narrow range.

The week started out on a negative as the market pulled back a bit but Tuesday we saw things quickly change.

Tuesday we saw the markets GAP UP and rally right to the close.

The rest of the week the strength continued and the markets closed higher after yet another UP leg in a move that started in September.

Overall the individual sectors are also acting very well although there are still a few laggards out there.

The Agriculture ETF's (DBA and MOO) exploded to the upside on Friday!

After last weeks big sell off in this sector we were waiting to see how this sector would trade this week.

Some of the stronger names in this sector (CF, CAT, AGU) offered good setups for LONG trades.

Energy and Oil Services continued upward as did the Semiconductors and Airlines.

Some of the sectors however did not participate (yet) much in the move this week.

Financials and the Homebuilders had a decent week but the Retail, Real Estate and Technology sectors traded sideways after gapping up with the market on Tuesday.

Although the sectors were a "mixed bag" we saw some great setups in some individual stocks this week.

AAPL and AMZN both had nice setups after their recent pullbacks although AAPL followed through a bit better this week.

DOW, MMR, ELN, AVP, CCJ and EL all had nice setups at some point during the week.

These were all text book type trades that should have been obvious candidates once the market spoke loud and clear on Tuesday.

As we go forward look for signs of strength in some of the stronger stocks and ETF's that have yet to take part in the market's recent move.

Be prepared for anything but with the recent strength in the market it is hard to make a case for the SHORT side of the market (unless of course you are a counter trend trader).

Until next week…Good Trading to YOU!