Swing Trading BLOG – Swing Trading BOOT CAMP

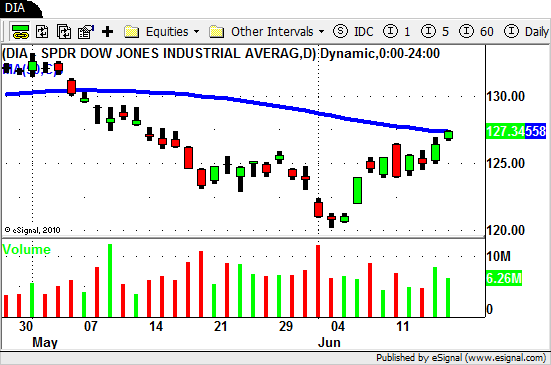

A nice week for the major indicies this week.

That being said was probably better to be a day trader this week instead of an overnight swing trader.

The intraday moves were very nice and offered reliable chart patterns to trade while the over night moves were less predictable.

See how we trade our Intraday Swing Trading Strategy here.

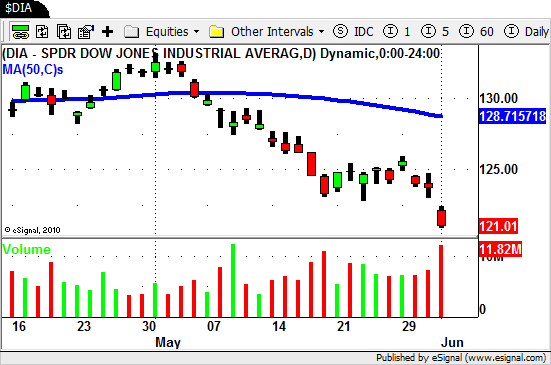

After a BIG GAP UP on Monday morning the sellers stepped in to bring the market down to end the day.

Tuesday didn't draw much excitement but starting on Wednesday the market started to show signs of moving higher.

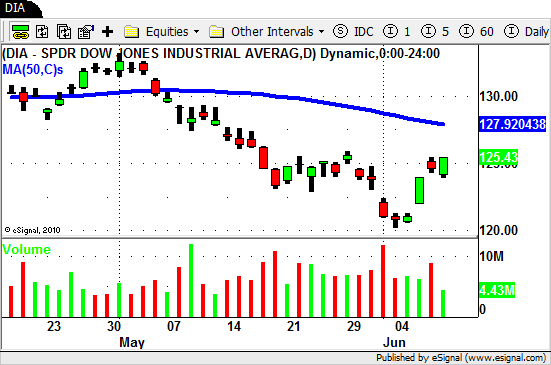

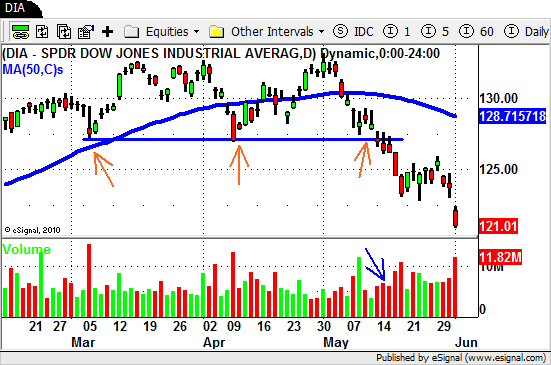

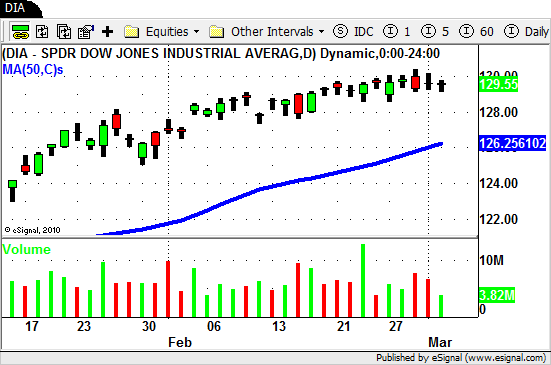

Fridays close brought the DJIA right up to its 50 day SMA while the S&P and Nasdaq aren't far behind.

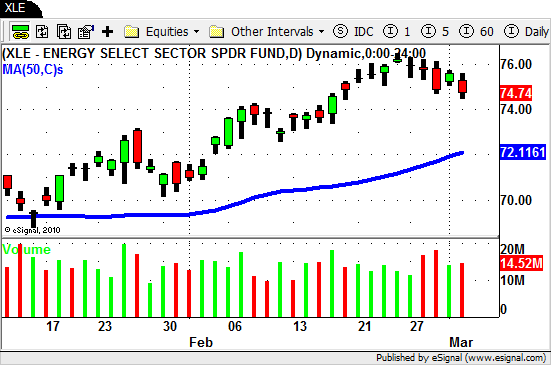

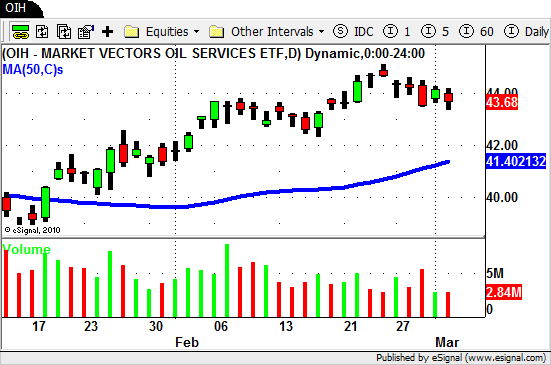

A few of the sector ETF's showed signs of life as well while others are showing extreme relative weakness.

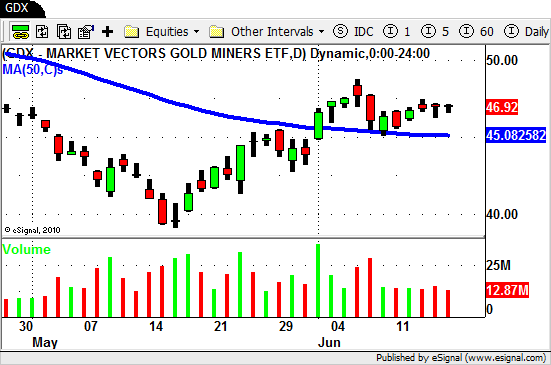

The Gold ETF's continue to trade above their 50 day SMA's and although Silver hasn't quite caught up just yet it looks to be showing signs of strength.

As next weeks trading begins things could change in a hurry.

With all the news coming out next week be prepared for the markets to move very quickly. One side will win the "tug of war" and you will miss the moves if you aren't ready.

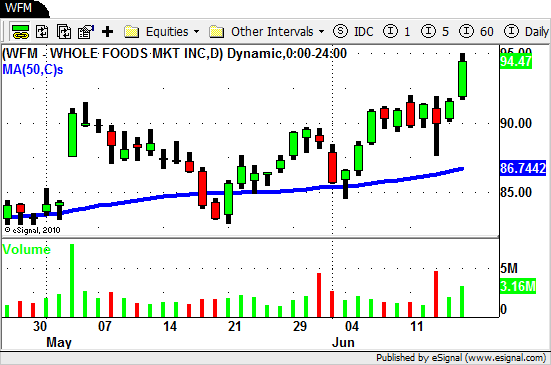

Look for stocks bucking the down trend (i.e. $WFM $EQIX) to add to your LONG watch list.

Look for those stocks that did not hold up well this week to add to your SHORT watch list.

Have a plan in place so whatever the market decides to do from here you will be prepared to act (and hopefully profit).

Until next week…Good Trading to YOU!