Swing Trading BLOG – Swing Trading BOOT CAMP

The sloooooow grind continues…

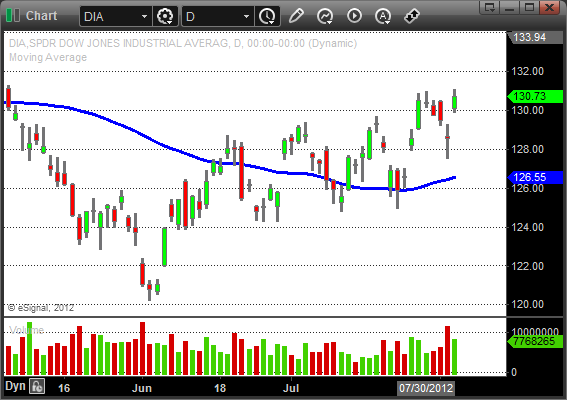

Swing Traders faced more of the same this week as the market is slowly making it's way higher.

For the last 2 weeks the move has been more of a crawl than a true breakout.

The DJIA as been a "turtle" but the technology focused NASDAQ has been moving up nicely.

When we look deeper into the tech sector we can see names like $AAPL and $QCOM making some nice moves while the tech/retail stocks like $AMZN also followed suite.

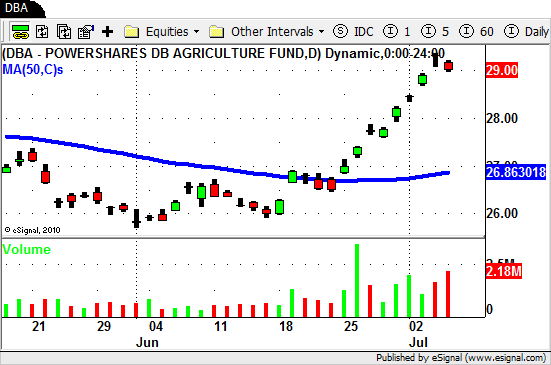

The recently strong Energy and Oil sectors showed signs of life again on Thursday.

$XLE, $USO, and $OIH all moved to multi month highs to end the week.

The Retail sector ($RTH) also broke to new highs this week.

$TGT, $WMT, $RL and $M all had nice moves and if you were lucky enough to be LONG $ANN the GAP UP was a nice surprise!

The Financials and Homebuilding sectors are playing along as well.

Plenty of choices to make on the LONG side no matter what your trading strategy is.

All in all this has been a great move up in the market since we bottomed out in early June.

Once we cleared the sideways trading early this month the wind has been at our back.

With that being said both the S&P and NASDAQ remain in extremely short term overbought territory.

Be cautious as we move into next week and don't chase trades…let them come to you.

Until next week…Good Trading to YOU!