Swing Trading BLOG – Swing Trading BOOT CAMP

Swing Traders saw a nice pop in the market this week!

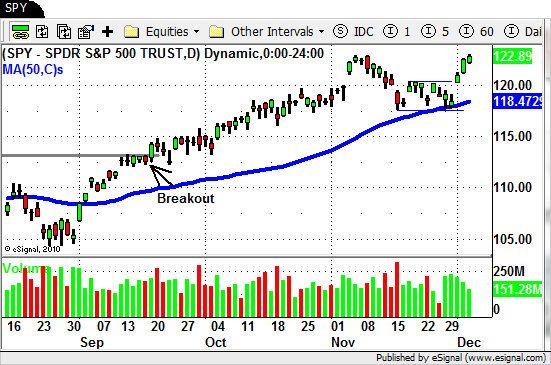

Tuesday's "inside day" was followed by a big GAP UP on Wednesday and nice follow through on Thursday and Friday.

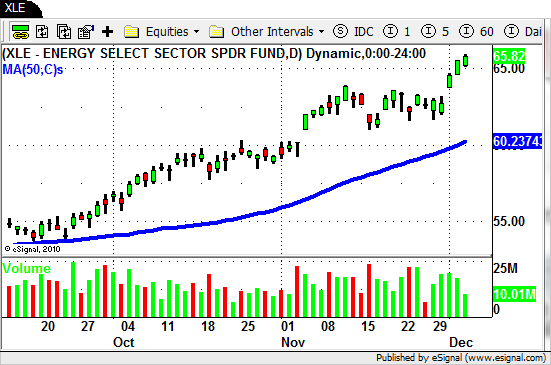

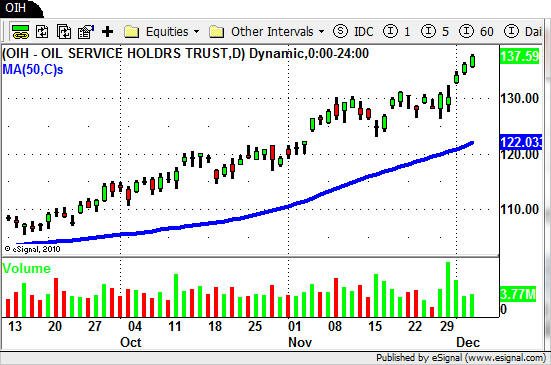

Several of the sector ETF's broke out to NEW HIGHS for the year!

The Energy ($XLE) and Oil Services ($OIH) ETF's made this list as did the Silver ETF ($SLV) and the Semiconductor ETF ($SMH).

All of these ETF's have been mentioned in our previous BLOG POSTS since they have been the strongest sectors during this recent move in the market.

If you only Swing Trade ETF's then these sector ETF's provided you with an opportunity to enter into another LONG trade this week.

If you trade both individual stocks and ETF's then this week you had plenty of trades to chose from.

In our nightly Swing Trading Newsletter we provided our subscribers with several trades that worked out very nicely this week.

The sectors we listed above had several stocks on our Watch List that made nice moves this week.

$APA $APC $NBR $BHI $HES $SLB $HAL $COG

$KLAC $NVDA $LRCX $MRVL $VSEA $NVLS

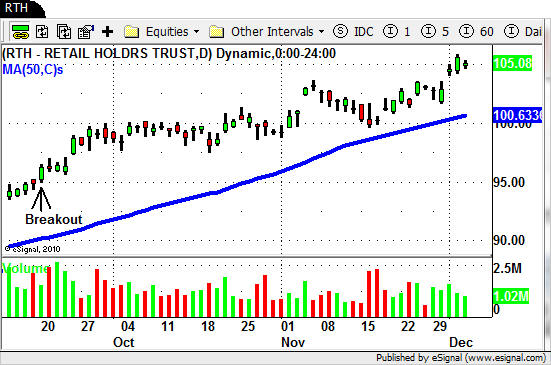

Even though it is not at a new yearly high the Retail sector ($RTH) has been HOT lately.

The stocks in this sector also had some nice trade setups.

$TGT $HOG $ANF $URBN $BOBE $TIF $COH

This week we also saw a big move in the "laggard" sectors that we have been watching.

After their recent BREAK OUT (and pull back all the way to support) we saw the Financials ($XLF), Homebuilders ($XHB) and Broker/Dealers ($IAI) all have nice moves to the UPSIDE this week.

We have been saying for the past few weeks that the market was at a pivotal point and that we needed the market to tell us where it was headed next.

This week it did exactly that!

We actually had a few SHORT trades on this week that were STOPPED OUT for a loss.

We did that (and will continue to do so) because at the time the market was a bit indecisive BUT the stocks we traded were showing signs of weakness.

Being stopped out does not bother us one bit.

As a matter of fact it gives us even more conviction as to where the market is headed in the near term.

Our SHORT trades were quickly replaced with several LONG trades as the market moved higher.

If you follow our BLOG you know by now that being prepared for ANYTHING is our mantra.

This week is great example of how and why that being prepared and reacting accordingly is exactly what it takes to profit from the market.

Until next week…Good Trading to YOU!