Swing Trading BLOG – Swing Trading BOOT CAMP

Nice follow through this week!

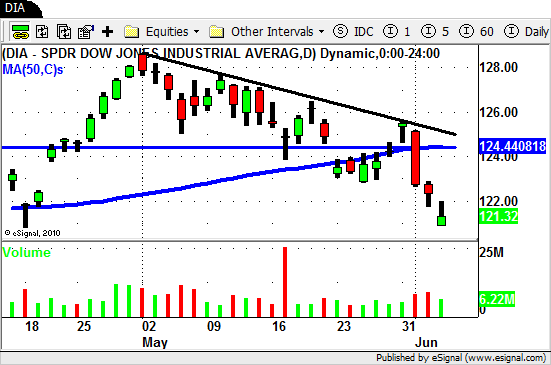

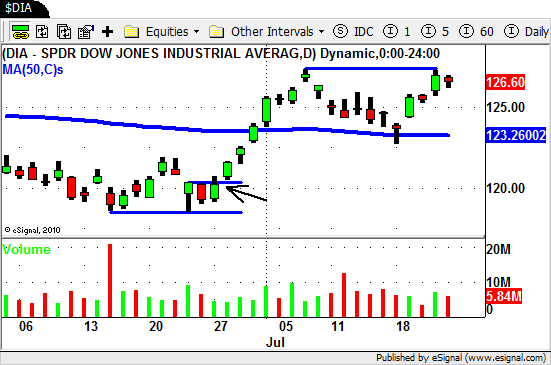

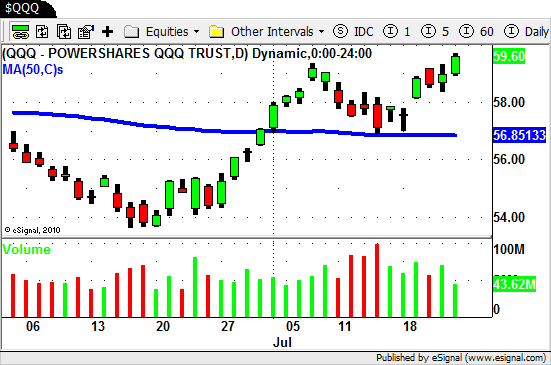

After a spike down below the 50 day SMA on Monday the market found its footing and resumed its move to the UP side this week.

As far as the indices are concerned the NASDAQ actually rallied up to a HIGHER HIGH while the DOW and S&P lagged behind a bit.

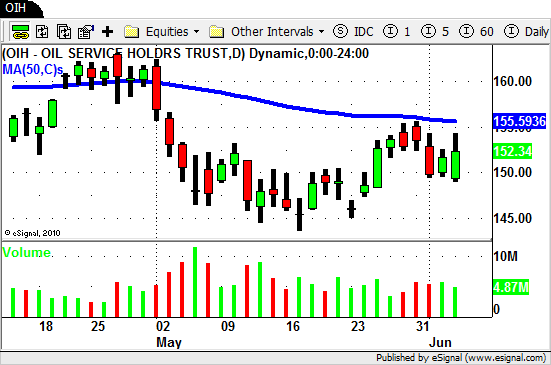

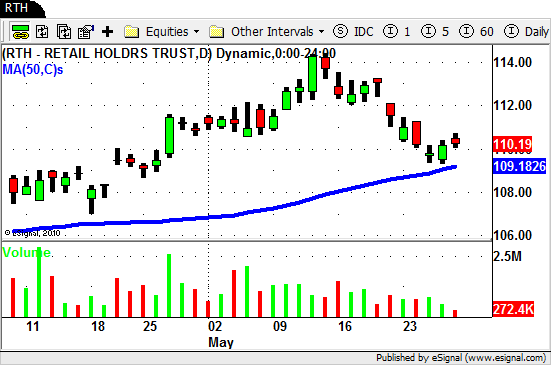

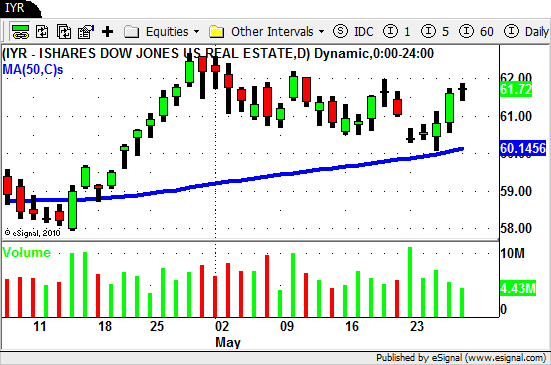

As expected the overall market did well but a few sectors really stood out.

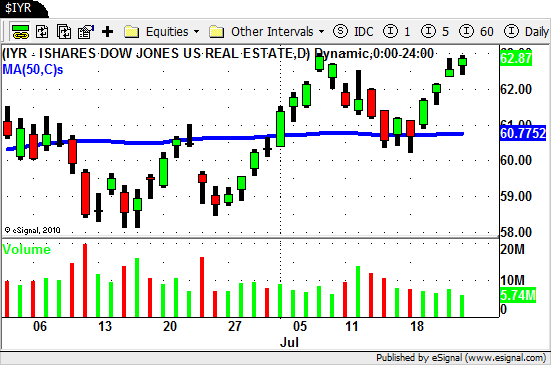

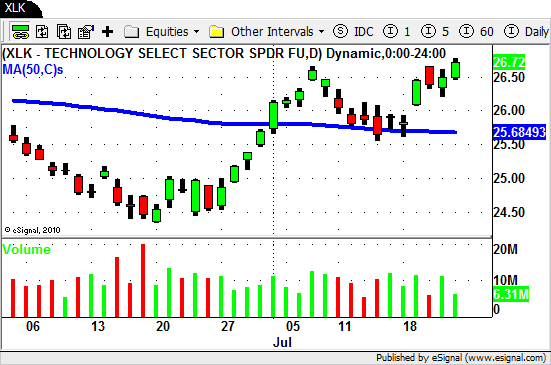

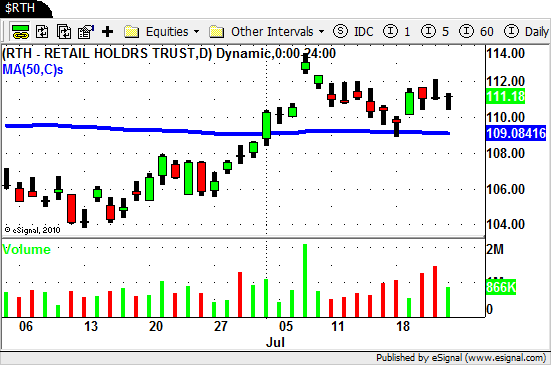

Here is a look at the charts for a few of the sector ETF's that performed well.

$XLE

$IYR

$XLK

$OIH

In last weeks BLOG POST we mentioned several individual stocks in these sectors to watch.

The Energy and Oil Service stocks we mentioned all did well.

The Casino stocks moved up but lacked the "pop" (so far) that we were looking for.

The Retail stocks (and ETF) basically "stalled" after moving higher on Tuesday.

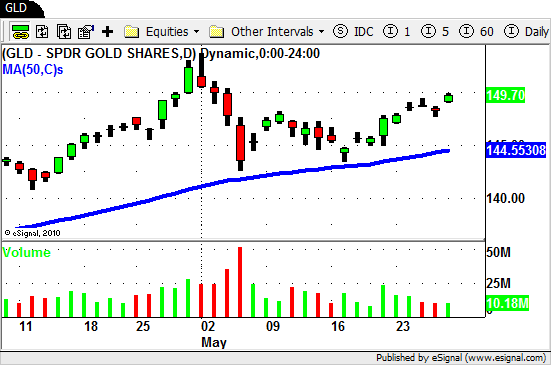

The Gold, Gold Miners and Silver ETF's continue to hold up after putting in a nice rally recently.

Keep your eye on the Agriculture ETF's (and stocks) as we move forward since we are seeing some interesting price action and volume patterns lately.

$MOO has drifted up but $DBA is still lagging behind.

The market has moved up fast this week and is flirting with being short term overbought.

Remember though that an overbought (or oversold) market can become even MORE OVERBOUGHT.

Price action and volume paint a picture so look for the clues the market gives you.

Be prepared for anything and as always…Good Trading to YOU!