Using Moving Averages

Moving Averages are some of the most popular swing trading indicators used by traders today.

Traders use moving averages for a variety of reasons with trend identification probably being the most popular.

Traders also use moving averages to determine areas of potential support and resistance, as filters for trading candidates or as trailing stops for open positions.

Popular lengths for these moving averages are 10 and 20 period for shorter time frames and the 50 and 200 period for longer times frames.

The most popular type of moving average used by traders has to be the the simple moving average.

The simple moving average, or SMA, is simply the average price of a security over a given period of time.

By comparison, the exponential moving average, or EMA, gives more weight to recent price data.

The EMA does this to try to eliminate "lag" between the moving average line and price itself.

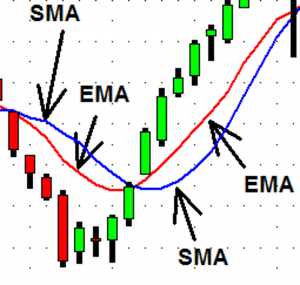

Here you can see both the SMA and the EMA plotted on a price chart.

You can clearly see how the EMA (red line) tracks price more closely than the SMA.

This can be either a benefit or drawback depending on what exactly you intend your moving average to do.

For example, if you are using a 10 period moving average as a trailing stop indicator then the EMA may be a better choice as it tracks price more closely than the SMA.

Or if you are using moving averages to identify a trending scenario then you could even use an SMA and an EMA of the same length to visually establish when the faster (EMA) indicator crosses the slower (SMA).

Moving Averages can be a simple, yet very powerful swing trading indicator to add to your tool box once you determine your objective for using them.