Intraday Swing Trading

Is Intraday Swing Trading possible?

This seems to be a question that comes up a lot.

"Swing Trading" is typically defined as…"a method or strategy used to profit from short term (1-4 day) price moves in the market".

Although the standard definition defines the typical length of time in a trade (1-4 days) another definition for "Swing Trading" is used to describe a method or strategy used to profit from "price swings" in the market.

This definition can be used to define trading strategy or method regardless of the time frame used.

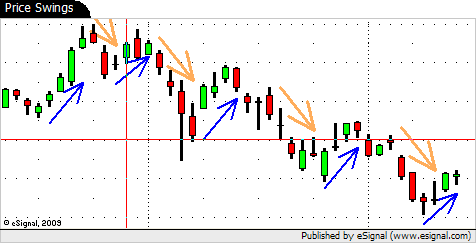

A "price swing" is used to describe the ebb and flow of price action.

As price moves from one point to the next it typically does so in back and forth wave like motions typically identified as "swings".

When price moves from a low point on a chart to a higher point this is typically identified as an "up swing".

The opposite is true for a "down swing" in price.

When price moves from a high point to a lower point on a chart this is called a "down swing".

Theses alternating "swing" extremes are further identified as "swing highs" and "swing lows" once they begin to retrace from their highest or lowest point.

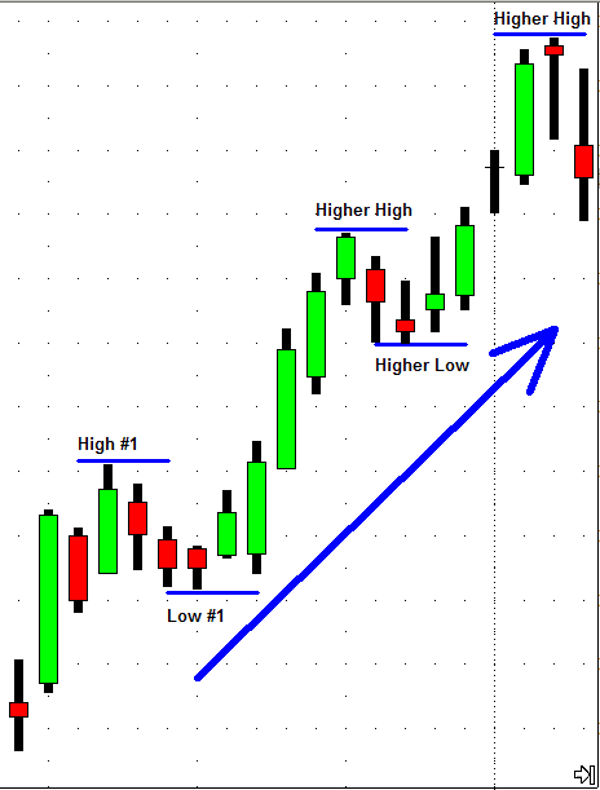

Technical Analysts use these "swings" to identify and label trends in a security.

A series of "up swings" and "down swings" that create higher highs and higher lows is classically defined as an UP trend.

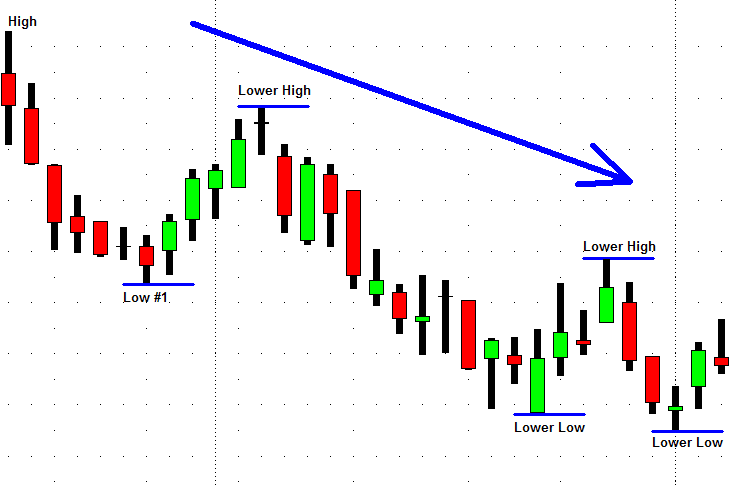

The opposite being true to identify and define a DOWN trend.

So now that we have the terminology and definitions out of the way lets get back to the original question.

Using the second definition of a "Swing Trader" you can surely see how a day trader can trade the "price swings" in the market.

Our main strategy for overnight Swing Trading is based on locating strong or weak stocks (and sectors) in relation to the market and trading these stocks (and ETF's) based on the context of the overall market conditions.

When we trade the "price swings" intraday we use the exact same strategy!

If the overall market is strong we are scanning the entire market looking for the strongest stocks and sectors.

Once we locate these strong stocks (and ETF's) we then use technical analysis to identify the "price swings" in each particular stock and ETF.

We want to be in sync with the market so if the overall market is strong and has made a run up (UP swing) and has now retraced (DOWN swing)we are looking for LOW RISK trade setups in the strongest stocks and ETF's.

That way if the market decides to make another UP swing we can enter into and hopefully profit from the next price swing (UP swing) in the stocks and ETF's that we have identified as being stronger than the market.

In a weak market we do the exact opposite.

We locate the weakest stocks and ETF's and then try to identify the best opportunity to SHORT each "down swing" in these stocks as the overall market trades lower.

Although this article simply scratches the surface when it comes to "Intraday Swing Trading" rest assured that there are many strategies one could come up with to attempt to profit from the intraday "price swings" in the market.