Swing Trading BLOG – Swing Trading BOOT CAMP

And DOOOOOOOWN we go…

This week traders watch the market roll over and finish out the week with DJIA dropping over 200 points.

After a bit of a retrace to start the week the NASDAQ got rocked again!

I'm sure the earning news from Google ($GOOG) didn't help matters at all.

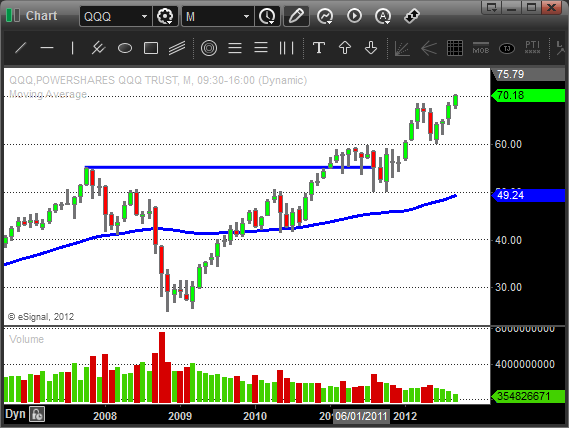

The chart of the NASDAQ is a classic chart pattern that shows the relative weakness we were looking at.

Thursday price action and volume confirmed the next move lower and let us draw our new accelerated trend line.

On the flip side a few sectors actually did quite well this week.

The Homebuilders ($XHB) actually traded to a NEW HIGH this and the Financials ($XLF) popped nicely early in the week.

The Energy and Oil sectors ($XLE $OIH) broke out of consolidation this week but were also met with a big day of selling on Friday.

The Tech sector (including the Semi's) continued to get whacked this week.

Both $XLK and $SMH traded to new multi month lows on Friday.

Gold ($GLD) and Silver ($SLV) continue to sell off after putting in a telltale "lower high" last week.

The amount of SHORT setups we saw this week were a good indication that the market was turning.

$AAPL was a pretty text book short.

The interesting thing here is that despite the hard sell off we saw this week there are still loads of stocks holding up.

This relative strength keeps us looking at both sides of the market for trade opportunities.

If the Dow and S&P follow the NASDAQs lead we will see how these stocks handle the heat.

Another sell off that brings these two indices below their 50 day SMA's would have us focusing mostly on the SHORT side but until then we will actively look at both sides of the market.

Will the market follow through to the DOWN side of find some support this week?

No one know for sure so be prepared for either option.

Until next week…Good Trading to YOU!