As the market continued its recent up move our "short term" LONG swing trades turned out nicely.

After bouncing off of the February lows the market has moved up for the last 9 days straight.

As you know from our last few BLOG posts we entered into some LONG swing trades (in strong stocks) as the market confirmed its "bounce" off of the February lows.

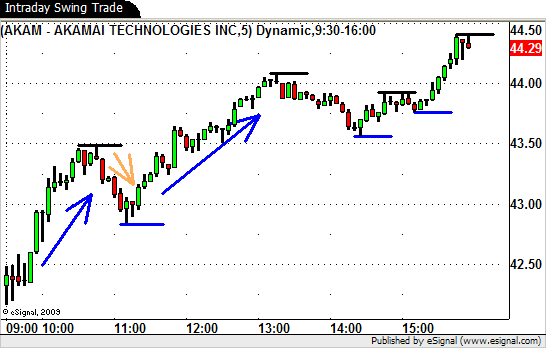

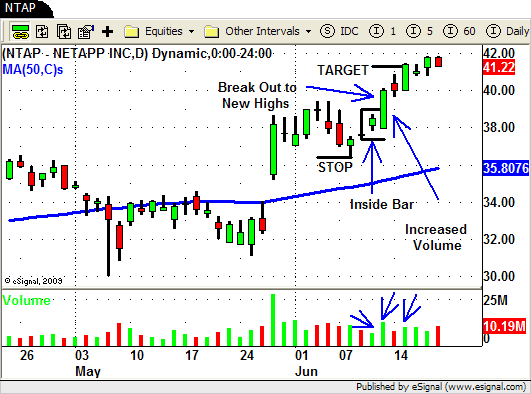

Strong stocks like ALK, AKAM and NTAP (chart below) hit their profit targets this week.

One of the strong stocks the we did not take a trade in but also turned out nicely was MELI.

MELI made a nice run to new yearly highs as the market made its "bounce".

In tonight's webinar we discussed how we determined which stocks and ETF's to trade during this last move in the market.

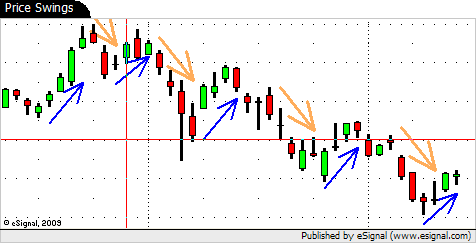

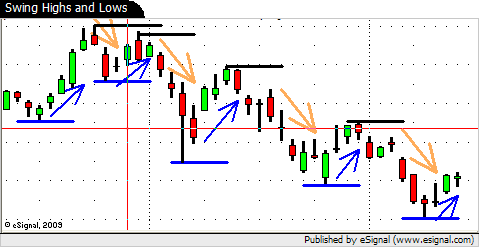

One of the biggest "clues" we look for is when a stock or ETF shows strength or weakness in relation to what the overall market is doing.

Look at the stocks we listed above.

All of the stocks above were showing signs of strength as the market was trading down to the February lows.

As the market confirmed its "double bottom" price pattern these strong stocks and ETF's were putting in a higher low prior to taking off to new highs.

The strongest stocks were also trading above their 50 period SMA, a basic filter we use to determine strength or weakness, while the market was trading well below it.

In contrast the weaker ETF's (and individual stocks) were the ones that made new lows or lower lows as the market "double bottomed".

Take a look at the chart of the DOW (above) and compare it to the RTH and XHB (below).

You can see how both sectors made new lows as the market put in the "double bottom" on June 8th.

We steered clear of these sectors during the recent up move and will continue to do so until they show signs of becoming at least as strong (and preferably stronger) than the overall market.

By locating the "clues" that these stocks and ETF's were giving us we were able to make some profitable LONG trades in a then down trending environment.

If you have any questions about the trades we entered into this week please post them below…we would love to hear from you!

Until next week…Good Trading to YOU!