Swing Trading BLOG – Swing Trading BOOT CAMP

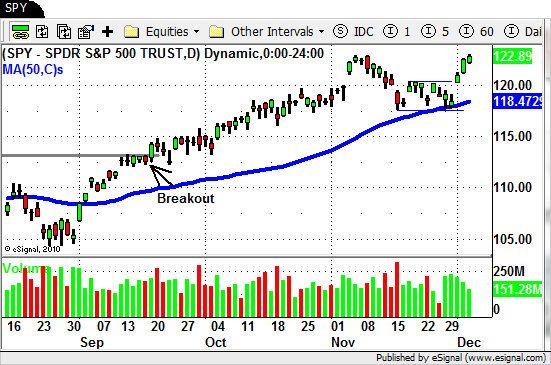

The market drifted a bit higher this week as both the S&P 500 and Nasdaq both made NEW HIGHS for the year.

The DJIA basically traded sideways all week but the action in some stocks and ETF's more than made up for it.

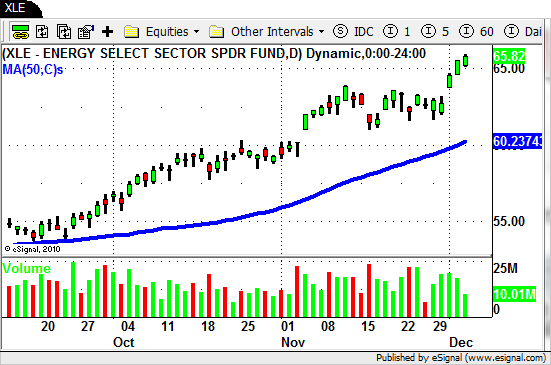

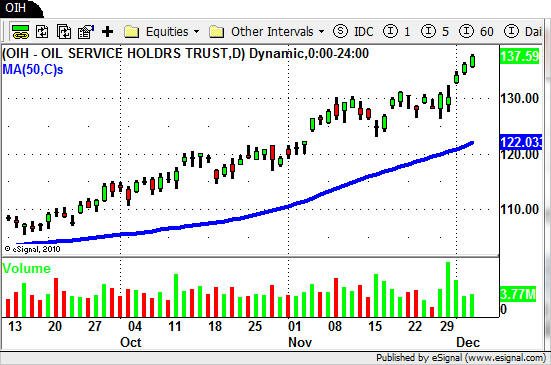

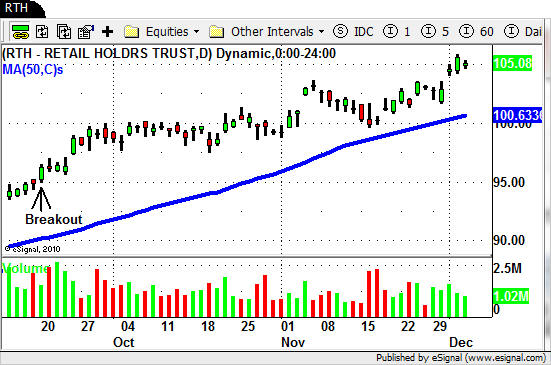

The action in the sector ETF's continues as the "weak" Financials ($IYF $XLF), Broker/Dealers ($IAI), and Hombuilders ($XHB) continued to rise.

We mentioned these ETF's several weeks back when they broke through their overhead resistance levels.

The pullback that followed was a bit extreme as it took these ETF's all the way back to their support levels.

The "bounce" we have seen in these sectors over the past 2 weeks has been impressive.

Some of the stocks on our list continued to move higher this week.

One of the hardest things to do as a trader is to let your winning trades ride.

Having a different strategy for different phases of the market may be something to consider.

When the market is in a "choppy" phase and lacks direction we use our STS (Short Term Swing) methodology.

In a "break out' trending type market we switch to a more traditional trend trading style in an attempt to capture bigger profits.

Several of these stocks are moving up nicely and may continue to do so.

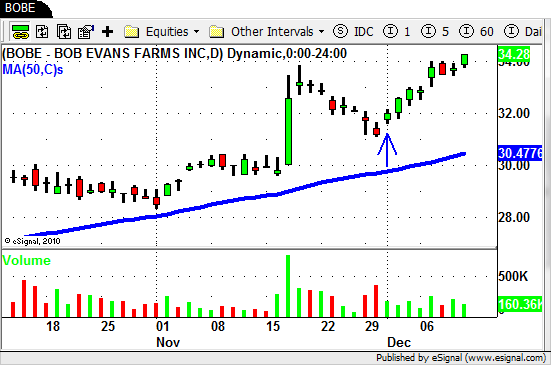

$ATMI, $LULU, $ADSK, $JAZZ, $BOBE and $INFA are few names on this list.

We saw a lot of stocks setting up towards the end of last week.

Friday we saw signs of these stocks making their next move higher.

Our newsletter subscribers were actually alerted to numerous new trades that triggered on Friday.

The market continues to show signs of strength and if that continues next week hopefully these trades will turn into winners.

Until next week…Good Trading to YOU!!!