Swing Trading BLOG – Swing Trading BOOT CAMP

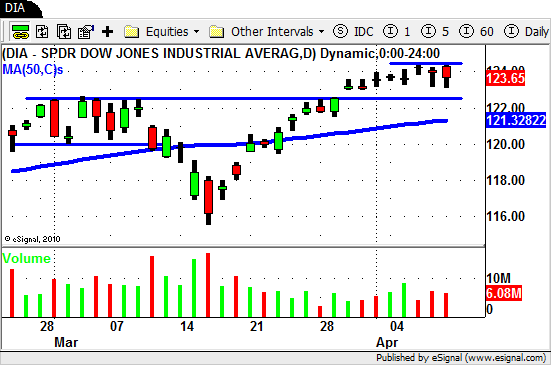

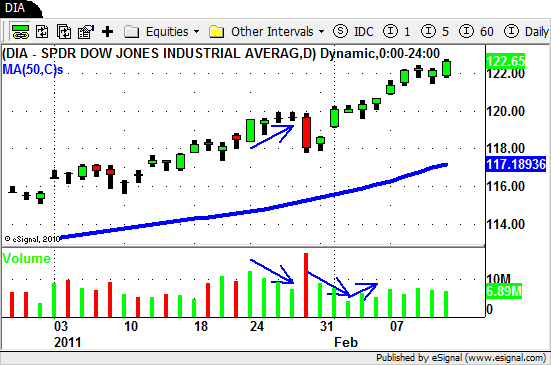

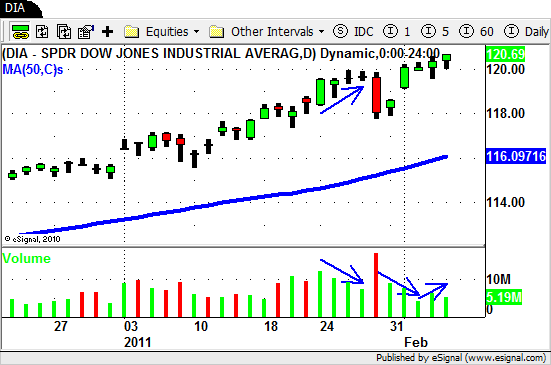

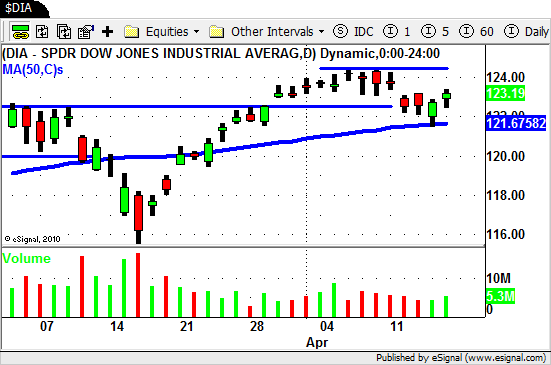

After failing to break out to the upside on Monday the market put in a nice orderly pullback to its 50 day SMA this week.

The overhead resistance is in place and its a good sign when the 50 day holds as support.

In order for us to stay optimistic about this market moving higher we are going to have to see price action and volume confirm our thoughts.

If the market stalls looks for clues that a short term trend transition may be in order.

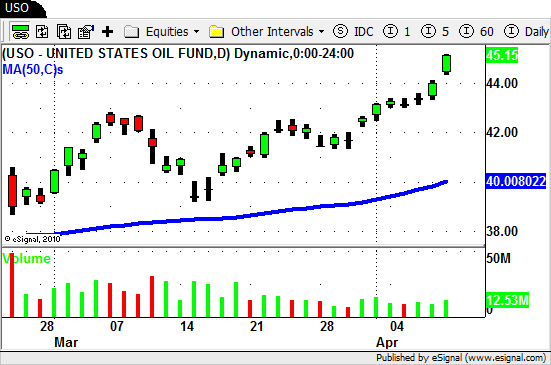

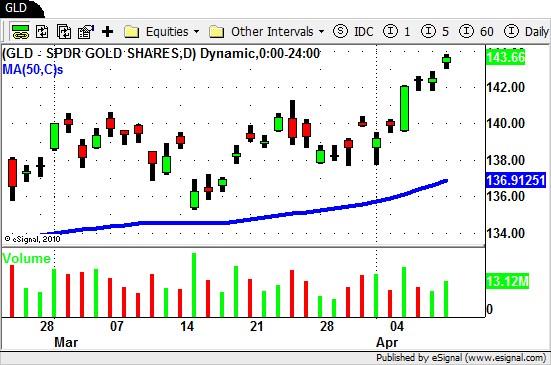

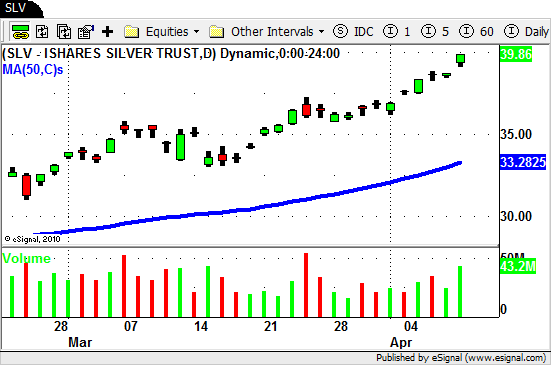

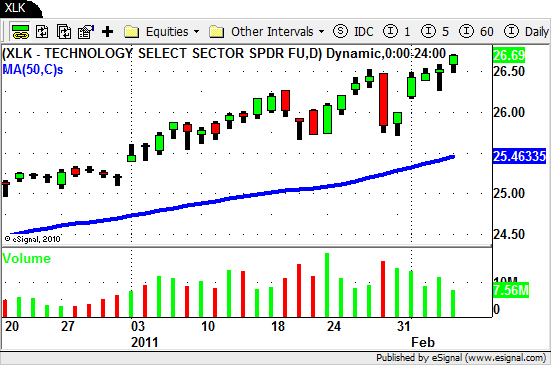

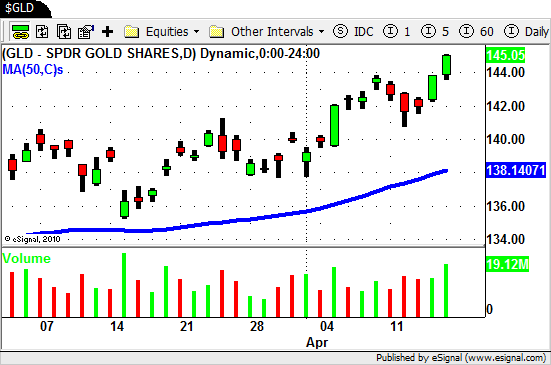

Earlier this week we posted a list of Gold Stocks to watch and a list of Silver ETF's.

We posted these to remind you of the recent strength in these two sectors.

Lets take a look at the chart for the Gold ($GLD) and Silver ($SLV) ETF's…

Both sector ETF's are in solid UP TRENDS and offered yet another opportunity for Swing Traders to profit.

While some Swing Trading BLOGS were actually advocating SHORTING these sectors we remained BULLISH due to the obvious strength.

No one knows for sure what the future holds but for now these two are about the strongest sectors in the market.

Until next week…Good Trading to YOU!