Swing Trading Blog – Swing Trading Boot Camp

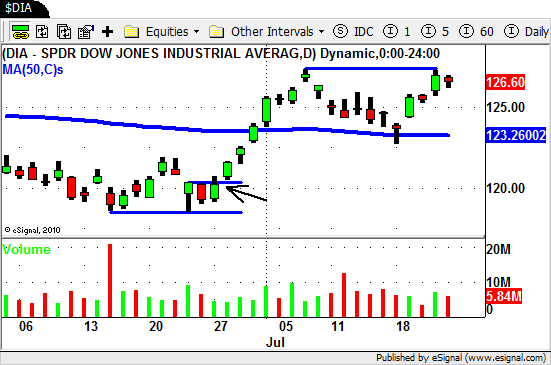

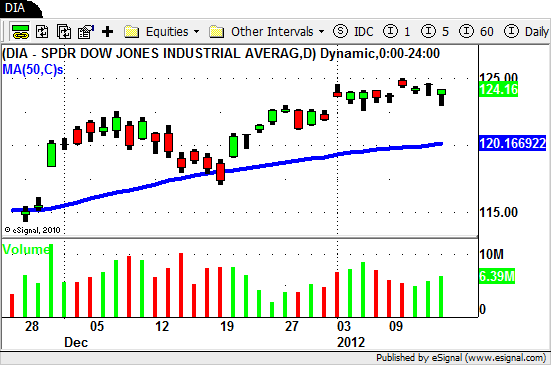

The sideways trading continues!

Swing Traders were a little excited Tuesday as the market GAPPED UP and broke out of the week long sideways trading range.

As the day progressed though the price action and volume painted a different picture. The low volume and close near the lows of the day did give us much conviction.

The rest of the week looked a lot like last week. Sideways trading and lack of follow through in the overall market.

Some individual stocks on the other hand looked much more impressive.

After breaking out of a longer term down channel $WLK broke out to a higher high on Monday.

Look at the last 5 days of volume. A pretty picture indeed!

$KMX made a nice move to the upside after a nice price and volume move on Tuesday.

The move takes $KMX to new multi month highs.

$ATMI (mentioned is last weeks BLOG POST) continued its UP move after breaking out of a nice "cup and handle" pattern on the daily chart.

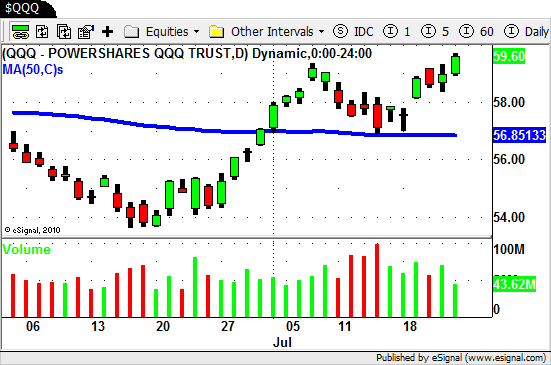

The market remains strong and continues to hover near its high.

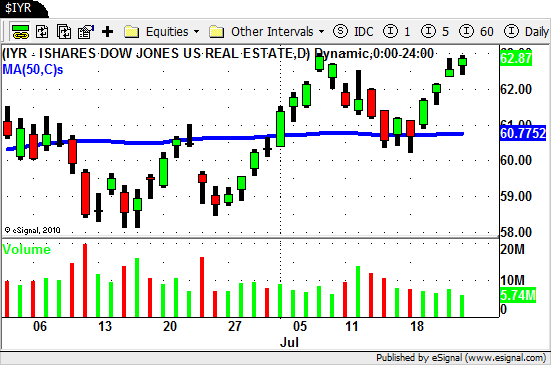

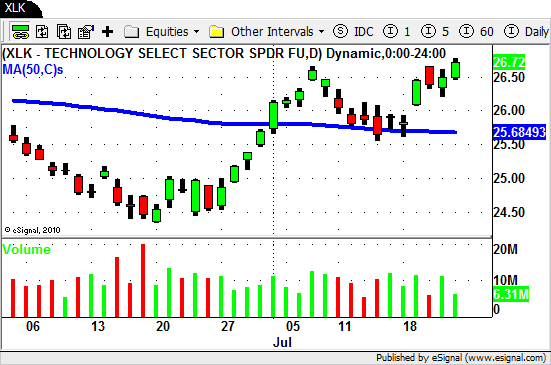

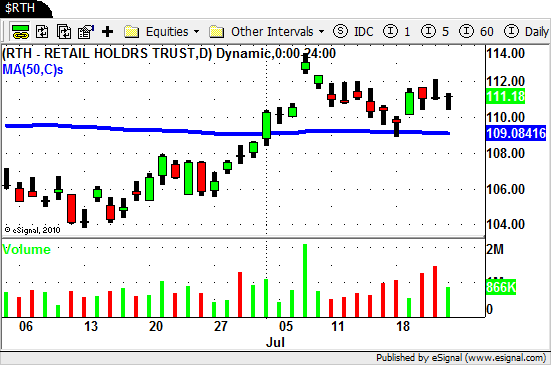

While its hard to look to the SHORT side with such apparent overall strength stay aware of the sectors that aren't really acting that well.

This will paint and very detailed picture for you of where the market sits and how each sector is acting.

Know each and every day which sectors and stocks are showing relative strength and which are showing weakness.

Doing so will keep your on the right side of the market and will also give you an idea of where to turn if the market reverses.

As always be prepared for anything and act accordingly when the market tell you to.

Until next week…good trading to YOU!